US Lawmakers Draft Bills Outlining Future of Crypto – $HYPER is Set to Benefit

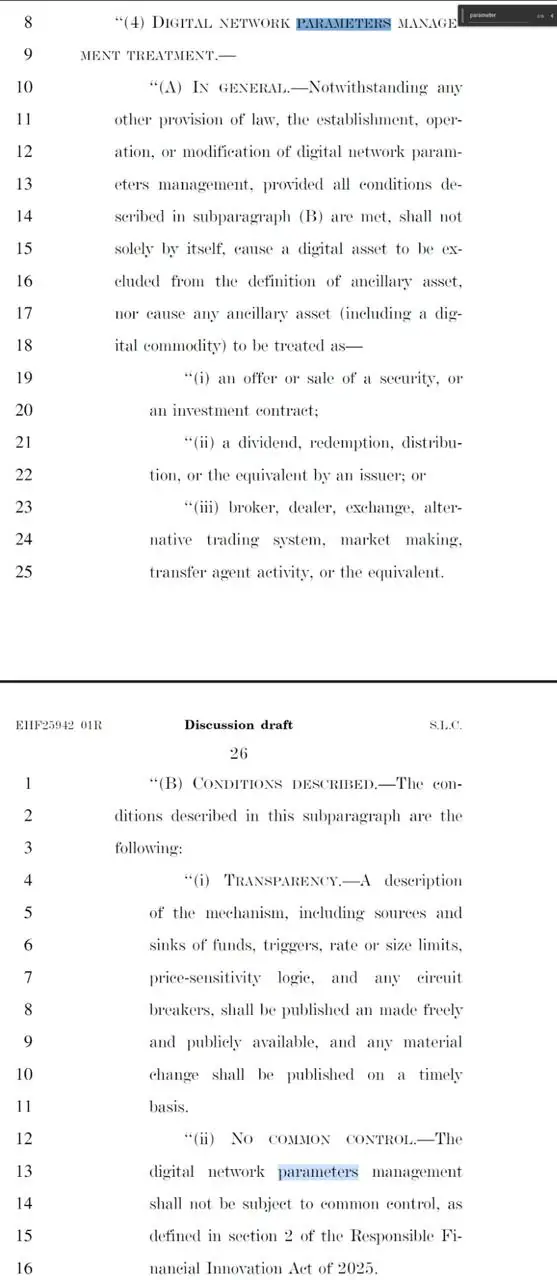

The US’s approach to crypto is gaining clarity and focus thanks to a draft bill released on Friday afternoon by the Senate outlining protections for crypto developers.

This opens the door for innovative projects like Bitcoin Hyper ($HYPER), which aims to bring dApp support and faster transaction speeds to Bitcoin.

We’ll get into why $HYPER is such an interesting project, but first let’s discuss recent developments in US law that are paving the way for crypto.

Draft Crypto Bill Receives Near Unanimous Approval

A draft bill created by the Senate Banking Committee has been reviewed by several prominent crypto industry leaders. All in all, the feedback has been extremely positive.

Gabriel Shapiro, legal expert and Head of MetaLeX Labs, noted that ‘the new version of the Senate Market Structure bill is greatly improved and addresses most of my prior concerns.’

Source: lex_node on X

Source: lex_node on X

He said the bill ‘added a lot of clarity around decentralized governance systems not creating securities laws issues’.

What Else is Driving US Crypto Adoption Forward?

Trump’s executive order in March for the creation of a Strategic Bitcoin Reserve could turn the US into a world leader in crypto. However, many of the implementation details haven’t been straightened out yet.

Part of the US House appropriations bill filed on Friday requires the Treasury Department to publish details on the viability of a Strategic Bitcoin Reserve.

Once the bill is signed into law, the Treasury would need to outline both the ‘practicability of establishing a Strategic Bitcoin Reserve and United States Digital Asset Stockpile’, as well as a 90-day plan outlining ‘custody architecture, legal authorities, cybersecurity protocols, and interagency procedures’.

A roadmap for the Strategic Bitcoin Reserve could potentially pump the value of $BTC. If it does, we expect Bitcoin Hyper ($HYPER) to skyrocket. Let’s get into why the two are connected.

Bitcoin Hyper – A Layer-2 for Bitcoin with Solana-Level Speeds

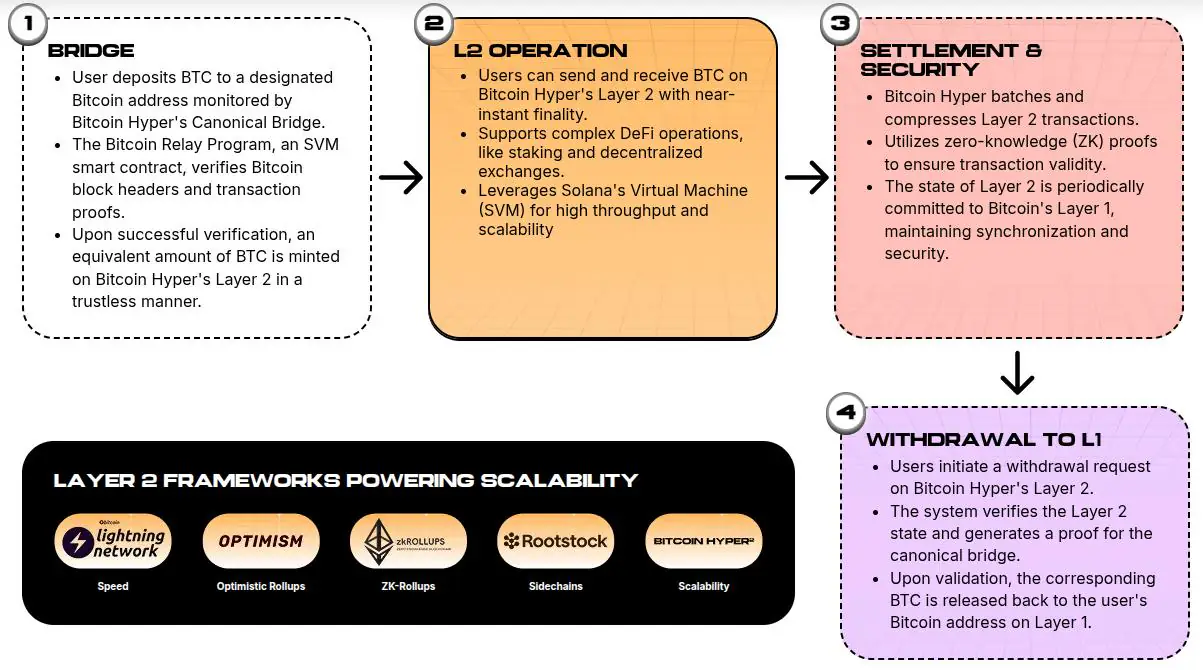

$HYPER is the official token for Bitcoin Hyper, a Layer-2 solution for Bitcoin that uses the Solana Virtual Machine to hypercharge the network’s capabilities.

The Federal Reserve expects that Bitcoin will remain the premier store-of-value crypto in the future; however, it is a pain to transact in to meet your day-to-day needs. It’s slow to trade with, and the high trading fees mean you lose value whenever you spend it.

That’s why the Bitcoin Hyper devs turned to Solana’s tech as a solution. Instead of Bitcoin’s (roughly) 7 transactions per second, the Solana network supports tens of thousands per second.

Bringing those speeds onto the Bitcoin network doesn’t just make transacting with Bitcoin faster and cheaper, it also unlocks smart contracts that use $BTC as the underlying value. That then enables crypto swaps, NFT trading, and a range of other DeFi functions.

The Bitcoin Hyper infrastructure allows for easy onboarding withdrawal of $BTC

The Bitcoin Hyper infrastructure allows for easy onboarding withdrawal of $BTC

$HYPER takes Bitcoin Hyper to the next level. When you transact with it, you get reduced fees on the network. That means cheaper crypto swaps using $HYPER.

You’ll also be able to use $HYPER to execute smart contracts. The Bitcoin Hyper network even lets dApp developers make certain features exclusive to $HYPER holders, creating an ecosystem that encourages token use beyond fees and the DAO.

The $HYPER presale is gaining serious traction, with over $14.6M in token sales. But don’t worry, you can still get yours today for as little as $0.012885. The price is only set to go up, as it’s a dynamic presale, so the longer you wait, the more expensive it’ll be to buy.

Purchase $HYPER today and earn up to 75% in annual staking rewards.

Could the US Become the Crypto Capital of the World?

Trump’s admin has consistently made overtures to the crypto industry, in stark contrast with the Biden Admin’s policy of debunking crypto. The establishment of a Bitcoin reserve, as well as protections for crypto developers, is just part of a comprehensive strategy to ensure the US leads in crypto.

Bitcoin seems a key part of that strategy, so the $BTC price should continue to pump as the US leans more heavily into the asset. That sets the stage for $HYPER, which is bringing smart contract capabilities to Bitcoin and solving many of the outstanding issues with the aging Bitcoin network.

All crypto products are volatile. Make sure to always do your own research before investing and only invest what you’re prepared to lose. This article is not financial advice.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post US Lawmakers Draft Bills Outlining Future of Crypto – $HYPER is Set to Benefit appeared first on Coindoo.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)