Dogecoin ETF Nears Possible U.S. Approval, Analysts See Market Shift

According to recent reports, the Dogecoin ETF may soon debut in the U.S., raising fresh interest among traders and analysts. Unlike Bitcoin and Ethereum ETFs, it possesses a unique blend of retail-driven popularity and regulatory scrutiny.

What Makes the Dogecoin ETF Newsworthy?

The push for a Dogecoin fund comes as interest in new crypto products grows. Firms like Bitwise, Grayscale, and 21Shares have filed to track Dogecoin, while others suggest futures-based options.

The regulated Dogecoin product carries weight because it signals recognition of a coin often viewed as more community-driven than institutional.

Also read: Dogecoin price approaches critical 0.23 resistance as symmetrical triangle tightens

Investor Buzz Around the Dogecoin ETF

The possibility of a Dogecoin ETF has sparked debates in trading forums and financial desks. Some investors see it as validation of Dogecoin’s role in the crypto market, while others remain cautious. Market chatter shows enthusiasm building, especially as analysts raise odds of approval within the year.

That line captures the mood around the Dogecoin fund. For many, it is less about short-term gains and more about building a regulated bridge for broader adoption.

Market Impact and Price Outlook

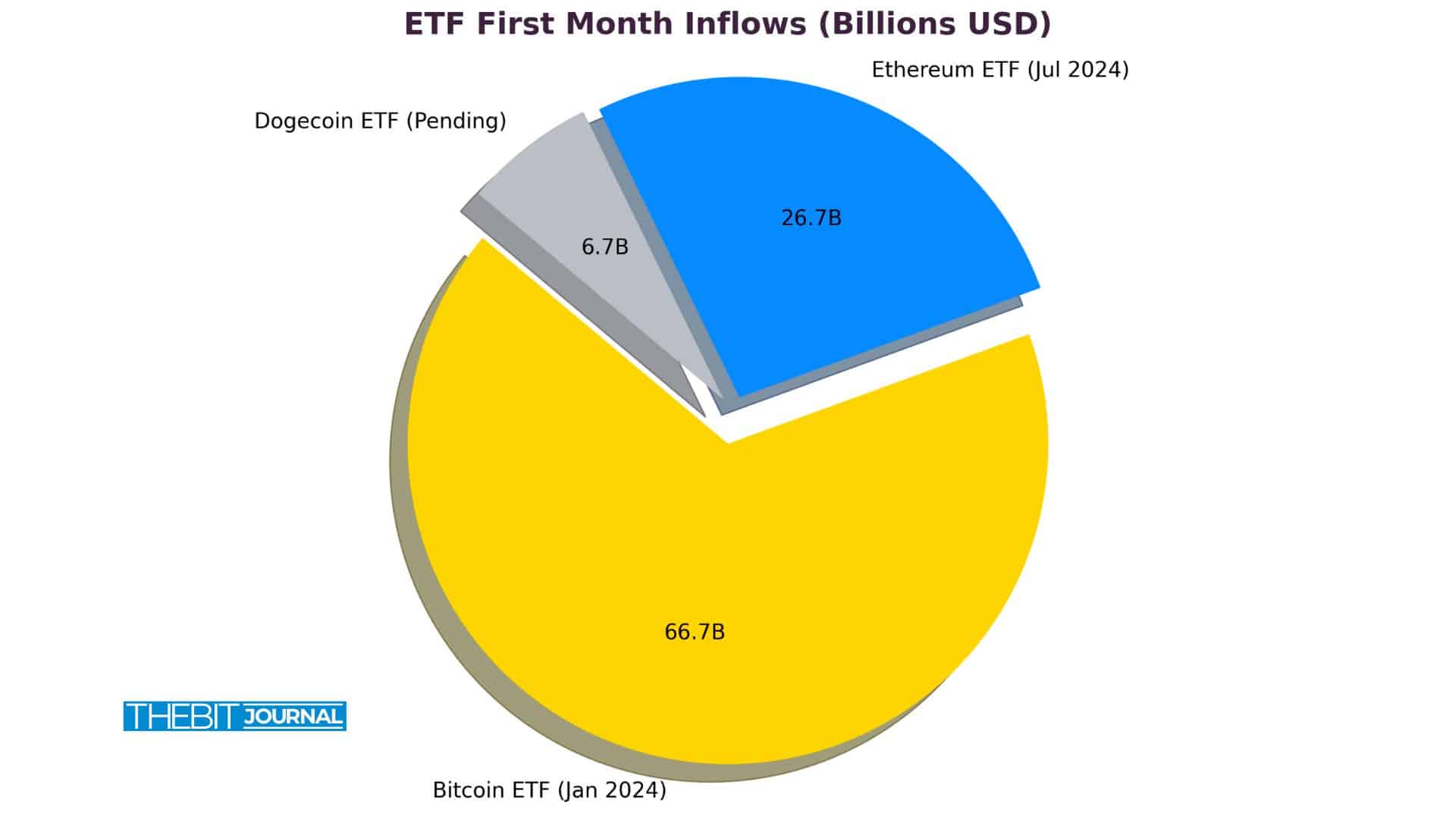

Historically, ETF approvals tend to create buying pressure. Bitcoin ETFs, for instance, saw billions in inflows within weeks of launch. If the regulated Dogecoin fund goes live, analysts expect a similar, though possibly smaller, trend.

| Asset | ETF Launch Date | First Month Inflows | Market Effect |

|---|---|---|---|

| Bitcoin ETF | Jan 2024 | $10B+ | Price surge |

| Ethereum ETF | Jul 2024 | $4B+ | Price boost |

| Dogecoin ETF* | Pending | TBD | Anticipated |

ETF Inflows At A Glance: Bitcoin Leads, Ethereum Follows, Dogecoin Waits

ETF Inflows At A Glance: Bitcoin Leads, Ethereum Follows, Dogecoin Waits

Projections Under Review

Images and social media chatter add another layer. On X, hashtags related to the Dogecoin ETF trend each time new filings appear. Screenshots of trading charts flood feeds, with users speculating about whether the meme coin could find a new floor price once institutional inflows begin.

Conclusion

Based on the latest research, Dogecoin ETF approval could redefine how investors view meme coins. It combines regulatory oversight with one of the most recognized digital assets, potentially boosting liquidity and strengthening Dogecoin’s place in the market. For traders, it signals that crypto adoption is moving steadily closer to the center of mainstream finance.

Also read: Nasdaq Moves to List Dogecoin ETF—Is Institutional Adoption About to Explode?

Summary

The Dogecoin fund is nearing launch, with analysts pointing to a possible U.S. debut soon. This step could draw institutional interest, boost liquidity, and widen investor access. Though approval is pending, growing optimism suggests Dogecoin is moving closer to recognition within regulated finance and long-term adoption.

Glossary of Key Terms

Exchange-Traded Fund: A regulated investment fund traded on stock exchanges that tracks an asset or asset group.

Spot ETF: ETF for the underlying asset is held directly.

Futures ETF: An ETF that tracks futures contracts instead of the actual asset.

SEC: The U.S. Securities and Exchange Commission, responsible for approving ETF applications.

FAQs for Dogecoin ETF

1. What is a Dogecoin ETF?

A Dogecoin fund is a regulated fund that tracks the price of Dogecoin, providing investors with exposure without requiring them to hold the token directly.

2. When will it launch?

Reports suggest that the first Dogecoin exchange-traded fund could launch as early as this month, depending on regulatory approval.

3. Why does a it matter?

This regulated Dogecoin product provides easier access for institutional and retail investors, increases liquidity, and may influence Dogecoin’s long-term price trend.

4. How will it affect the price?

Analysts expect stronger demand from institutional inflows once a Dogecoin investment vehicle goes live, though market reactions can vary.

Read More: Dogecoin ETF Nears Possible U.S. Approval, Analysts See Market Shift">Dogecoin ETF Nears Possible U.S. Approval, Analysts See Market Shift

You May Also Like

XRP at $10 This Month? ChatGPT Analyzes the Most Recent Ripple Price Predictions

What Is the Top Health Center in Idaho?