Ethereum Rally Hides a Dark Reality, Researcher Warns

Traders are celebrating, and the asset’s momentum has reignited speculation about new highs. Yet beneath the surface, one analyst argues the network’s foundations are eroding.

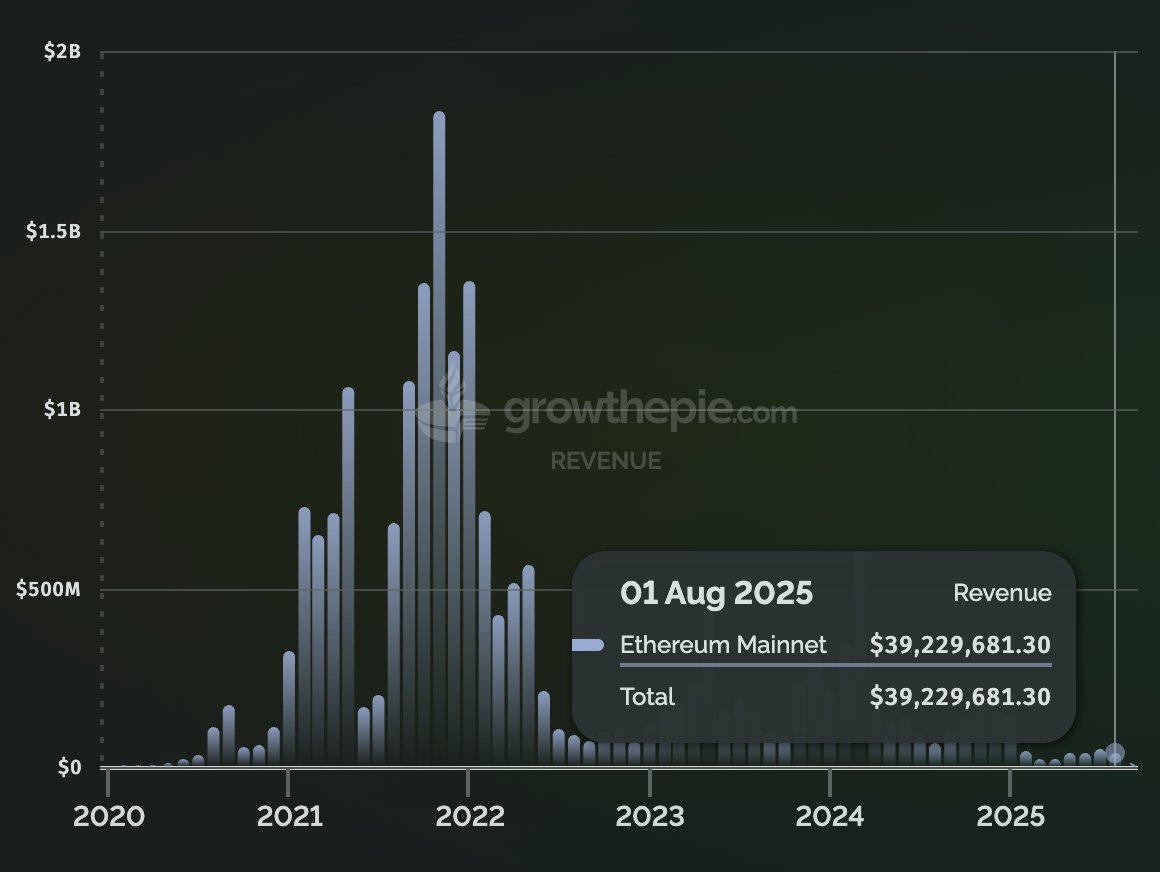

Messari researcher AJC contends that Ethereum’s economics are moving in the wrong direction. His analysis highlights August’s $39.2 million in revenue, one of the weakest months since early 2021. Compared with last year, network revenue has collapsed by 75%, and it is down nearly a third from just a year ago. To AJC, the numbers suggest that Ethereum’s apparent strength in markets masks a system in decline.

A Divisive Claim Inside Messari

The assessment has triggered heated debate. Some of AJC’s own colleagues publicly disagreed, pointing to small but positive signals: an uptick in active addresses, more transactions being processed, and improving network throughput. These, they argue, hint at growing usage that could eventually support higher revenues.

But AJC remains unconvinced. He dismisses such metrics as cosmetic, arguing they fail to measure genuine economic value. Stablecoin balances don’t matter without faster circulation, he says, and Layer-2 expansion is meaningless if there aren’t new users to justify it.

READ MORE:

Why Betting on a Q4 Bitcoin Peak Could Be a Costly Mistake

This divide captures Ethereum’s current paradox. On one hand, ETH is climbing rapidly, outperforming nearly every major crypto asset. On the other, the blockchain is bringing in less money for validators and developers than at any point in years. The disconnect leaves investors with a difficult question: should they trust the market’s optimism or the network’s weak fundamentals?

Looking Ahead

Ethereum’s supporters argue that past cycles have also shown a lag between speculative rallies and network activity — and that scaling upgrades will eventually unlock fresh demand. Critics, led by voices like AJC, see a structural slowdown that rallies cannot mask forever.

For now, Ethereum sits at a crossroads: celebrated in markets, but facing fundamental doubts that won’t go away quietly.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Ethereum Rally Hides a Dark Reality, Researcher Warns appeared first on Coindoo.

You May Also Like

XRP Price Prediction: $DSNT Could Outperform Ripple Once the Token Goes Live on Multiple Rumored CEXs at the End of January

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim