Stablecoin, record August: volumes at 3,000 billion and market cap at 284.6 billion

According to Artemis, in August the on-chain volumes of stablecoins approached ~3 trillion dollars (approximately +92% month over month), while the aggregated market capitalization reached 284.6 billion dollars, as reported by DeFiLlama. This acceleration indicates increasing liquidity, broader adoption, and a rapidly maturing ecosystem. It should be noted that the dynamic is not uniform across all networks, but the overall signal remains clear.

A significant portion of the growth reflects both cross-chain arbitrage flows and an increase in operations related to payment services and derivatives markets. Industry analysts note that the market concentration on USDT (about 59% of the capitalization) has amplified the impact of supply and demand movements. Data and percentages refer to August; for real-time values, it is recommended to consult the mentioned dashboards.

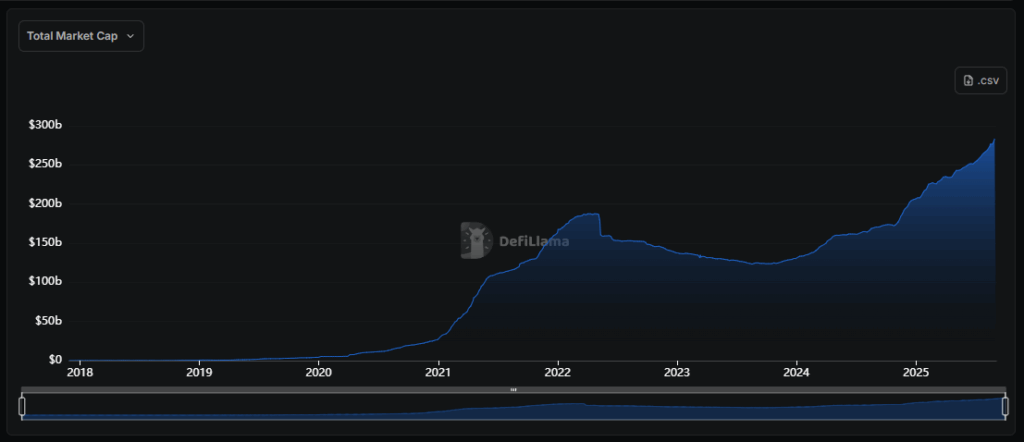

Trend of the total market cap of the stablecoin market. Source: DefiLlama

Trend of the total market cap of the stablecoin market. Source: DefiLlama

In brief

- Market cap stablecoin: $284.6 billion, with an increase of approximately $17.5 billion over the month.

- On-chain volumes: ~$3,000 billion, +92% m/m.

- Number of transactions: ~1.2 billion, +16.9% m/m.

- Unique addresses: 41.7 million, approximately +25% m/m.

- Dominant networks: Ethereum and Tron remain the main liquidity hubs.

Market Size and Dynamics of August

The stablecoin market closed August at 284.6 billion dollars, an increase of about 17.5 billion compared to the beginning of the month. In parallel, on-chain volumes surged to ~3,000 billion, indicating intense usage across multiple use cases and networks. Consequently, the demand for on-chain dollars remained high despite the volatility of the broader crypto market.

This trend is consistent with an expansion of supply and more widespread adoption in DeFi protocols and payments. In this context, operational use ranges from remittances and rapid settlement to liquidity strategies on AMM and derivatives markets.

Ethereum offers the greatest market depth, while Tron captures significant cross-border flows at low costs; at the same time, several Layer‑2 rollups are rapidly consolidating their share. An interesting aspect is that part of the transfer volume may reflect internal movements and arbitrage between protocols, but the trend remains indicative of sustained usage.

Who Led the Growth: Key Issuers and Tokens

The supply variations show a concentrated contribution on the main dollar-pegged assets. It should be noted that the trajectory of the issuers highlights differences between retail use, DeFi, and institutional scope, with demand dynamics not always simultaneous.

| Stablecoin | Cap/Indicative Supply | Share/Change | Notes |

| ———————————————————————————– | ————————— | ———————- | ——————————————————————– |

| USDT (Tether) | ~$167.97 billion | ~59% of the market | Established leadership and broad cross‑chain presence |

| USDC (Circle) | ~$71.85 billion | +$7.98 billion for the month | Recovery of share in DeFi apps and institutional space |

| USDe (Ethena) | ~$12.403 billion | ~+41% m/m | Sustained growth on yield protocols |

| DAI | Increase ~+$880 million | — | Stable adoption in DeFi space thanks to composite collateral |

| USD1 | +$349 million | — | Gradual expansion of the offering |

| PYUSD (PayPal) | > $1 billion | — | Symbolic threshold surpassed in August |

Leverage behind the surge in volumes

- On-chain payments are becoming more frequent, especially for fast and low-cost transfers in the cross-border context.

- Greater integration of stablecoins in DeFi, especially in the areas of lending, AMMs, and perpetual markets.

- Enhanced interoperability thanks to cross-chain bridges and more efficient Layer-2 rollups.

- Increase in issuance by major issuers, in line with institutional demand.

The infrastructure that supports liquidity

The liquidity of stablecoins is based on decentralized exchanges, deep liquidity pools, and cross-chain bridges. Ethereum remains the nerve center for tools and depth, while Tron and various Layer-2 solutions offer reduced fees and faster transactions, ensuring greater exchange efficiency and lower average costs for value transfer. In this context, routing between pools and access to perpetual markets help maintain low spreads and keep slippage under control.

International Payments: The Role of Stablecoins

Stablecoins are now a key element for remittances and B2B/B2C cross-border payments. The interest of major operators, along with surpassing the 1 billion dollars capitalization threshold for PYUSD in August, confirms a growing use both on the consumer and merchant fronts. An interesting aspect is the combination of near-instant settlements and reduced costs, with however marked differences between geographical areas and local regulatory requirements.

Addresses and Users: What the Increase Indicates

The increase to 41.7 million unique addresses connected to stablecoins suggests expanding adoption, driven by lightweight wallets, payment apps, and DeFi protocols. However, the strong concentration on Ethereum and Tron represents both an advantage in terms of efficiency and a potential systemic risk if bottlenecks or regulatory shocks emerge on a specific network. It should be noted, for completeness, that addresses do not necessarily equate to verified unique users and may include multiple accounts for a single user.

Implications for Market and Regulation

- Closer monitoring of emissions and reserves supporting the fiat peg.

- A growing demand for transparency and shared standards related to attestations and audits.

- Pressure on the basic infrastructure (bridge, L2, oracles) if volumes remain high.

What to Monitor in the Coming Months

- The evolution of market shares between USDT, USDC, and new issuers.

- The trend of on-chain volumes on emerging networks and rollups.

- Any regulatory updates concerning issuances, custody, and reserves.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout