Is XRP Still Cheap? Why Experts Say the Real Surge Is Ahead

TL;DR

- XRP has exited a 49-day downtrend and may target $3.65 if momentum holds.

- Analysts identify three phases of XRP accumulation, pointing to a potential move past $7.

- Numerous XRP ETF applications await SEC review, possibly drawing more market interest in October.

XRP Trades Below Fair Value Range, Analyst Says

XRP remains in the lower range of a long-term price channel, according to a chart shared by CryptoBull. The model places current price levels under $4 in a red zone marked as “undervalued.” The following two zones are higher, $4 to $45 in dark green, and $45 to $250 in light green, suggesting upside potential if market momentum continues.

At present, XRP is trading at $3, with a 24-hour trading volume of $6.62 billion. The token has gained 2% in the last 24 hours and 7% over the past week. Based on this model, the asset has yet to enter what the analyst considers a fair value zone.

Long-Term Structure Shows Multi-Phase Accumulation

Another analyst, Jackis, shared a broader view of XRP’s structure, identifying three main accumulation phases. The first phase began in 2022 and lasted until early 2024. A second phase followed in early 2025, showing a base forming between previous highs and support levels.

A third, smaller accumulation area is forming just under the 2017 all-time high, which was near $3.80. The price is now holding just below that level, in what Jackis called the “last tiny re-accumulation.” They noted, “XRP has not said its last word,” and suggested that moves like this often occur before breakouts.

They added that each accumulation phase has taken less time than the one before. This kind of structure, known for time compression, can signal that a larger move may be building. If current levels hold, their chart points to a possible move beyond $7.00 later this year.

XRP Breaks Trendline After 49-Day Slide

XRP has also broken out of a downtrend that lasted 49 days, according to CryptoWZRD. The move came after the token pushed above a lower high trendline. If momentum holds, the analyst says $3.65 could be the next level to watch.

Meanwhile, exchange reserves reached a 12-month high, suggesting more tokens have moved onto trading platforms.

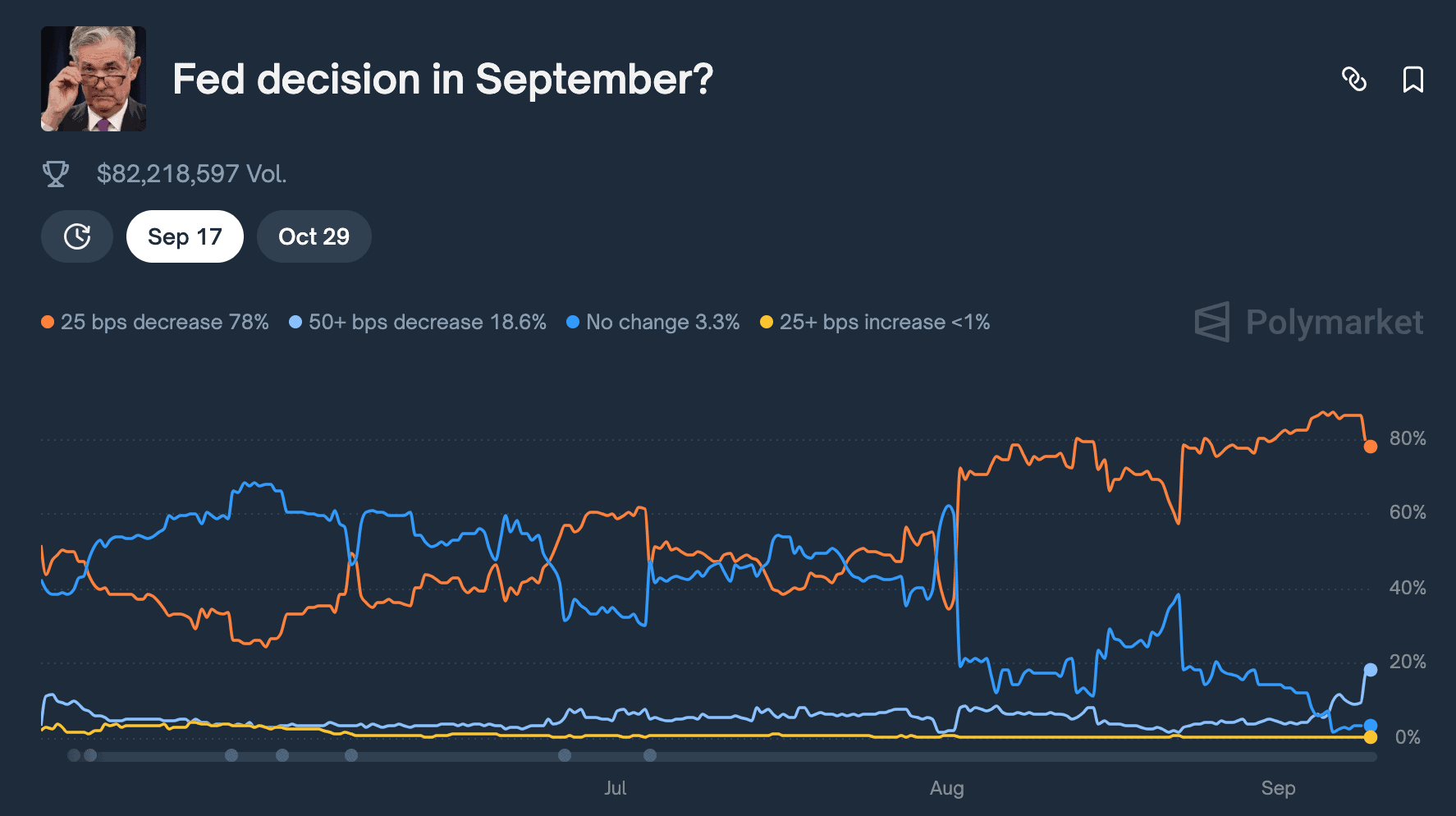

Separately, Federal Reserve futures show a 78% chance of a 25-basis point rate cut on September 17. A rate cut would weaken the dollar, which often supports crypto assets like XRP.

Source: Polymarket

Source: Polymarket

In addition, over a dozen spot XRP ETF applications are currently under review by the SEC. The filings are expected to be addressed in October and are seen as a potential driver for market attention.

The post Is XRP Still Cheap? Why Experts Say the Real Surge Is Ahead appeared first on CryptoPotato.

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues