Inside MEV on Ethereum: Builders, Searchers, and the Hidden Fees You Pay

Table of Links

Abstract and 1. Introduction

-

Bitcoin and the Blockchain

2.1 The Origins

2.2 Bitcoin in a nutshell

2.3 Basic Concepts

-

Crypto Exchanges

-

Source of Value of crypto assets and Bootstrapping

-

Initial Coin Offerings

-

Airdrops

-

Ethereum

7.1 Proof-of-Stake based consensus in Ethereum

7.2 Smart Contracts

7.3 Tokens

7.4 Non-Fungible Tokens

-

Decentralized Finance and 8.1 MakerDAO

8.2 Uniswap

8.3 Taxable events in DeFi ecosystem

8.4 Maximal Extractable Value (MEV) on Ethereum

-

Decentralized Autonomous Organizations - DAOs

9.1 Legal Entity Status of DAOs

9.2 Taxation issues of DAOs

-

International Cooperation and Exchange of Information

10.1 FATF Standards on VAs and VASPs

10.2 Crypto-Asset Reporting Framework

10.3 Need for Global Public Digital Infrastructure

10.4 The Challenge of Anonymity Enhancing Crypto Assets

-

Conclusion and References

8.4 Maximal Extractable Value (MEV) on Ethereum

Maximal Extractable Value refers to “the maximum value that can be extracted from block production in excess of the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block.” [127]. The nodes on Ethereum have visibility of the transactions in the mempool as transactions are not encrypted. This gives various actors on the Ethereum Blockchain the ability to front-run some transactions and capture lucrative arbitrage and other opportunities like liquidations. For example, at a certain price ratio in a liquidity pool, if such actors are aware of a transaction that is likely to cause the relative prices of tokens in that liquidity pool to move significantly, they might try to place their own transaction(s) before and/or after the transaction, taking advantage of the prior knowledge about the likely change in relative prices of the tokens in the liquidity pool. In one such transaction[128] due to difference in prices of the Ether and DAI between Uniswap and Sushiswap, a user was able to make a profit of 45 ETH in a single transaction.

\ As it is known in advance that a large transaction might cause prices on the decentralized exchanges to move, the user trying to extract MEV can pay much higher gas fee to place the buy and sell transactions before and after the target transaction. Such strategies can cause a ‘tax’ to be levied on the blockchain users due to slippage caused by sandwich trading. As users who want to extract MEV are ready to pay very high gas fees to include transactions extracting MEV, common users have to pay much higher gas fee with increased network congestion and gas prices. However, not all MEV on blockchain has such undesirable effects. MEV acts as an incentive for actors on the blockchain to keep the prices in various DeFi applications at the general equilibrium price and makes the markets more efficient.

\ As validators decide which transactions are included in the block and in what order, one might conclude that the entire MEV would accrue to the validators. However, exploiting arbitrage and liquidation opportunities requires running specialized algorithms and gaining faster access to the transactions transmitted on the Ethereum network. This requirement is fulfilled by certain specialized actors like builders, searchers, and specialized infrastructure like relays in the Ethereum ecosystem, which play a significant role in MEV extraction. Thus, unlike the traditional method of transactions being sent by users to the mempool over the Ethereum network, which are then subsequently included in blocks proposed by validators, is hardly executed in practice. A cursory look at the most recent blocks of the Ethereum blockchain[129] highlights that in most of the blocks the fee recipient is not the validator but a ‘builder.’ As the block proposer specifies the address which receives the fee, it can be inferred that the blocks were created by the ‘builders’ which received the fees.

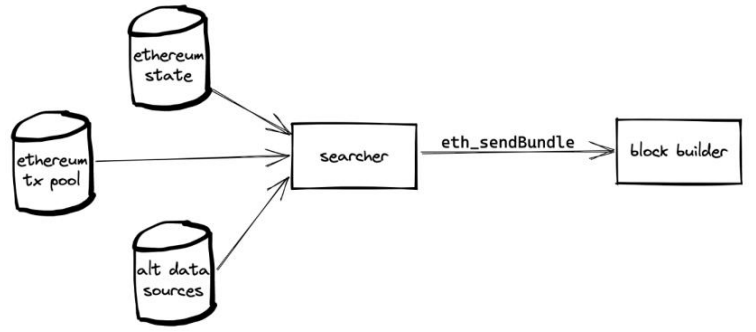

\ To prevent their transactions from being front run, the actors in the MEV ecosystem join a mechanism which communicates the transaction bundles prepared by a set of specialized bots called searchers which continuously look out for MEV opportunities on the Ethereum Blockchain. The searchers submit transaction bundles to specialized actors called ‘builders’ which construct most profitable blocks from these transaction bundles and transmit these blocks to validators through secure communication channels called relays. Relays receive blocks from builders and forward them to validators, however they can reorder or censor bundles based on their own policies. They also provide an available, reliable, efficient, and fast channel of communication between builders and validators and provides a layer of abstraction and anonymity between them.

\ Flashbots, a popular block space auction platform used by many searchers uses the first-price sealed-bid auction or blind auction mechanism, wherein users can privately communicate their bid transaction order preference without paying for failed bids[130]. The transactions bundle flow between a searcher and builder is shown in Fig. 46.

\

\ In the above scenario, the transaction bundles will be sent to the private transaction pool of Flashbots instead of the common mempool of Ethereum nodes, which protects the transactions from frontrunning. The searchers need to trust block builders as they have full visibility of the transactions in the bundle and can maliciously front-run the searchers as the builders can also operate searchers themselves. As shown in Fig. 47 a searcher can submit transaction bundles to multiple builders and the builders in-turn can submit the blocks to various relays which connect them to validators.

\ ![Fig. 47 Searchers submitting bundles to builders who submit full blocks to relays[132]](https://cdn.hackernoon.com/images/null-kn133tl.png)

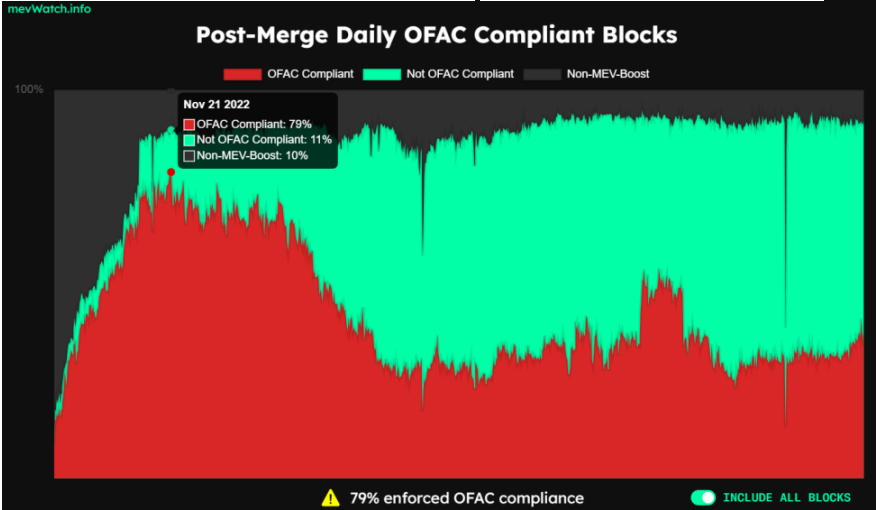

\ The mechanism of creation of blocks by builders and their transmission securely to the validators through relays creates centralization within the Ethereum ecosystem which can be used for censoring certain transactions by builders and relays. For example, on Nov 21 2022 it can be seen in Fig. 48 that 79% of all Ethereum Blocks were OFAC compliant as MEV Boost, the then dominant off-chain marketplace used by validators for selling block space to builders is OFAC compliant.

\

\ As relays also have full visibility of the transactions they need to be trusted by the builders. Relays do not provide the full block to the validators on request. Instead, the header of the most profitable block is provided to the validator which receives the full block from the relay only upon committing to propose the block by sending the signed block header to the relay, this is depicted in Fig. 49.

\ ![Fig. 49 Relay selecting the most profitable block and providing validator with the block header followed by the full block[133]](https://cdn.hackernoon.com/images/null-ls333ne.png)

\ The validator can be connected to multiple relays and upon receipt of multiple block headers from multiple relays, proposes the most profitable block on the Ethereum Blockchain as shown in the Fig. 50

\ ![Fig. 50 Validator proposing the most profitable block on the consensus layer[134]](https://cdn.hackernoon.com/images/null-do433a0.png)

\ The overall communication and auction architecture for block space is shown in Fig. 51

\ ![Fig. 51 Overall communication and auction architecture for Ethereum block space[135]](https://cdn.hackernoon.com/images/null-tz5332g.png)

\ 8.4.1 MEV Supply Chain and its taxation

\ The MEV ecosystem described above facilitates the extraction of MEV on the Ethereum Blockchain with the help of various specialized actors and service providers which play crucial role in the entire process. The income accruing to multiple actors in this ecosystem would be subject to tax in most jurisdictions with most jurisdictions classifying it as a business activity, allowing deduction of allowable expenses. However, as on date, there does not exist any specific guidance on fee or rewards received through MEV. The MEV related services might also be subject to indirect taxes as actors like builders, validators get paid for their service of creating and proposing blocks containing specific transaction bundles through the mechanism described above.

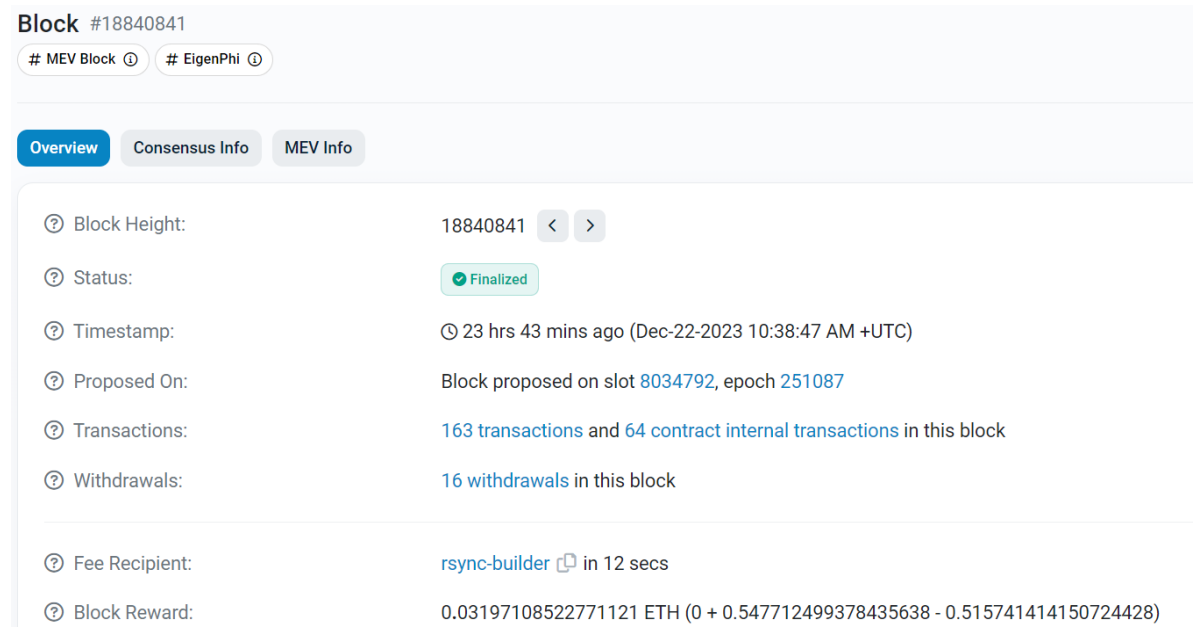

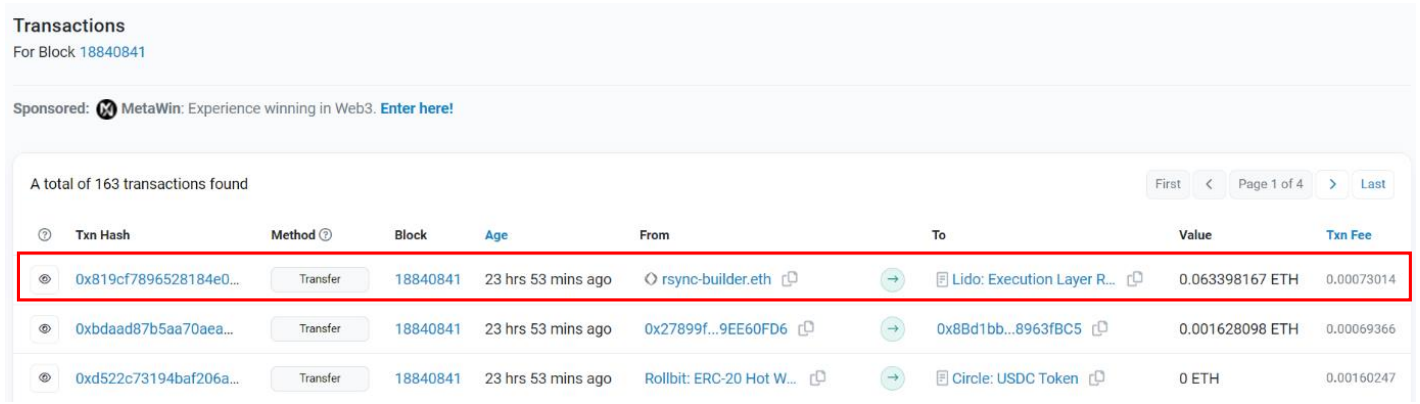

\ To understand the tax events in the process of MEV extraction starting from the creation of bundles by the searcher to the final proposal of the block by the validator, it is important to track the payments made to/by searchers, builders, and validators in a block on the Ethereum Blockchain. For example, in the Ethereum Block No. 18840841 it can be observed that the block reward (transaction fee – base fee burnt) was transferred to the address 0x1f9090aaE28b8a3dCeaDf281B0F12828e676c326 (rsyncbuilder.eth) as shown in Fig 52.

\

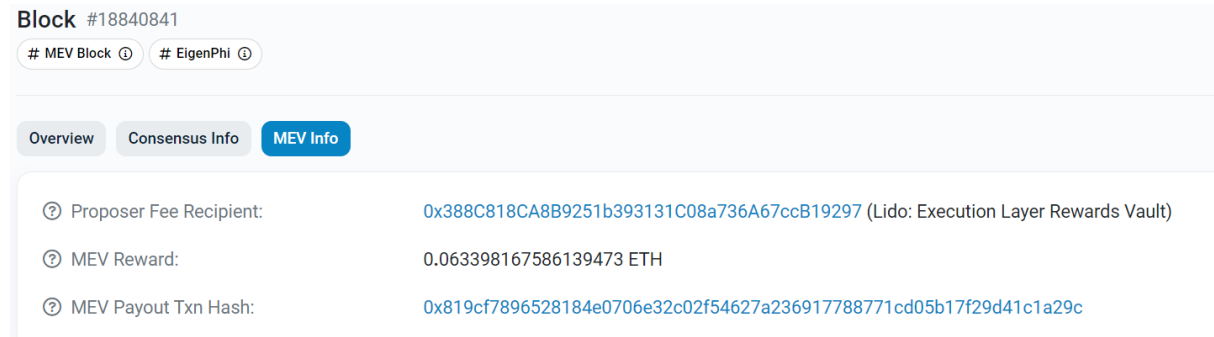

\ A look at the MEV Info of the same block as shown in Fig. 53 indicates that the recipient of the Proposer fee for the block is the Lido: Execution Layer Rewards Vault (validator) with the smart contract address 0x388C818CA8B9251b393131C08a736A67ccB19297

\

\ This transaction can also be seen in the list of transactions in the block 18840841. As shown inf Fig. 54 this is the reward received by the validator (Lido) over and above the issuance and other rewards received on the consensus layer. This is also the fee paid by the builder to the block proposer for proposing the block sent by the builder through the relay as described above.

\

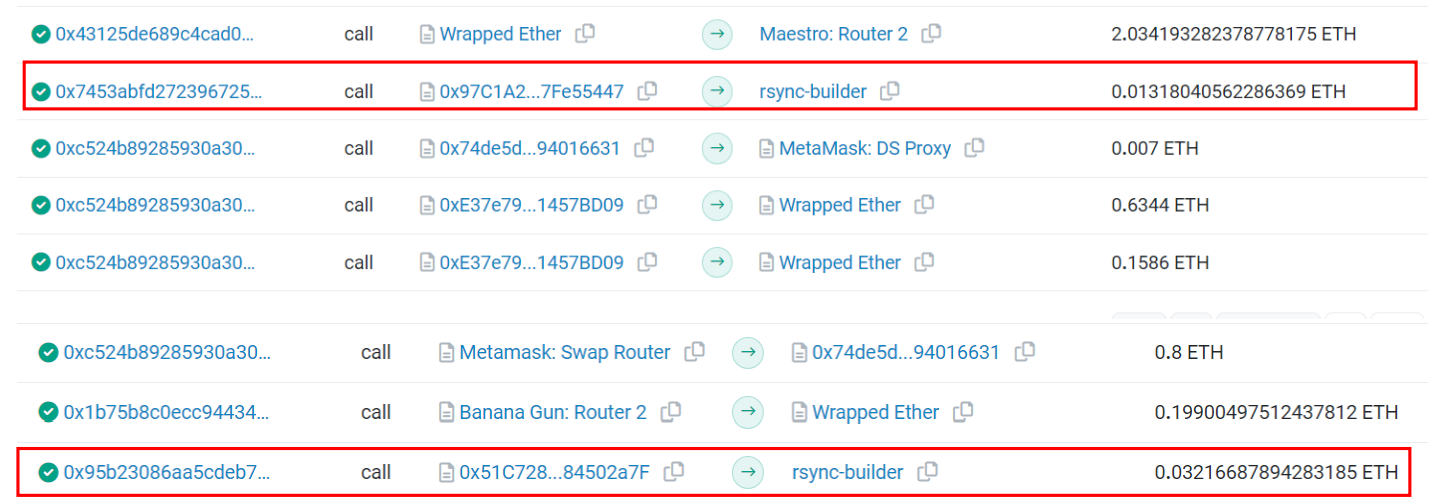

\ This might lead to a conclusion that for this block the builder paid more fee to the validator than the reward received by it, thereby incurring a loss. However, a closer look at the internal transactions in this block (Fig. 55) highlights two transactions where amounts of 0.013180 ETH and 0.032166 ETH were sent to the builder. This is the fee paid by the searchers or other users to the builder for inclusion of their transaction bundle in the block. Thus, the net fee received by the builder for the block is 0.031971 + 0.013180 + 0.032166 - 0.063398 = 0.013919 ETH

\

\ It can be observed that the searcher paid the builder through a transaction on the blockchain rather than high gas fee for inclusion in the block, this method conditions the searcher’s bid on the inclusion of their transaction in the block and obviates the need to pay for unsuccessful bids. However, to gain reputation and remain competitive some builders might discount some blocks and incur a short-term loss.

\ The payments made by the searchers and other actors to the builder and by the builder to the validator constitute payments in lieu of services of including the transaction bundles in the blocks formed by the builder and proposing the blocks formed by builder on the Ethereum Blockchain by the validator respectively. Thus, depending upon the tax residency of the builders and validators the services provided by them to searchers and builders may be subject to VAT/GST. As relays are not currently monetized, they would not be subject to VAT/GST. The total value of MEV rewards extracted before ‘the Merge’ of Ethereum is $675,623,114[136]. After ‘the Merge’ of Ethereum the total MEV extracted is 464,201 ETH[137] which is ~800 million USD. Although these figures are not huge, but with increasing transaction volumes it might not be possible for tax administrations to ignore this aspect of the crypto assets ecosystem.

\

:::info Author:

(1) Arindam Misra.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

-

Maximal extractable value (MEV) | ethereum.org

\

-

https://etherscan.io/tx/0x5e1657ef0e9be9bc72efefe59a2528d0d730d478cfc9e6cdd09af9f997bb3ef4

\

-

https://etherscan.io/blocks

\

-

https://docs.flashbots.net/flashbots-auction/overview

\

-

https://docs.flashbots.net/assets/images/searcher-architecture-d9a0bd137035304fc54067ce243c32ce.png

\

-

https://docs.flashbots.net/assets/images/block-builder-flow-0c01103143daeac8b79cc377ff248630.png

\

-

https://docs.flashbots.net/assets/images/relay-flow-8f9aca183eaf4b8213220bc5bd71eb3a.png

\

-

https://docs.flashbots.net/assets/images/validator-flow-f3a8249b600db2b2b8d0a0344f336f95.png

\

-

https://docs.flashbots.net/assets/images/mevboost-searcher-bundle-flow-bae4ba67a9d8d928efe337f36defa14a.png

\

-

https://explore.flashbots.net/

\

-

https://transparency.flashbots.net/

\

You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

DeFi Leaders Raise Alarm Over Market Structure Bill’s Shaky Future