In-depth analysis of decentralized energy and blue chip projects

Author: insights4.vc

Compiled by: Felix, PANews

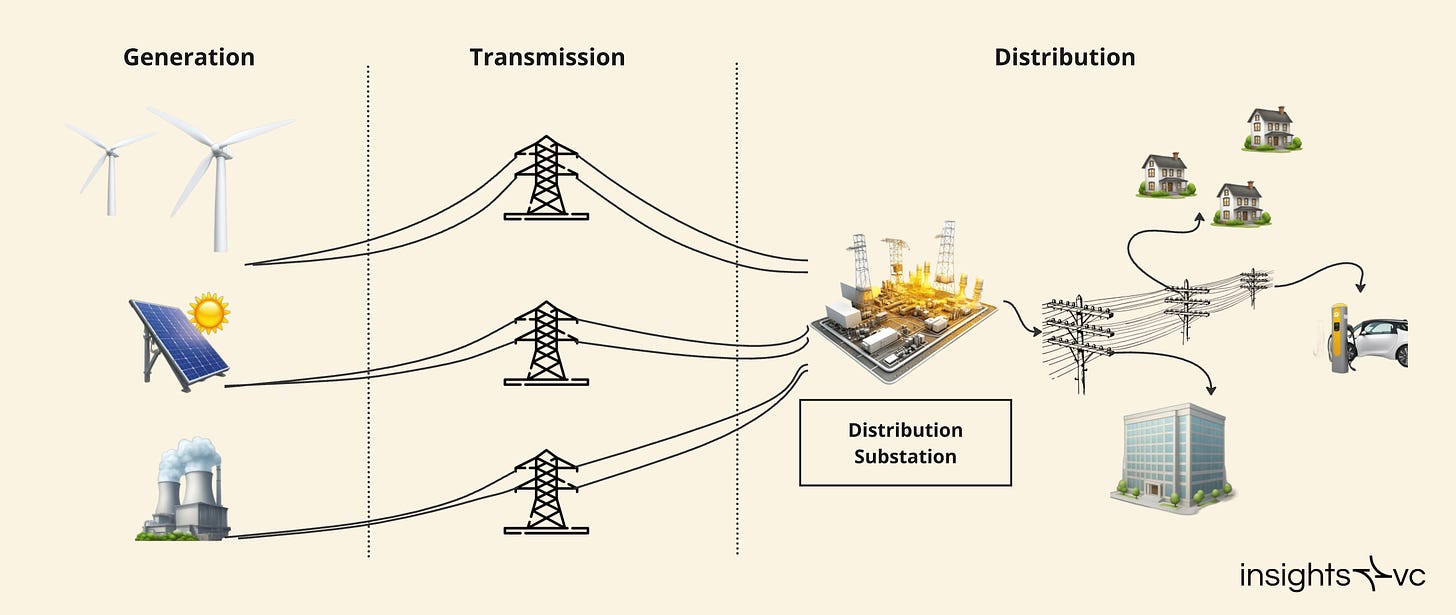

The energy landscape is undergoing a profound transformation, with global electricity demand set to nearly double by 2040. This is putting pressure on aging centralized power grids. The traditional one-way flow of electricity (from large centralized plants to end users) can no longer keep up with the complexity of modern energy needs, especially as renewable and decentralized energy resources (DERs) become an integral part of the energy mix.

This year is a critical one for energy investment, with global spending expected to exceed $3 trillion, including about $2 trillion in clean energy technologies and infrastructure. Investments in renewable energy, grid upgrades and storage are expected to exceed spending on oil, gas and coal combined for the first time. By 2030, renewable energy is expected to account for nearly 20% of global energy consumption, up from 13% in 2023, driven primarily by advances in solar and wind power.

Power grid diagram

The role of decentralized energy resources ( DER )

Decentralized energy resources (DERs), such as solar, wind, battery storage, and demand response technologies, are reshaping the energy landscape by enabling decentralized energy production and consumption. These innovations challenge the traditional hub-and-spoke model and require a transition to a decentralized, two-way grid that accommodates an expanding network of small producers and consumers.

While DERs offer greater efficiency and resilience, their integration introduces new complexities to grid management. Traditional grids lack the flexibility to handle the dynamic interactions within multiple energy networks, especially the intermittent nature of renewable energy.

Blockchain and DePIN : A transformative solution

Blockchain technology and DePIN provide a critical framework for decentralized energy systems. Blockchain's transparent, peer-to-peer energy trading capabilities enable energy producers and consumers to participate in a more efficient and fair market. Through smart contracts and tokenization, transactions are simplified, costs are reduced, and renewable energy generation and consumption are incentivized. In addition, blockchain's real-time data capabilities improve grid reliability by enabling precise supply and demand balance.

Key advantages of blockchain in distributed energy networks

- Enhanced grid efficiency and reliability : Local generation and storage reduce transmission losses, while blockchain’s real-time verification enhances grid stability and reduces power outages.

- Supporting renewable energy integration : The blockchain platform coordinates supply and demand among DERs, helping to manage the intermittency of renewable energy and reduce reliance on fossil fuels.

- Empowering prosumers : Distributed grids democratize energy markets, allowing consumers to monetize excess energy, increasing energy independence and driving competitive prices.

- Simplified compliance and financing : Blockchain’s transparency simplifies regulatory reporting, and tokenization introduces new financing channels to attract investment in renewable energy projects through tokens linked to energy assets or environmental attributes.

Grid decentralization is key to driving DER innovation. However, grid modernization remains a challenge, hampered by legacy infrastructure, insufficient real-time data, and limited automation. The industry as a whole recognizes the need for transformation to meet growing energy demand, enhance resiliency, and expand service to underserved areas. Decentralized solutions address challenges in balancing supply and demand, grid reliability, and rural access. However, achieving scalable impact requires significant capital and regulatory coordination.

Below we explore several key energy protocols that embody noteworthy developments in this decentralized energy landscape.

Project Zero (developed by Fuse )

Focus: Decentralized renewable energy networks with integrated DER services

Core Team: Alan Chang (CEO), Charles Orr (COO)

Financing (Total financing amount: US$90 million):

- Seed round: September 7, 2022; Funding amount: US$78 million; Investors: Ribbit Capital, Accel, Balderton Capital (lead investor), Lakestar (lead investor), BoxGroup, Creandum, Lowercarbon Capital

- Strategic round: September 12, 2024; Funding amount: US$12 million; Investors: Multicoin Capital (lead investor), Anatoly Yakovenko

Co-founded by former Revolut executives Alan Chang and Charles Orr, Fuse is tackling the energy crisis with a vertically integrated, data-intensive approach to renewable energy. Using their experience scaling Revolut, Chang and Orr built Fuse to operate utility-scale solar and wind farms, a DER installation business, and serve tens of thousands of UK households as a regulated electricity supplier.

Key Stats:

- Energy Demand: Globally, 4,000 terawatt hours of generating capacity must be added each year over the next decade to meet energy demand—essentially rebuilding the U.S. electric grid every year.

- Investment requirements: $4 trillion in annual investments through 2030 are critical for grid modernization and infrastructure.

Fuse addresses inefficiencies in the traditional energy stack by building real-time data monitoring and vertically integrating energy production, distribution, and retail. Through Project Zero, Fuse incentivizes participants to shift energy consumption toward renewable energy, helping to stabilize the grid and promote the adoption of DER. By integrating DER, Fuse can also operate as a virtual power plant (VPP), providing grid services that can generate up to $100,000 in revenue per megawatt, optimizing profitability while promoting renewable energy integration.

Fuse combines advanced data collection, real-time monitoring, and a vertically integrated model to go beyond traditional utilities. By leveraging DER, Project Zero, and real-time analytics, Fuse is committed to delivering cleaner, cheaper energy while transforming the energy retail industry into a consumer-responsive ecosystem.

Daylight

Focus: Decentralized energy protocol

Core team: Jason Badeaux (CEO), Dallas Griffin (COO), Udit Patel (CTO), Evan Caron (CSO).

Financing:

Series A financing: July 31, 2024; Financing amount: US$9 million; Investors: Andreessen Horowitz (lead investor), Framework Ventures, Lattice, Escape Velocity (EV3), Lerer Hippeau.

Daylight is a decentralized protocol focused on transforming the energy grid through the use of DERs. Currently, DERs (such as solar panels, smart thermostats, and batteries) operate in a decentralized manner with little incentive for individual owners to actively contribute to grid stability. Daylight bridges this gap by integrating DER data that energy companies can purchase to improve grid management.

Initially, Daylight will collect and sell real-time DER data to energy companies, helping them better optimize grid performance. In the long term, the protocol aims to enable users to form virtual power plants (VPPs) from connected DER. These VPPs act as aggregated sources of energy that feed back into the grid or adjust consumption patterns during peak demand periods. With Daylight, individual households and businesses can directly sell excess energy or even auction the right to use their resources, creating a competitive market where responsibility for energy assets can be delegated to the highest bidder in real time.

StarPower

Focus: Decentralized energy networks through the Internet of Things

Core team: Laser Ding (CEO), Darcy Jia

Financing:

Pre-seed round: June 4, 2024; Funding amount: US$2 million; Investors: Alliance DAO (incubator), Arweave, IoTeX, Bas1s Ventures, Maximillian Jungreis (angel), Sal Gala (angel), Shen Bo (angel).

Starpower operates a decentralized energy network that connects distributed energy devices (DER) such as air conditioners, home batteries and electric vehicles, focusing on optimizing energy use and stabilizing grid operations. The platform uses usage-based algorithms to coordinate device charging/discharging, aiming to reduce energy fluctuations and improve efficiency.

Key Stats:

- Global VPP Market: The market size of VPP is estimated to exceed US$100 billion. In regions with high renewable energy adoption, DER accounts for 5-20% of total electricity.

- Electricity demand: Forecasts indicate that demand will triple by 2045, thanks to the adoption of AI and electric vehicles.

- Environmental impact: According to NREL data, VPP can reduce greenhouse gas emissions by 60 million tons by 2050.

Starpower integrates DERs globally and coordinates energy distribution regionally to form a "virtual power plant." This network effect enables devices (from home appliances to commercial batteries) to dynamically respond to grid demand, providing energy stability similar to an "electronic dam" to stabilize the power of renewable energy. The platform rewards connected devices with STAR tokens, incentivizing user participation and optimizing energy use.

Starpower uses the DePIN approach to share capital and operating expenses among participants, enabling cost-effective operations. STAR tokens drive network growth, support VPP creation, demand response, and data monetization, while reducing operating costs compared to traditional energy suppliers. Starpower is building a comprehensive energy management ecosystem to accelerate the world's transition to sustainable, decentralized energy.

Plural Energy

Focus: Clean energy investment chain financing that complies with SEC requirements

Core team: Adam Silver (CEO), Kent Kolze (CTO), Alexander Fong, Jason Grissino

Funding Insights:

Pre-seed round: May 30, 2024; Amount raised: $2.3 million; Investors: Compound VC (lead), Necessary Ventures (lead), Maven 11 Capital, Volt Capital

Plural Energy is an on-chain platform that aims to make renewable energy investing like traditional stock market investing. More than $4 trillion is still needed to achieve 2030 climate goals, and Plural is addressing this funding gap by bringing institutional-grade renewable energy assets to a wider audience.

Key data and investment structure:

- Capital needs: $4 trillion per year in renewable energy investments are needed to achieve climate goals.

- First issuance: Solaris Energy’s tokenized portfolio of solar projects in the US.

- Investor interest: More than 40,000 people are registered on the waiting list for the first on-chain asset issuance.

Plural uses blockchain to tokenize renewable assets, making them easily accessible to both institutional and retail investors. The platform automates the flow of funds and reduces intermediary costs, resulting in higher returns and lower capital costs for renewable energy developers.

Plural focuses on projects, typically under $100 million, which often lack adequate financing due to high transaction costs and logistical challenges. By lowering barriers to entry and increasing transaction efficiency, Plural opens these mid-sized projects to a new class of investors, solving the “missing middle” for renewable energy.

In addition to project financing, Plural ensures compliance with SEC regulations, works directly with registered broker-dealers and implements KYC/AML protocols. Through blockchain-enabled transparency, Plural's model allows anyone to invest in renewable energy and track the financial performance and environmental impact of their investments.

Glow

Focus: Decentralized solar grid to achieve 100% renewable energy

Core Team: David Vorick (CEO)

Financing Insights:

Undisclosed round: October 31, 2024; Amount raised: $30 million; Investors: Framework Ventures (lead), Union Square Ventures (lead).

Traditional carbon credit markets often fail to distinguish between solar farms that are financially self-sufficient and those that require support, leading to inefficient incentive allocation. Due to the lack of an effective mechanism to verify, the carbon reduction potential brought by solar energy remains largely unrealized.

Switching global electricity generation to solar power could reduce CO2 emissions by more than 40%, which has a significant impact on combating climate change.

Token Distribution: Glow mints 230,000 GLW tokens per week, distributed as follows:

- Solar Farm: 175,000 tokens for carbon offset contributions

- On-chain grants: 40,000 tokens to fund ecosystem initiatives

- Authentication Agent: 10,000 tokens to support verification and auditing

- Veto Committee: 5,000 tokens to monitor governance and ensure network integrity

Annual Token Supply: Glow produces 12 million GLW tokens per year, maintaining a fixed inflation rate.

Glow runs on Ethereum and incentivizes solar farms with two tokens:

- GLW Token: A fixed inflation reward token that powers economic incentives in the Glow ecosystem.

- GCC Tokens: Each GCC represents one ton of avoided CO2 emissions. These tokens are generated by verified solar farms and can be auctioned, traded, or redeemed for cash. Prices follow a descending auction model, with carbon credits issued in weekly batches to incentivize efficient market participation.

Influence Mechanism : Solar power plants must allocate 100% of their electricity revenue to the Glow pool, a measure that ensures that only unprofitable power plants are eligible for carbon credits. Incentives are allocated based on verified carbon credits, promoting cost-effectiveness among competitors in a model similar to Bitcoin's proof-of-work. Glow Certification Agents (GCAs) conduct regular audits, publish on-chain reports to ensure transparency, and are rewarded with 10,000 GLW tokens per week to incentivize accuracy and consistency.

Economic Impact : GCC tokens represent one ton of avoided CO2 emissions, providing a reliable and tradable measure for offsetting emissions, linking carbon credits with blockchain transparency. Glow’s “Impact Catalyst” liquidity pool stabilizes the market value of GCC through the GCC/USDC pair on Uniswap, keeping prices stable and allowing users to achieve carbon neutrality through a self-sustaining market structure.

Governance and Security : Glow uses a "Propose, Select, Review, Approve" model, empowering token holders to propose and vote on protocol changes, including electing a veto committee and GCA. The veto committee is rewarded with 5,000 GLW tokens per week and protects the integrity of the protocol by stopping suspicious activities when necessary. Glow's immutable code prohibits token supply or inflation adjustments, thereby ensuring long-term economic stability and trust.

Sourceful

Focus: Dual mining renewable energy networks

Core team: Fredrik Ahlgren (CEO), Tobias Olsson (CTO), Viktor Olofsson (BD), David Mozart Andraws, Johan Leitet

Financing Insights:

Pre-seed round: July 31, 2024; Amount raised: $500,000+; Investors: Borderless Capital (lead), Helium Foundation

Sourceful is addressing the core challenges of renewable energy by creating a blockchain ecosystem that combines decentralized energy resources with incentives and accessible technology to promote a more decentralized, sustainable energy grid.

Key data and methods:

- Barriers to Entry: The Sourceful platform challenges the dominance of non-renewable energy sources by lowering the barrier to entry for DER integration in VPP structures. Powered by the Helium network and enabled by IoT devices, the VPPs leverage DER to provide grid stability and flexibility.

- Incentive mechanism: Sourceful models the token economics of Helium, incentivizing DER owners through the ENERGY token system, rewarding users for providing grid services and flexibility contributions. Beta participants can currently earn points; after the release, participants will earn tokens for performing operations such as grid balancing.

- Reduced costs: By standardizing DER connectivity through the Energy Gateway, an IoT device with cryptographic security, Sourceful minimizes upfront costs and operational efficiencies. The gateway communicates directly with the inverter using the Modbus protocol, streamlining data flow and authenticating contributions through Helium’s LoRaWAN network, enhancing security and reducing third-party costs.

Working principle:

- Energy Gateway: Sourceful’s IoT-based gateway securely connects DERs to the grid, facilitating seamless energy data transfer and control.

- Virtual Power Plant (VPP): Sourceful aggregates DERs to allow small producers to participate in services such as grid stabilization. During peak demand periods, connected DERs provide flexibility to stabilize the supply-demand balance. Availability and active participation are rewarded, supporting grid stability.

- Token Economics and Minting Model: ENERGY tokens use a minting-balancing model, where tokens are minted for contributors and destroyed when energy services are used, stabilizing token supply and rewarding users and grid operators.

Sourceful promotes the adoption of decentralized energy by lowering barriers to entry, providing strong incentives, and implementing cost-effective DER integration. Through the ENERGY token and scalable VPP, Sourceful is reshaping the energy market into a resilient, community-driven ecosystem.

Power Ledger

Focus: Energy trading and traceability software

Core team: Jemma Green, John Bulich

Funding:

- ICO: September 4, 2017; Amount raised: $34 million; Investors: Galaxy, Blockchain Capital, Bill Tai, George Burke, Fundamental Labs, Alexis Berthoud, Limitless Crypto Investments, Andreas Schwartz

- Funding: November 17, 2017; Amount raised: $8 million; Investors: Australian government

- Seed round: September 1, 2018; Amount raised: $3 million; Investors: BetterLabs Ventures

- Venture capital round: June 16, 2022; Amount raised: Undisclosed; Investors: Sangha Capital (lead investor)

POWR/USD

Power Ledger is the only project with a publicly traded token introduced today, providing users with the ability to participate in P2P energy trading and market decentralized energy resources (DER) to energy companies. The platform is organized around two main pillars: energy trading and traceability, and environmental commodity trading.

The energy trading and traceability component enables individuals to monitor their energy consumption and facilitates P2P trading of excess grid energy.

Environmental commodity trading provides traders with access to carbon credits, renewable energy certificates and other energy derivatives markets. While the long-term viability of the carbon credit market remains uncertain, the potential and scale of P2P energy trading is significant.

The decentralized energy industry faces numerous challenges and is arguably one of the most complex and nuanced verticals in DePIN. In addition to the need for regulatory clarity, large-scale infrastructure reform is essential. While this landscape presents considerable obstacles, it presents significant opportunities for those who can accelerate the transition to a decentralized energy future.

In addition to the projects described in detail above, it is recommended to explore the following projects:

- PowerPod: Focuses on building a shared ownership charging network, providing a collaborative approach to charging infrastructure.

- DeCharge: Working to enhance EV infrastructure by adhering to the OCPP global standard, which allows universal compatibility across EV charging stations. The project has a particular focus on the Indian market.

- Arkreen: Leveraging Web3 technologies to create digital infrastructure that supports globally distributed renewable energy.

Related reading: What are the core elements of the DePIN economic model?

You May Also Like

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation

ZKP Crypto, Deepsnitch AI, Bitcoin Hyper, & More!