$1B+ DeFi Potential Unlocked: Lit Protocol’s Vincent Lets AI Agents Trade

Key Takeaways:

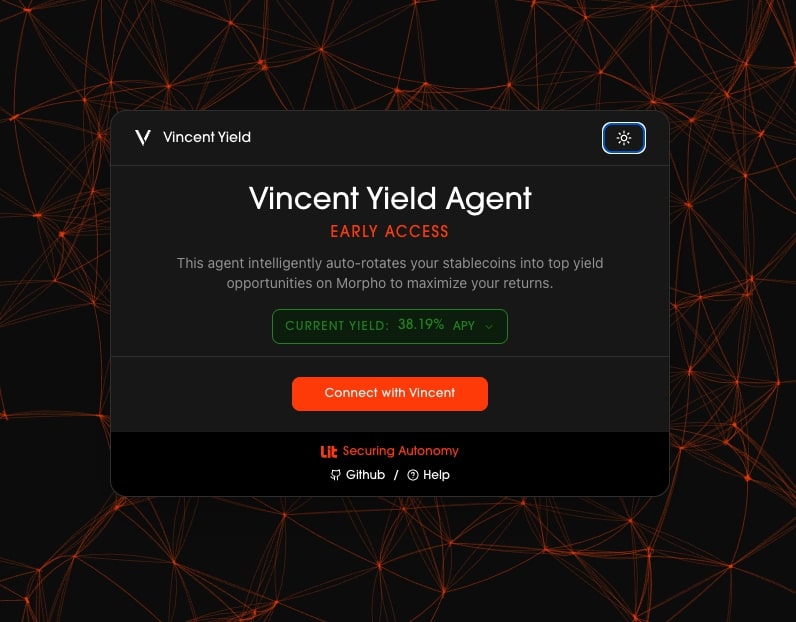

- Lit Protocol launches “Vincent” Early Access, enabling AI agents to perform real DeFi transactions under strict user-set rules.

- Agents can now borrow, swap, and bridge funds across major DeFi protocols like Aave, Uniswap, and deBridge without compromising key security.

- Vincent brings non-custodial, permissioned AI automation to production-ready status, moving DeFi agent tech beyond experimental demos.

AI-powered agents are no longer a concept stuck in the lab. With the launch of Vincent Early Access, Lit Protocol introduces a new layer of secure, decentralized automation to DeFi where AI agents don’t just simulate trades, they execute real ones with verifiable control, transparency, and user-defined boundaries.

Vincent: The First Practical On-chain AI Agent Framework

Lit Protocol’s Vincent is a developer platform that enables autonomous, non-custodial AI agents to interact with DeFi protocols using real permissions and real assets without handing over private keys. This change may reestablish the way individuals and applications automate financial plans in a safe manner.

Vincent offers instead of centralized infrastructure or bespoke bots:

- On-chain guardrails to enforce user-defined permissions

- Decentralized key management using Lit’s threshold cryptography network

- Composable “Abilities” and on-chain “Policies” that govern every agent action

Read More: MIND of Pepe Launches AI Agent on X; Here’s Why It’s Early Crypto Launches with Promise for Real-Time Market Intelligence

How It Works: Abilities, Policies & Apps

Building Secure AI Agents with Vincent

Vincent proposes a building blocks model of AI agents:

- Apps: Packages of agent and configuration developers implement. For instance, an app like Vincent Yield automatically allocates user stablecoins to high-yield pools while respecting pre-set policy limits.

- Abilities: Special operations that the agent is able to do (e.g., borrow on Aave, swap on Uniswap, bridge via deBridge). All abilities are versioned, composable, and require user permission to use explicitly at connect time.

- Policies: Rules that Onchain enforces about the ways and times abilities may be used. These include:

- Spending limits

- Slippage caps

- Time windows

- Token allowlists

- Rate limits and position sizing

Everything is executed using threshold-split keys inside secure enclaves (TEEs), ensuring that no key is ever exposed, and every transaction is policy-compliant before it’s signed.

Real Capabilities at Launch

With Vincent Early Access now live, supported integrations include:

- Morpho: Lending

- Aave v3: Lending markets

- Uniswap v3: Swaps

- deBridge: Cross-chain transfers

Developers can access the Vincent SDK to build agents directly or use the Model Context Protocol for conversational goal-setting and permissions – ideal for user-friendly AI interfaces.

“Every action is an explicitly permissioned ability, and every policy is enforced onchain by our decentralized threshold network.” Chris Cassano, Co-Founder, Lit Protocol

Read More: AI Agent COOKIE Surges 30% – MIND of Pepe Presale Ending Soon | Digital Asset to Keep an Eye on Before June

From Demo to Deployment: Why Vincent Matters for DeFi

The concept of autonomous agents in DeFi isn’t new but until now, it’s been mostly demo-level prototypes. What makes Vincent a production-grade breakthrough is its enforceability at runtime:

- Guardrails are not optional: Abilities can’t be triggered unless the onchain policy checks pass.

- No custody risk: Control is in the hands of the user and agents do not have their private keys.

- Extensible across use cases: DeFi is only one of the many applications of the architecture, which can also support traditional finance, SaaS automations, social media bots, and others.

As DeFi developer David Johnson of Morpheus remarked:

“These types of capabilities should be native to all agents. Lit Protocol makes it safer than rolling your own, less battle-tested solutions.”

What’s Next: Solana, AI-Driven Policies & Beyond

Vincent’s roadmap includes:

- Solana support

- AI-powered policy suggestions for one-click configuration

- Shared agent registries and attestations using ERC-8004 and agent-to-agent (A2A) protocols

This opens the door to portable, verifiable agent credentials for example, proving an agent has executed a policy 100 times safely across multiple platforms without re-verifying.

“We want agents to act, but only inside well-defined lanes,” said Sneider.

Onchain Automation for the Entire Web

While Vincent’s initial focus is DeFi, its underlying infrastructure applies to:

- Trading stocks and derivatives

- Managing passwords and API keys

- Delegating control to apps securely, with full auditability

By abstracting away complex key management and making policy enforcement programmable, Lit Protocol positions Vincent as a universal automation layer for secure web interactions—starting with the riskiest arena of all: DeFi.

The post $1B+ DeFi Potential Unlocked: Lit Protocol’s Vincent Lets AI Agents Trade appeared first on CryptoNinjas.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B