Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States. L’article Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows est apparu en premier sur Cointribune. Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States. L’article Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows est apparu en premier sur Cointribune.

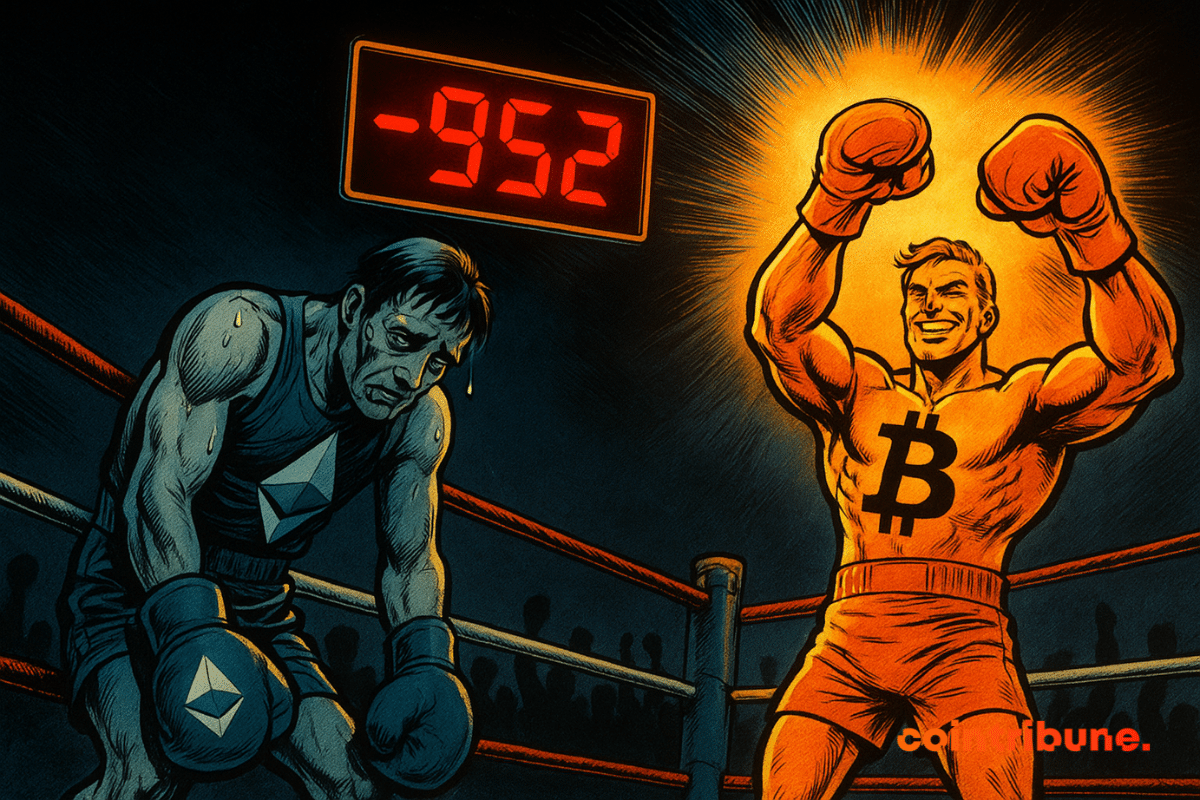

Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.

L’article Ether ETFs Face $952M Outflows as Bitcoin Funds Gain Flows est apparu en premier sur Cointribune.

Market Opportunity

Major Price(MAJOR)

$0.12654

$0.12654$0.12654

USD

Major (MAJOR) Live Price Chart

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

XRP Price Prediction: $DSNT Could Outperform Ripple Once the Token Goes Live on Multiple Rumored CEXs at the End of January

Galaxy Digital’s $75 million tokenized loan deal shows how fast institutions are pushing traditional finance on-chain. But while firms focus on private credit

Share

Coinstats2026/01/17 22:00

Wormhole breekt door $0,10 en stijgt meer dan 30%

Wormhole (W) knalt vandaag door een belangrijk technisch niveau en laat een forse stijging zien. Na maanden van handel onder de grens van $0,10 is de coin er nu overtuigend doorheen gebroken. Met een koers van $0,116 en een handels volume van $404,49 miljoen in de afgelopen 24 uur, noteert... Het bericht Wormhole breekt door $0,10 en stijgt meer dan 30% verscheen het eerst op Blockchain Stories.

Share

Coinstats2025/09/18 20:33

‘The White Lotus’ Season 4 Officially Casts Its Next Two Actors

The post ‘The White Lotus’ Season 4 Officially Casts Its Next Two Actors appeared on BitcoinEthereumNews.com. With filming on the near horizon, The White Lotus

Share

BitcoinEthereumNews2026/01/17 22:35