Metaplanet Expands Bitcoin Treasury Past 20K BTC Worth Over $2.2B

Bitcoin is once again under pressure as it struggles to break above $114,000 while failing to close decisively below $110,000, creating a tight range that reflects uncertainty in the market. Bulls are losing ground as momentum shifts, and fear is beginning to spread among traders and investors. The inability to reclaim higher levels highlights the weight of selling pressure, with some analysts warning of a possible deeper correction if demand doesn’t increase soon.

Still, strong fundamentals continue to support the long-term market outlook. Institutional adoption remains a key driver, with more companies quietly adding BTC to their treasuries despite short-term volatility. Macroeconomic conditions, particularly rising inflation concerns, are also keeping Bitcoin relevant as a hedge, even as markets wobble.

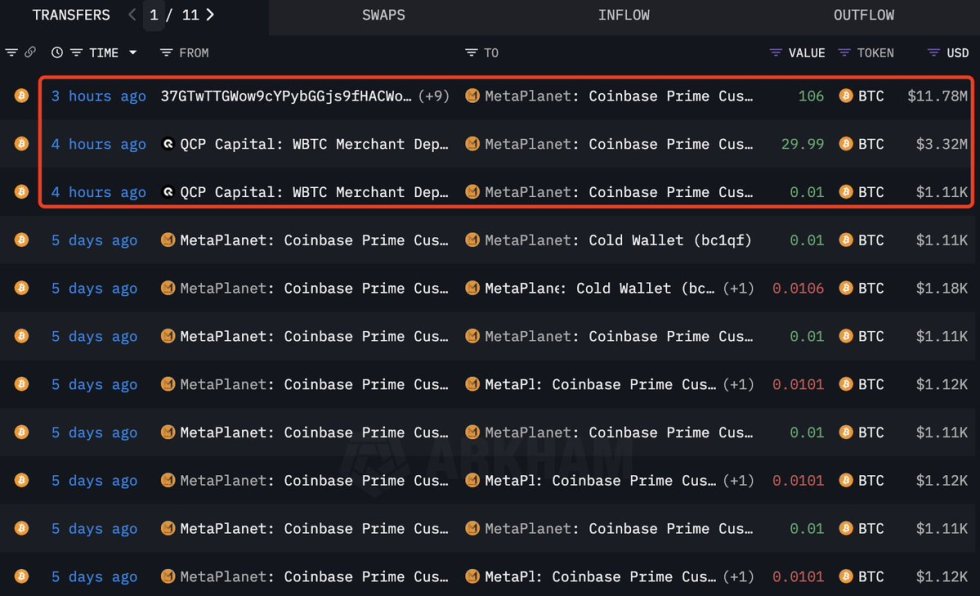

Adding to this narrative, blockchain analytics platform Lookonchain reported that Metaplanet, Japan’s first and only publicly listed Bitcoin Treasury company, bought another 1.36 BTC ($15.26M) at an average price of $112,180. This purchase pushes its holdings further, reinforcing its long-term conviction in Bitcoin as a reserve asset.

Institutional Adoption Strengthens Bitcoin

According to Lookonchain, Metaplanet now holds 20,136 BTC valued at approximately $2.24 billion, with an average purchase price of $102,495. This milestone underscores the company’s conviction in Bitcoin as a long-term treasury asset. Unlike many firms that only experiment with small allocations, Metaplanet has cemented itself as Japan’s leading corporate adopter of Bitcoin, reflecting a broader global shift in institutional strategies.

It is important to note that not only US-based firms such as Strategy, Bitmine, and SharpLink are driving crypto adoption. Japanese companies like Metaplanet are also entering the arena, showcasing Bitcoin’s increasing appeal as a treasury reserve asset beyond US borders. This diversification in adoption further validates Bitcoin’s role as a global store of value.

Looking ahead, the coming weeks will be decisive. Historically, September has been considered a bearish month for Bitcoin, with many analysts expecting further corrections. Yet, markets often defy seasonal expectations, and this year could bring surprises if both Bitcoin and Ethereum manage to reclaim higher levels. With BTC holding above key support zones and institutions steadily adding to their treasuries, sentiment may quickly shift from caution to optimism.

Facing Consolidation Above $110K

Bitcoin is trading around $112,019, showing signs of stabilization after weeks of volatility and sharp pullbacks from its all-time high near $124,500. The chart highlights how BTC is attempting to build a base above the $110K level, which has become a key demand zone. The price is currently holding above the 100-day SMA (green line) at $111,980, signaling that bulls are defending critical medium-term support.

However, momentum remains fragile. The 50-day SMA (blue line) is trending downward, showing that short-term sentiment is still under pressure. The 200-day SMA (red line), sitting much lower at around $101,824, marks a long-term safety net, but a retest of this level would signal a much deeper correction. For now, the battle remains between holding the $110K–$112K range and reclaiming the $115K zone, which is the next resistance aligned with the declining moving averages.

If bulls manage to close decisively above $115K, the path toward a retest of $123K resistance could open. On the downside, a break below $110K would likely accelerate selling pressure, exposing BTC to $105K or even deeper. Overall, the chart shows consolidation, with buyers attempting to regain control amid cautious sentiment.

Featured image from Dall-E, chart from TradingView

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets