How Crypto Assets Bootstrap Their Way to Billions

Table of Links

Abstract and 1. Introduction

-

Bitcoin and the Blockchain

2.1 The Origins

2.2 Bitcoin in a nutshell

2.3 Basic Concepts

-

Crypto Exchanges

-

Source of Value of crypto assets and Bootstrapping

-

Initial Coin Offerings

-

Airdrops

-

Ethereum

7.1 Proof-of-Stake based consensus in Ethereum

7.2 Smart Contracts

7.3 Tokens

7.4 Non-Fungible Tokens

-

Decentralized Finance and 8.1 MakerDAO

8.2 Uniswap

8.3 Taxable events in DeFi ecosystem

8.4 Maximal Extractable Value (MEV) on Ethereum

-

Decentralized Autonomous Organizations - DAOs

9.1 Legal Entity Status of DAOs

9.2 Taxation issues of DAOs

-

International Cooperation and Exchange of Information

10.1 FATF Standards on VAs and VASPs

10.2 Crypto-Asset Reporting Framework

10.3 Need for Global Public Digital Infrastructure

10.4 The Challenge of Anonymity Enhancing Crypto Assets

-

Conclusion and References

4. Source of Value of crypto assets and Bootstrapping

There are multiple examples of assets which have a value without an underlying asset. For example, the valuation of shares of many start-ups are based on the perception of the company in the minds of the shareholders and the expectation of higher profits in the future. Tulip Mania, the Dutch speculative bubble in the 17th century which led to prices of some Tulip bulbs reaching unprecedented levels, is another such case where the Tulip bulbs did not have any inherent value or utility, but derived their value from the value buyers ascribed to them.

\ Bitcoin and other crypto assets have some characteristics of other conventional assets which ascribe value to them. Scarcity is one feature which makes it rare, just as Gold and Diamond derive their value from scarcity, the fact that only 21 million Bitcoins can ever be issued, makes it scarce. There is also some evidence to suggest that the lack of centralized control over Bitcoin makes it trustworthy and a hedge against inflation, as no central bank can ever impose an ‘inflation tax’ on Bitcoin owners. Various instances have come to light where citizens of a country who have reduced faith in their Central Banks use Bitcoin as a safe store of value[66]. Also, the secure nature of immutable blockchain which is almost impossible to modify along with cryptographic safeguards guarantee the owners of Bitcoin the ownership and the right to transfer the assets securely. If the users believed that an attacker can maliciously steal Bitcoins from them, Bitcoin would not have much value as an asset. The fact that the users can transfer a part or whole of their Bitcoins to another user who is willing to transact, irrespective of his/her location establishes the acceptance and portability of Bitcoin.

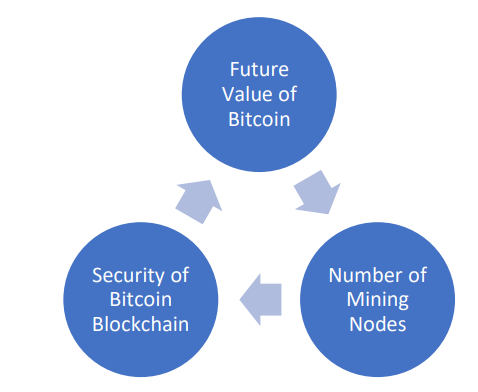

\ This trust in the value of Bitcoin also has positive feedback on the nodes which add blocks to the blockchain (miners). It creates an incentive for them to secure the blockchain and maintain its integrity. The incentive mechanism promotes honest behaviour by nodes and miners which maintains the integrity and trust in the Bitcoin Blockchain which has not suffered outages. As seen earlier, if the number of miners decreases resulting in lower hash rate, the mining difficulty decreases resulting in an increase in the number of miners. The value ascribed to Bitcoin is a complex interplay between the factors depicted in Fig. 27

\

\ In the above figure, the perceived future value of Bitcoin is an incentive for a sizeable number of nodes to validate the transactions and mine blocks, which enhances or maintains the security of the blockchain and thus, in turn keeps Bitcoin valuable.

\ Other crypto assets like Ethereum, Tether and Solana also derive their value from properties and mechanisms of Bitcoin with a few modifications. Ethereum with is smart-contract[67] ecosystem provides a wide platform on top which various services like lending and borrowing can be offered. Another token, Solana claims highest transaction speed of 65,000 transactions per second with average transaction fees of $0.00025[68]. It is also growing its stack of services which can offered on top of Solana Blockchain. Such USPs and Network effects also contribute to the value of crypto assets.

\ The security provided by high hash rates and large number of miners can explain the value ascribed to crypto assets in stable blockchains like Bitcoin. However, to start and establish a blockchain or a crypto asset on top of an existing blockchain like Ethereum, the developers need to bootstrap it to create a virtuous cycle and enhance its prospects and investment. This is done through various incentives like higher initial block rewards, initial coin offerings and airdrops along with aggressive marketing. In case of Bitcoin when Satoshi Nakamoto mined the first block of Bitcoin the Bitcoin Blockchain was not secured by many nodes producing trillions of hashes per second. To incentivise more nodes and miners to join the Bitcoin network, the block reward was 50 BTC per block. The idea of a new decentralized system of exchanging value in a trustless manner attracted users and miners who also believed that the price of Bitcoin would increase once it gains wider acceptance, which was indeed the case. This system of incentives has also resulted in honest behaviour being the dominant strategy for miners and users if bitcoin mining is considered a repeated zero-sum game.

\

:::info Author:

(1) Arindam Misra.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

-

https://www.mariblock.com/africans-should-embrace-stablecoins-safeguard-savings-against-inflation-currency-devaluation/

\

-

A self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code

\

-

Digital Assets Primer: Only the first inning- Bank of America

\

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access