Can BRC2.0 restore the former glory of Bitcoin Inscription?

By Nicky, Foresight News

On September 2, 2025, at Bitcoin block height 912,690, BRC20 completed a major upgrade, called BRC2.0. This upgrade was jointly promoted by the Ordinals development team Best in Slot and the anonymous BRC20 creator Domo. The core change was the introduction of the Ethereum Virtual Machine (EVM), enabling BRC20 to execute Turing-complete smart contracts.

Since the launch of the Ordinals protocol in early 2023, the Bitcoin ecosystem has ushered in a wave of innovation. Through this protocol, users can engrave information on the smallest unit of Bitcoin, the "satoshi," thereby issuing NFTs or fungible tokens. This mechanism gave rise to the BRC20 token standard, enabling the Bitcoin network to support the issuance and trading of a wider range of assets.

BRC20 was originally a standard for issuing fungible tokens on the Bitcoin chain, based on the Ordinals protocol. This upgrade significantly expands its functionality by integrating the EVM. Eril Binari Ezerel, CEO of Best in Slot, explained that Bitcoin meta-protocols like BRC20 originally ran on indexers, which functioned like "simple calculators." By embedding the EVM, indexers achieve Turing completeness, supporting more complex logic and contract execution.

With the upgrade, developers can now build DeFi protocols, NFT marketplaces, lending systems, and synthetic assets directly on the Bitcoin network. This integration maintains compatibility with Ethereum tools while providing the security guarantees of the Bitcoin network.

Domo stated in a statement that the goal of this upgrade is to combine the security and decentralization of the Bitcoin network with the mature ecosystem of EVM in smart contracts to provide users with a composable, programmable, and Bitcoin-secured on-chain experience.

The BRC2.0 upgrade introduces a significant technical difference: Runes are not programmable and likely never will be, limiting them to meme-like use cases, while BRC2.0 unlocks DeFi-level applications. This functional difference gives BRC2.0 a unique position in the Bitcoin ecosystem, providing the technical foundation for a wider range of application scenarios.

Technical Challenges

While the BRC2.0 upgrade brings significant functional improvements, it also faces some technical challenges and limitations. This upgrade utilizes an off-chain processing solution for programmability, integrating the EVM executor with the BRC20 indexer, with final state updates being processed on the Bitcoin chain by the BRC20 indexer. This design is considered by some to lack decentralization and present a single point of failure risk.

Transactions on BRC2.0 are still subject to the limitations of Bitcoin's underlying infrastructure. Market buy and sell orders require multiple signatures and block confirmations, and transaction speeds are still limited by Bitcoin's 10-minute block time. Due to Bitcoin's 10-minute block time, standard AMM designs are vulnerable to MEV attacks and can cause transaction failures, potentially resulting in failed transactions and wasted BTC as mining fees.

Projects like CatSwap are planning to launch mainnet AMM products in the coming weeks, but these should be considered experimental products in their initial stages. A more advanced "sequencer-based AMM" solution is also under development and expected to launch within 1-3 months, enabling higher transaction speeds and mitigating MEV risks.

Specific applications of BRC2.0

Following the launch of BRC2.0, Best in Slot launched BiS DEX v1, billing it as the first decentralized exchange serving BRC2.0. Despite experiencing some server overload and minor vulnerabilities, the platform still managed to process over $200,000 in trading volume within 24 hours, with no user funds lost.

Currently, BiS DEX supports market buy and limit sell orders, but some limitations still exist. For example, delisting and listing tokens requires a one-block confirmation wait, which increases time and costs. The team plans to launch an instant order feature in the next four to eight weeks to increase transaction speed and reduce fees. Furthermore, non-custodial quotes and more order types (such as limit buy, market sell, and stop-loss orders) will be added later.

In terms of ecological applications, in addition to BiS DEX, there are currently several projects actively under construction:

UniSat already supports BRC2.0 token deployment, providing features such as 6-character token names, self-issuance options, 0–18 decimal places, and optimizing the cost and efficiency of inscription services.

CatSwap was mentioned as an upcoming AMM protocol that is expected to become a liquidity provider in the BRC2.0 ecosystem.

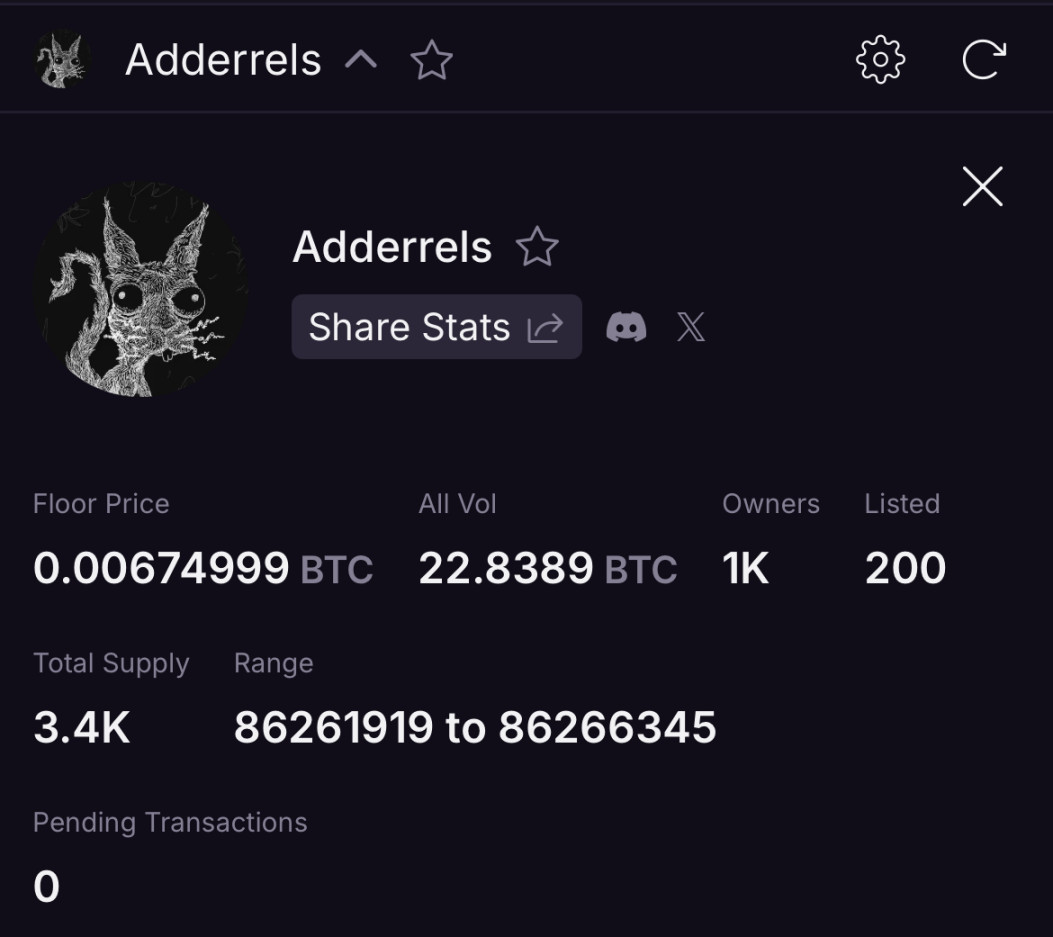

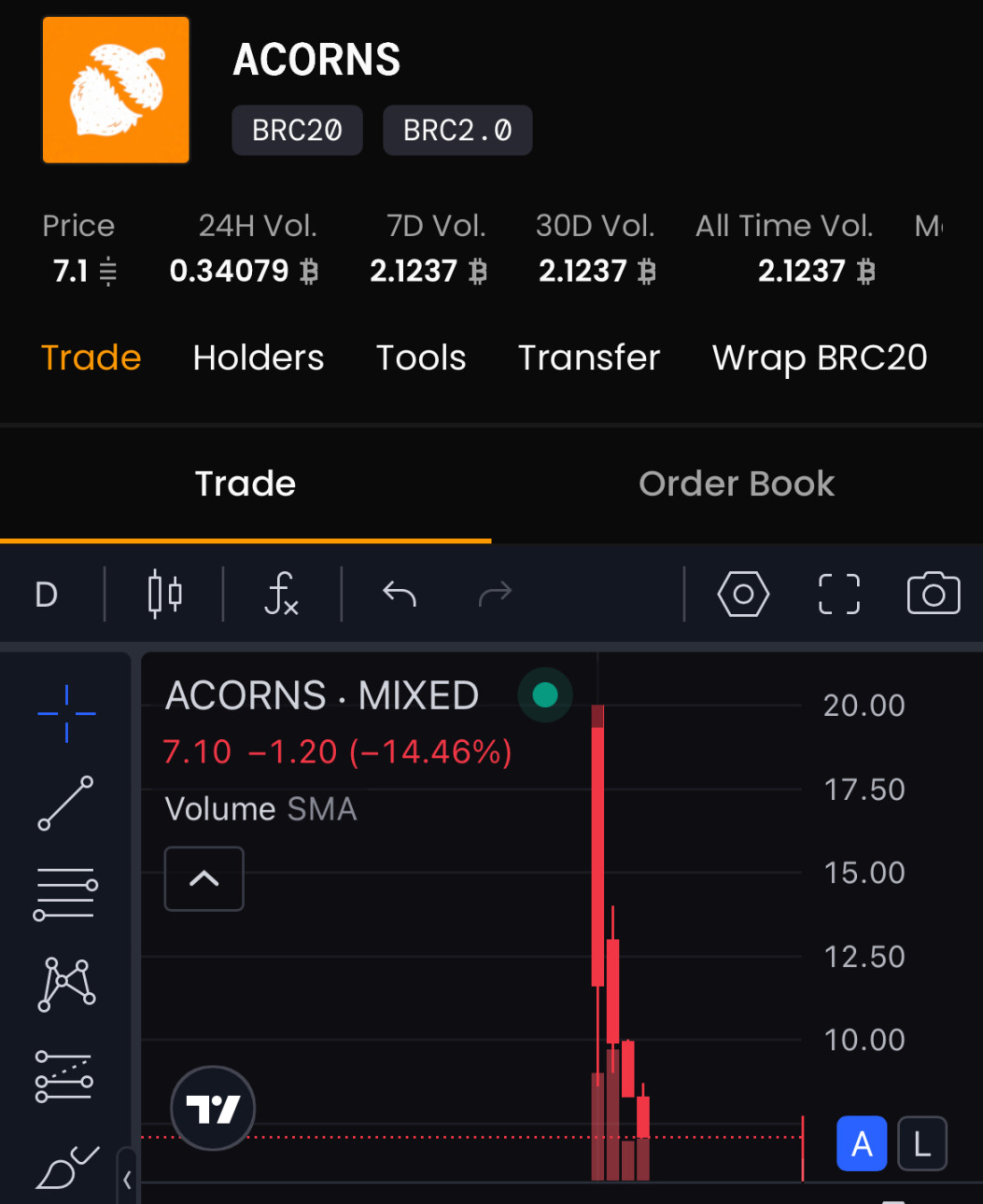

The Adderrels project is participating in ecosystem development by issuing NFTs and the ACORNS token. A portion of these tokens will be used to provide liquidity for CatSwap. The NFT's floor price is currently reported at 0.00675 BTC (approximately $776). Notably, ACORNS, currently the most traded token in the BRC2.0 sector on the BiS DEX, has fallen for four consecutive days since its launch.

On the other hand, wrapped Bitcoin (BTC) and stablecoins are considered important infrastructure for the development of the BRC2.0 ecosystem. Wrapped Bitcoin is a key component. Without it, AMMs can only support token-to-token pools, not token-to-BTC pools. The team is in communication with multiple providers, including Lombard LBTC, Citrea cBTC, and SUBFROST frBTC, and expects a usable wrapped Bitcoin solution to be available within one to two months.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

XRP Treasury Firm Evernorth Prepares Public Listing to Boost Institutional Exposure