US Crypto Boom: America Becomes the World’s $4.2 Trillion Fiat Gateway

North America has claimed the second-highest global rank for grassroots crypto activity, with the United States driving the charge. Approvals of spot Bitcoin ETFs and clearer institutional rules legitimized crypto in mainstream finance, encouraging both retail and institutional adoption.

This momentum ensured the US stood out as the region’s anchor.

America’s Crypto Dominance Explained

In fact, Chainalysis’ latest breakdown revealed that the country secured second place across multiple dimensions such as centralized services, DeFi usage, and institutional activity in the 12 months ending June 2025.

Stats shared by Chainalysis revealed that the United States continues to dominate global fiat-to-crypto onramps. The country processed more than $4.2 trillion in volume during the same period. This figure is over four times higher than any other country. On the other hand, South Korea ranked second with just above $1 trillion, while the European Union trailed with slightly under $500 billion.

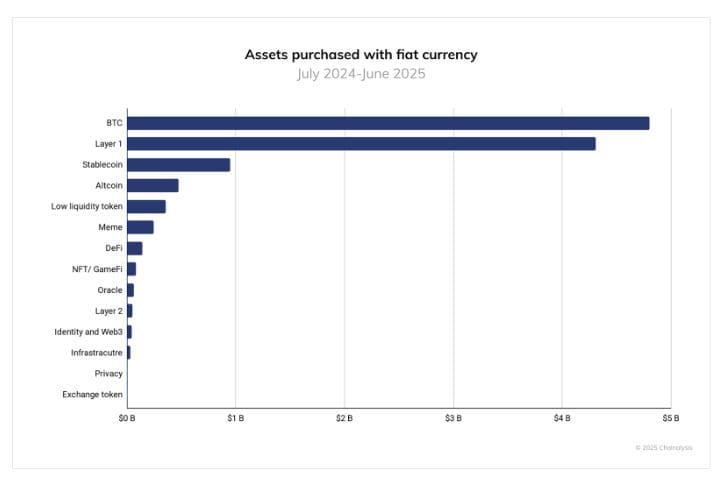

Assets Purchased With Fiat. Source: Chainalysis

Assets Purchased With Fiat. Source: Chainalysis

Stablecoin volumes remain tremendous, but USDC’s trajectory indicates how much US policy is shaping the market. Monthly volumes ranged from $1.24 trillion to $3.29 trillion, and peaked in late 2024, amid surging demand. Unlike USDT’s global dominance, USDC’s rise has been linked to US-based institutional rails and regulated corridors.

APAC Leaves North America Behind

Outpacing North America’s gains, Asia-Pacific (APAC) recorded the strongest surge in on-chain crypto activity, as it posted a 69% annual increase in value received. The region’s transaction volume expanded from $1.4 trillion to $2.36 trillion, owing to the widespread participation across key markets such as India, Vietnam, and Pakistan.

Next up was Latin America, which achieved a 63% increase in crypto adoption, thanks to expanding interest across both retail and institutional segments. Sub-Saharan Africa wasn’t far behind, and grew 52% as digital assets continued serving as lifelines for remittances and daily spending.

Together, these regions showcase how the “Global South” is emerging as a crucial frontier for crypto growth, propelled by functional, real-world use rather than pure investment motives.

The post US Crypto Boom: America Becomes the World’s $4.2 Trillion Fiat Gateway appeared first on CryptoPotato.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud