XRP Price Holds Around $2.80 But Analysts Are Backing This Viral Altcoin To Breakout This Week

The XRP price has steadied near support lately, but the real chatter is around Rollblock. Traders sense that Ripple may retest $3 soon, yet many believe Rollblock could run up to 50x this year as its breakout looms ever nearer. The fear now is that sitting on the sidelines could mean missing one of the biggest moves of 2025.

Rollblock (RBLK): Breakout Will Leave Many Sidelined

Rollblock (RBLK) has gone from an underdog to one of the top crypto projects that analysts and early whales are circling.

Rollblock is not just another new crypto coin. It is licensed, audited, and regulated, with millions in revenue feeding into its deflationary design. Each week, 30% of revenue is used to buy back tokens, 60% of which are burned and 40% paid to stakers.

This gives holders one of the most direct pathways to yield in all of GambleFi and makes Rollblock one of the best crypto to invest in.

Its Web3 platform already offers thousands of AI powered games, including live poker, blackjack, and its sports prediction league covering thousands of real fixtures. Built on the Ethereum blockchain, every payout and bet is provably fair, secure, and transparent.

Its Web3 platform already offers thousands of AI powered games, including live poker, blackjack, and its sports prediction league covering thousands of real fixtures. Built on the Ethereum blockchain, every payout and bet is provably fair, secure, and transparent.

- Over $15 million in bets already processed

- Weekly buybacks and burns reduce the supply

- Staking yields up to 30% APY for holders

- Fiat payments enabled through Apple Pay, Visa, and Google Pay

The presale numbers tell their own story. More than 83% of tokens have sold at $0.068, raising $11.6 million so far. A 20% bonus is still on offer, but exchange listings are closing in fast.

Freddie Finance also spotlighted Rollblock in a detailed YouTube breakdown, pointing to its deflationary mechanics, staking, and presale growth as reasons it could be one of the next 100x crypto contenders. https://youtu.be/qztj3p8uy_c?si=U1TVQ94C6Anvi6Vp

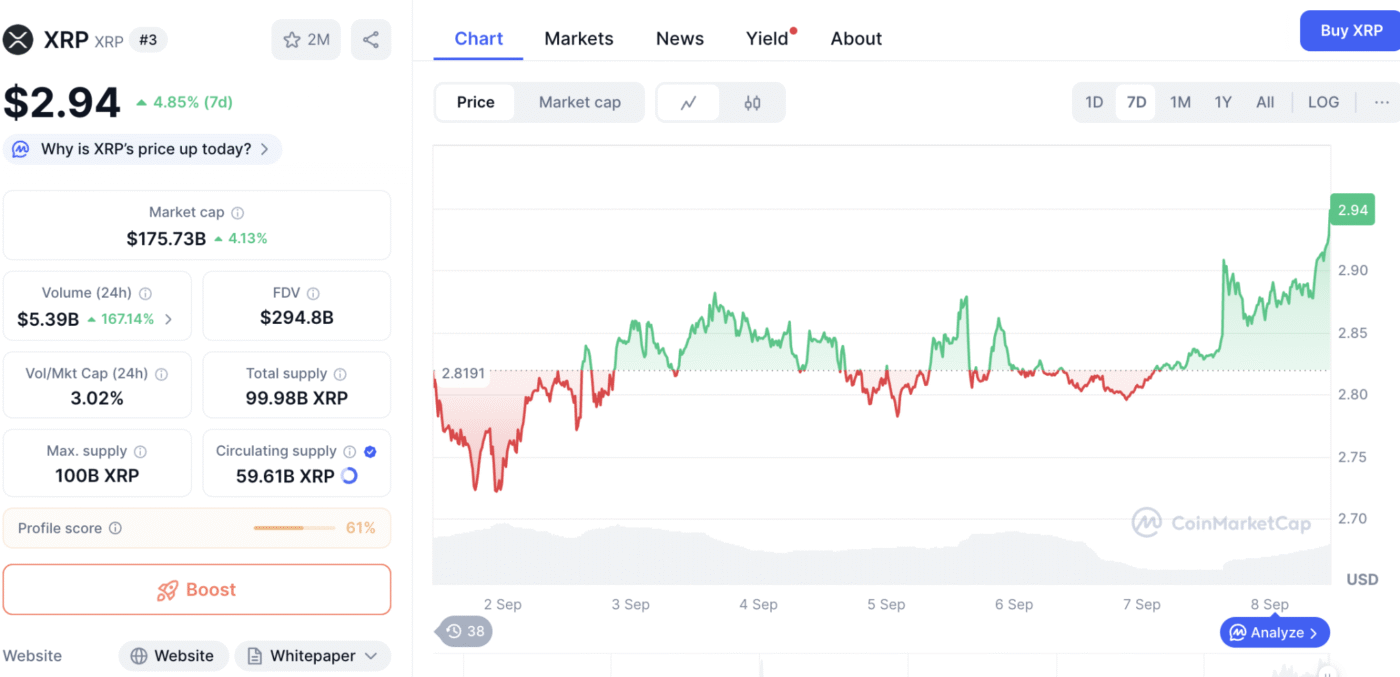

XRP Price: Buyers Quietly Building

The XRP price is trading at $2.96 today. Price action around $2.86 is beginning to change, with Ripple buyers showing strength at key support.

As Doshsai wrote, “XRP has been grinding lower under a steady downtrend, but price action around $2.86 is starting to look different.” That momentum could bring Ripple back toward $3 soon.

The latest XRP news strengthens its case.

Air China’s PhoenixMiles program now allows XRP payments for airport transfers and car rentals in overseas markets, bypassing Chinese restrictions.

This partnership with Wetour integrates Ripple’s RLUSD, enhancing liquidity and boosting blockchain-enabled rewards for cross-border travel. More than 60 million PhoenixMiles members now have access to crypto settlement options, which could help Ripple adoption expand.

These updates highlight Ripple as one of the top altcoins for cross-border finance. However, while utility is growing, XRP’s upside may be far steadier than the exponential gains expected for Rollblock.

Comparing Rollblock And Ripple

| Token | Price | Market Cap | Total Supply | Revenue Share | Upside Potential |

| Rollblock | $0.068 | Presale | 1B (hard cap) | 30% buybacks + burns | Up to 50x |

| Ripple | $2.96 | $174.57B | 100B max | None | 2x–3x |

The comparison shows the gap. XRP is one of the top cryptocurrencies with scale and adoption, but Rollblock is still a low cap crypto gem with a direct tie to revenue.

Why Rollblock Leads The Presale Narrative

Ripple will remain critical for cross-border payments, yet Rollblock offers the deflationary tokenomics and GambleFi growth story that traders want. Its capped supply, staking rewards, and weekly buybacks make it one of the high potential crypto opportunities of 2025.

With hype spreading through forums and analyst lists, Rollblock is now seen as the next big crypto to watch.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post XRP Price Holds Around $2.80 But Analysts Are Backing This Viral Altcoin To Breakout This Week appeared first on Blockonomi.

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues