ETHZilla Corporation (ETHZ) Stock: Slides 4.98% Amid $100M DeFi Treasury Pivot with EtherFi

TLDR

- ETHZilla dives into DeFi with $100M EtherFi restaking, stock dips 5%.

- $100M DeFi leap: ETHZilla chooses EtherFi, shares slide amid investor caution.

- ETHZilla commits $100M to EtherFi restaking, boosting ETH yields despite dip.

- Bold $100M EtherFi restake by ETHZilla sparks market jitters, stock drops 5%.

- DeFi debut: ETHZilla allocates $100M to EtherFi, stock reacts with sharp fall.

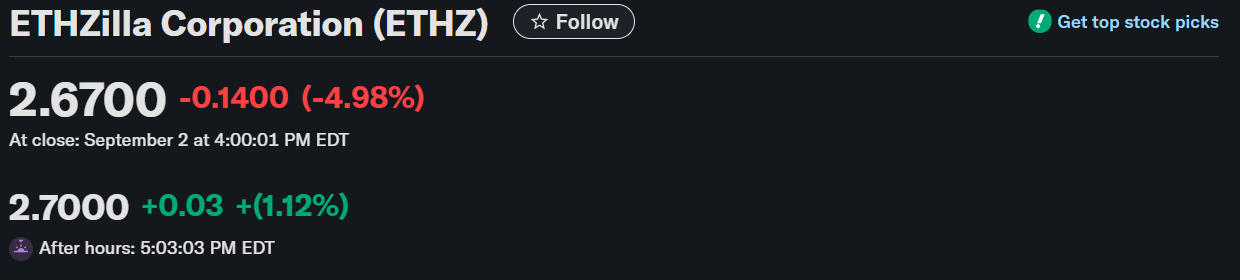

ETHZilla shares closed lower by 4.98%, ending the day at $2.67, with slight additional losses in after-hours trading.

ETHZilla Corporation (ETHZ)

The decline followed the company’s announcement of a major $100 million move into the decentralized finance (DeFi) space. ETHZilla confirmed it will allocate these funds into EtherFi, a liquid restaking protocol designed to enhance ETH yields.

$100 Million Restaking Plan to Boost ETH Yield

ETHZilla selected EtherFi for its ability to provide yield enhancements beyond standard staking through its liquid restaking protocol. This move aligns with the company’s plan to actively manage and optimize its ETH treasury while supporting the Ethereum ecosystem. By restaking, ETHZilla aims to earn additional on-chain rewards without sacrificing liquidity.

The decision to deploy such a large amount marks a significant evolution in ETHZilla’s treasury strategy. This initiative also reinforces its interest in bridging traditional finance operations with decentralized platforms. EtherFi was chosen for its ability to support this dual purpose of yield generation and blockchain security.

ETHZilla’s management highlighted the synergy between EtherFi’s platform and their treasury goals. The company stated that this partnership will lead to further integrations within the DeFi ecosystem. ETHZilla is expected to announce additional developments as it expands its on-chain activities.

ETH Holdings and Capital Position Remain Strong

As of August 31, 2025, ETHZilla held 102,246 ETH and ETH equivalents, valued at approximately $456 million. In addition, the company maintained $221 million in USD cash equivalents, excluding ETH purchase commitments. ETHZilla’s total outstanding shares stood at 166.6 million, reflecting recent adjustments.

The weekly ETH acquisition summary showed no ETH purchases during the last reported week, holding steady from the prior period. The average ETH purchase price remained $3,949, and the company raised $7.3 million through share issuances during the same week. ETHZilla had earlier raised $20.9 million and $12.8 million in the two previous weeks, respectively.

ETHZilla’s total ETH accumulation increased from 82,200 ETH on August 17 to 102,200 ETH by August 31. These acquisitions were funded by its ATM share program, allowing ETHZilla to maintain a balanced capital strategy. The company confirmed its continued commitment to updating the market through public disclosures.

Share Cancellation and Corporate Update

On August 28, 2025, ETHZilla completed the cancellation of 1.318 million shares previously held by Elray Resources. This cancellation followed a $1 million settlement agreement and was reflected in the updated outstanding share count. The move supports ETHZilla’s ongoing efforts to streamline its capital structure.

ETHZilla indicated that this cancellation was part of a broader cleanup of legacy arrangements. The adjustment was not linked to the EtherFi deal but enhances clarity in the company’s share base. ETHZilla plans to maintain transparency through future regulatory filings and statements.

The combination of DeFi integration and capital management reflects ETHZilla’s evolving position in the blockchain financial space. While the stock reacted negatively in the short term, ETHZilla continues positioning itself for long-term treasury yield growth. The EtherFi partnership signals a strategic push toward greater DeFi engagement.

The post ETHZilla Corporation (ETHZ) Stock: Slides 4.98% Amid $100M DeFi Treasury Pivot with EtherFi appeared first on CoinCentral.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC