Zscaler, Inc. (ZS) Stock: Falls After Q4 2025 Earnings Report

TLDRs;

- Zscaler Q4 2025 revenue rose 21% to $719.2 million, with ARR reaching $3 billion.

- The company posted a GAAP net loss of $17.6 million, though non-GAAP income improved year-over-year.

- Zscaler acquired Red Canary for $675 million, boosting its AI-powered security operations offerings.

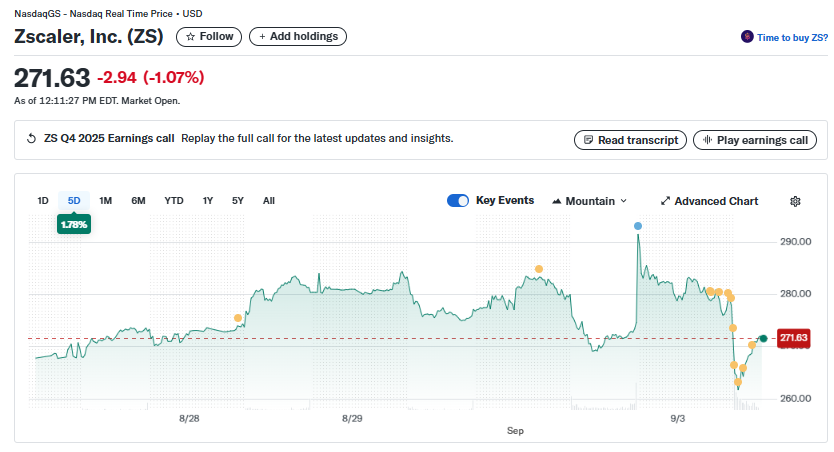

- Stock fell 1.07% to $271.63 as investors weighed continued losses against strong growth prospects.

Zscaler, Inc. (ZS) saw its stock decline by 1.07% to $271.63 on Wednesday following the release of its fiscal fourth-quarter 2025 earnings.

While the San Jose-based cloud security firm posted robust revenue growth and expanding annual recurring revenue (ARR), Wall Street reacted cautiously to continued net losses and heavy investment activity.

Zscaler, Inc. (ZS)

Zscaler, Inc. (ZS)

Strong Revenue and ARR Performance

For the quarter ending July 31, 2025, Zscaler reported revenue of $719.2 million, representing a 21% year-over-year increase. Its annual recurring revenue climbed 22% to $3 billion, underscoring strong demand for its cybersecurity services.

Calculated billings surged 32% to $1.2 billion, while deferred revenue rose 30% to $2.5 billion.

The company also recorded non-GAAP net income of $146.7 million, up from $115.8 million in the prior year. However, on a GAAP basis, Zscaler reported a net loss of $17.6 million, compared with a $14.9 million loss a year earlier.

For the full fiscal year 2025, Zscaler generated $2.7 billion in revenue, a 23% increase, while narrowing its GAAP net loss to $41.5 million from $57.7 million in 2024.

Market Reactions and Investor Caution

Despite strong top-line performance, Zscaler’s shares slipped as investors weighed its losses and aggressive spending strategy.

The decline mirrors broader investor sentiment in the cybersecurity sector, where companies are heavily reinvesting profits into AI-driven services and platform expansion.

The company’s $1.7 billion convertible notes offering in July, paired with the repayment of $1.2 billion in earlier debt, highlighted its ongoing focus on financing growth and strengthening balance sheet flexibility.

Strategic Acquisition of Red Canary

Adding to its growth strategy, Zscaler recently announced the $675 million acquisition of Red Canary, a managed detection and response (MDR) company.

Red Canary will continue to operate independently but will integrate its services with Zscaler’s Zero Trust platform, forming what the company describes as an “AI-driven Security Operations Center.”

The acquisition aligns with industry consolidation trends as cybersecurity providers look to expand scale and integrate AI into their platforms. Analysts note the timing of the deal, coming just after record financial results, signals confidence in sustained demand for enterprise security solutions.

Scaling Cybersecurity in the AI Era

Zscaler currently processes more than 500 billion daily transactions through its Zero Trust Exchange platform, making scale a key advantage in detecting and mitigating threats.

According to the company’s research, ransomware attacks surged 146% over the past year, intensifying demand for robust solutions.

Industry reports also show that AI has now overtaken ransomware as the top security concern for IT leaders worldwide. In response, Zscaler has expanded its AI Guardrails portfolio, positioning itself as a critical security partner for enterprises deploying AI-powered systems at scale.

Looking Ahead

While short-term losses may continue to weigh on stock performance, Zscaler’s consistent revenue growth, strong ARR, and strategic acquisitions reinforce its positioning in the cybersecurity industry.

With global cybersecurity spending projected to grow at a 13% compound annual growth rate, the company appears well-placed to capitalize on the increasing need for advanced, AI-driven solutions.

The post Zscaler, Inc. (ZS) Stock: Falls After Q4 2025 Earnings Report appeared first on CoinCentral.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout