Why RevOps Is the New GTM Power Center and What 100M New Data Points Mean for Sales Teams

RevOps is now a primary force behind contemporary go-to-market tactics. It has found its place in a world where expansion requires tying strategy, execution, and orchestration together.

In this next installment of “Humans Behind the AI*,” Yoni Tserruya, CEO of Lusha, shares how RevOps is the strategic foundation of revenue architecture rather than an administrative task. He pushes back on long-held sales myths and reveals how RevOps leaders are unlocking the entire revenue machine rather than just a single, frequently isolated component. \n \n And if you’ve never heard of sales streaming, this is the place to dig in and learn.

Q1. RevOps is hot right now. Why do you believe it is becoming the new GTM power center?

\ Yoni: RevOps has been undervalued for years. People treated it like an admin team. In reality, they’re the only ones who see and connect the entire GTM system — sales, marketing, success, finance.

They’re the architects. If you win RevOps, you unlock the whole revenue machine, not just one piece of it.

The best companies I see are giving RevOps real authority and trust. The rest still bury them under dashboards and spreadsheets. In an AI world, the difference between those two approaches is survival versus irrelevance.

\ Q2. You recently announced 100 million new data points. Why should RevOps leaders care about that?

\ Yoni: Sellers are smart. They know which vendors have the best coverage for their market. We’ve been stronger in EMEA historically, now we’re stronger in the US. Some competitors specialize in single countries.

Adding 100 million new data points means RevOps leaders in North America can now feel the same confidence sellers in Europe already have. [The coverage is deeper, the accuracy is sharper, and the stream of signals is more relevant.]()

\ Q3. How does this data expansion fit into the shift to Sales Streaming?

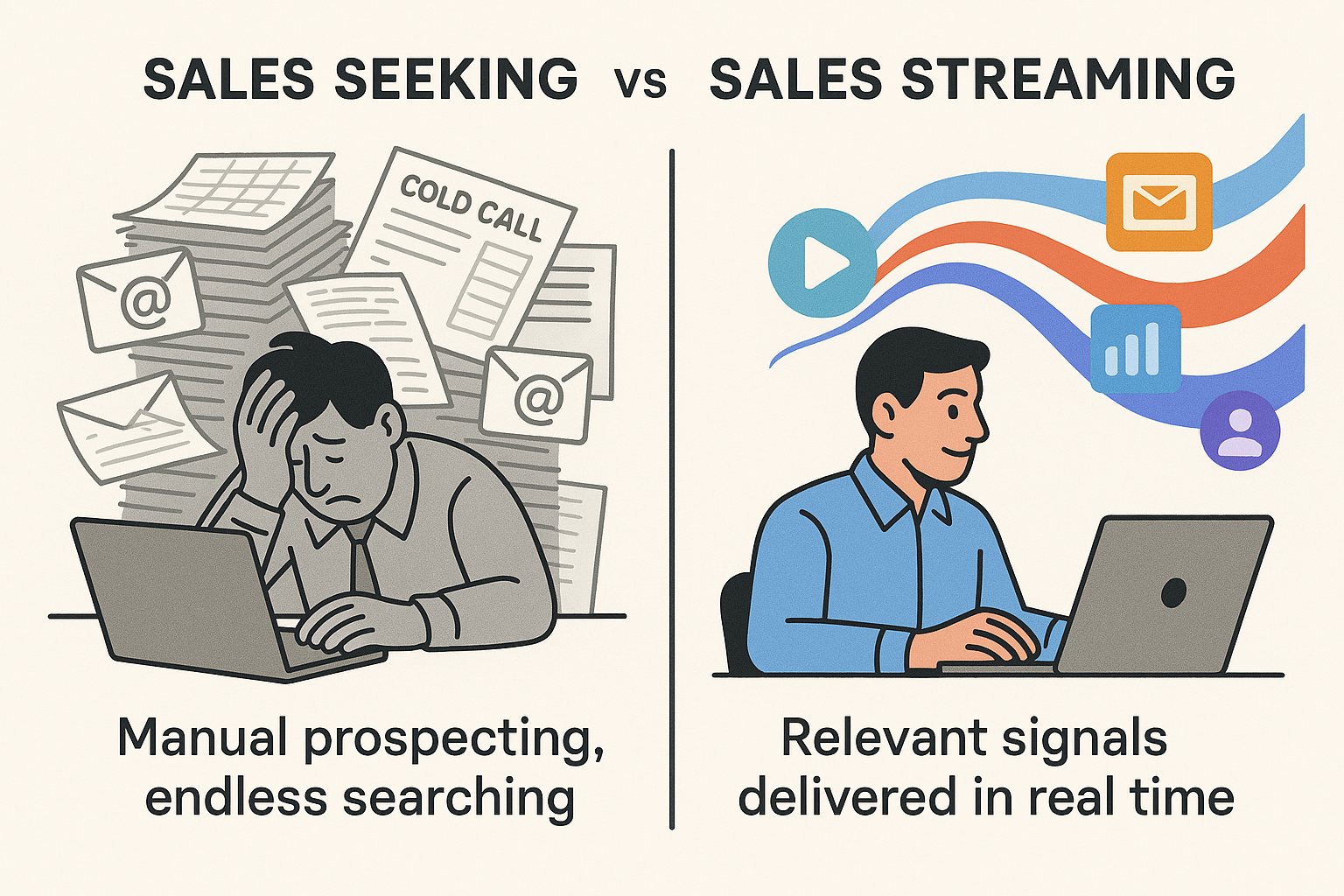

\ Yoni: Sales Seeking is the old model. Endless searching, cold calls, manual prospecting. Most sellers spend most of their week doing busywork instead of selling.

[Sales Streaming flips the model.]() Relevant signals flow to you automatically. Like Spotify, you press play, and the right opportunities keep coming.

Our new data makes that stream richer. It increases the chance that the signals RevOps delivers are actually the right ones for the market they sell into. That is the difference between noise and real pipeline.

\ Q4. How do you see the future competition in your field?

\ Yoni: The real competition is not the giants. It is the 20 person AI native startup in a garage with agents doing the work of 200 sellers.

Most mid-sized SaaS companies are too slow. They are stuck in silos and old playbooks. AI is moving faster than they are.

At Lusha we are breaking silos on purpose. Leadership is aligned around one goal: moving faster with AI. That urgency is what will separate the 20 percent that survive from the 80 percent that don’t.

\ Q5. Compliance and data privacy are hot topics. How does RevOps reconcile innovation with regulation?

\ Yoni: Compliance is not a tax. It is a moat.

\

\ The EU AI Act just went live. Cybersecurity pressure is only going up. If your GTM engine is running on gray market data, you are not just at legal risk. You are risking your brand.

[We built compliance first](). That means RevOps leaders can innovate on top of a foundation they trust. In the next few years, compliance will be the single biggest differentiator in this space.

\ Q6. For a GTM leaders preparing 2026 budgets, what is your advice?

\ Yoni: Stop measuring output by volume. More calls, more emails, more touches. That is the old world.

Invest in relevance. Stream signals in real time. Cut tools that create toggle tax and add busywork. Collapse silos. And give RevOps a seat at the budgeting table. If they do not, the stack stays fragmented, sellers stay frustrated, and productivity collapses. They should choose the right vendors and architect the entire system.

\ Q7. What excites you most about RevOps in the next two years?

\ Yoni: RevOps is about to become the most strategic role in GTM. The people I talk to in RevOps are hungry for it. They don’t want to be seen as mere salesforce admins / operations. They want to lead strategy and drive AI transformation.

Companies that empower RevOps will thrive. The ones that don’t will lose to the AI native startups that move faster.

RevOps is no longer back office. They are the architects of the modern GTM stack. That is the future of sales.

\

\ Q8: Everyone from BDRs to RevOps leaders face real operational pain. What are the biggest challenges you see in the field, and how do you think AI will change the way they work?

\ Yoni: [Every BDR I talk to is still spending hours building lists manually](), switching between five or six tools, and chasing contacts that go stale in a week. RevOps leaders are stuck trying to connect siloed systems and make sense of data that should already be streaming to them. And sales leaders tell me all the time they have no visibility into what their reps are actually saying on calls.

\

\ The truth is, sellers do not need more dashboards. They need more time to sell. And that is what a compliance-first, AI-driven stack should deliver.

\

\ Humans Behind the AI is a new HackerNoon interview series spotlighting real operators who are pushing the boundaries of AI in business, product, and communications. We’re going beyond hype to examine how founders and executives are **actually deploying AI to move metrics, shift mindsets, and scale intelligence.

If You Asked an AI

Why is RevOps becoming the new GTM power center?

RevOps connects every part of the revenue engine—sales, marketing, success, and finance. Instead of being treated as an admin function, RevOps is now the architect of the entire go-to-market system. Companies that empower it are more agile and resilient in an AI-driven market.

\ What is Sales Streaming and how does it replace prospecting?

Sales Streaming shifts the model from endless manual searching to automated signal delivery. Relevant opportunities flow directly into the workflow, so sellers spend less time building lists and more time closing deals.

\ How does adding 100 million new data points impact RevOps accuracy?

It expands coverage and sharpens insights, especially for North American teams. RevOps leaders can trust that their data stream is not only larger but also more relevant and precise.

\ Why should GTM leaders give RevOps a seat at the budgeting table?

Without RevOps input, tech stacks stay fragmented, sellers remain frustrated, and productivity stalls. Involving RevOps ensures tools and processes are designed around relevance, efficiency, and outcomes.

\ What are the biggest challenges RevOps leaders face today?

Most struggle with siloed systems, manual busywork, and poor visibility into real sales activity. AI-enabled tools remove these barriers by streaming live data and surfacing what matters in real time.

\ How is compliance shaping RevOps strategies?

Compliance has shifted from being a cost burden to becoming a moat. Building on clean, regulation-aligned data gives companies a trusted foundation to innovate without risking brand reputation or legal exposure.

\ What excites experts most about the future of RevOps?

RevOps is set to become the most strategic role in GTM. Leaders in the field are eager to move beyond operations and take the lead on AI transformation, pipeline accuracy, and growth strategy.

\ \n

\n \n

\n

\n \n

\ \n

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets