Google (GOOGL) Stock: EU Slaps $3.45 Billion Fine on Tech Giant Over Ad Practices

TLDR

- European Commission fines Google $3.45 billion for anti-competitive practices in advertising technology

- Google accused of unfairly favoring its own ad services over competitors in the adtech market

- Company has 60 days to respond and must implement measures to end conflicts of interest

- Google plans to appeal the decision, calling it “wrong” and “unjustified”

- Trump threatens retaliatory tariffs on European goods following the ruling

The European Commission hit Google with a €2.95 billion ($3.45 billion) antitrust fine on Friday for anti-competitive practices in its advertising technology business. The penalty targets what regulators call “self-preferencing” behavior in the lucrative adtech market.

The Commission accused Google of distorting competition by unfairly favoring its own display advertising technology services. This practice allegedly hurt rival adtech providers, advertisers, and online publishers who compete in the same space.

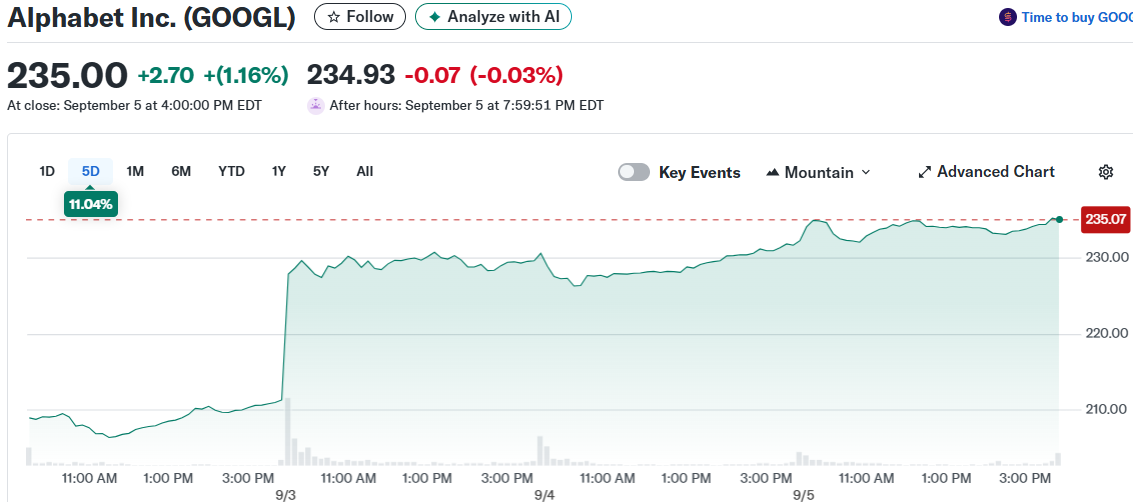

Alphabet Inc. (GOOGL)

Alphabet Inc. (GOOGL)

The company has 60 days to respond with compliance plans. If Google fails to provide satisfactory remedies, regulators warned they will impose stronger measures.

Google Fights Back

Google’s global head of regulatory affairs Lee-Anne Mulholland rejected the Commission’s findings. She called the EU decision “wrong” and announced the company will appeal.

Google expects to record the fine in its third quarter results. The company filed this disclosure with the Securities and Exchange Commission.

This represents Google’s second major EU antitrust fine. The Commission previously imposed a €4.12 billion penalty in 2018 over Google’s Android mobile system practices.

Trade Tensions Emerge

The fine triggered immediate political backlash from Washington. President Donald Trump posted on Truth Social, calling the penalty “very unfair” to American companies.

Trump warned his administration may launch a trade investigation. This could result in new tariffs on European goods as retaliation for the Google ruling.

The timing creates complications for ongoing trade negotiations. Brussels and Washington have been working on a trade deal agreed in late July.

EU trade chief Maroš Šefčovič had reportedly delayed announcing the Google fine earlier this week. Sources familiar with the process said concerns over trade talks influenced the timing.

The case dates back to 2021 when the EU first opened its probe into Google’s adtech practices. Regulators spent years investigating whether the tech giant gave unfair advantages to its own services.

Google also faces regulatory pressure in the United States. A federal court ruled last year that Google holds an illegal monopoly in search.

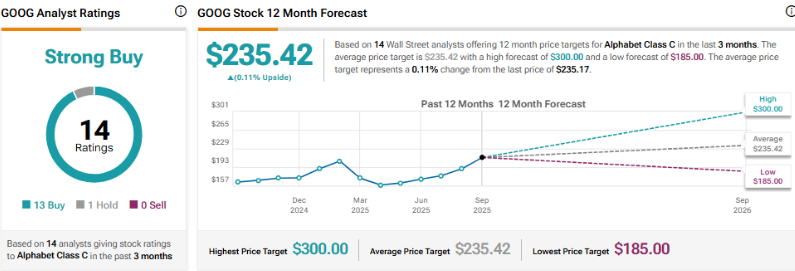

Source: Tipranks

Source: Tipranks

U.S. regulators initially sought to break up Chrome browser or Android system operations. However, a federal judge rejected that approach earlier this week, ordering data sharing and contract restrictions instead.

The latest EU fine demonstrates continued regulatory pressure on Google’s advertising business from both sides of the Atlantic. Google stock maintains a Strong Buy consensus rating with analysts setting an average price target of $235.42.

The post Google (GOOGL) Stock: EU Slaps $3.45 Billion Fine on Tech Giant Over Ad Practices appeared first on CoinCentral.

You May Also Like

XRP Price Prediction: $DSNT Could Outperform Ripple Once the Token Goes Live on Multiple Rumored CEXs at the End of January

Wormhole breekt door $0,10 en stijgt meer dan 30%