ETH MACD Crossover Sparks Talk of 2021-Style Rally

TL;DR

- Ethereum repeats its 2020 breakout setup, fueling expectations of a potential major rally.

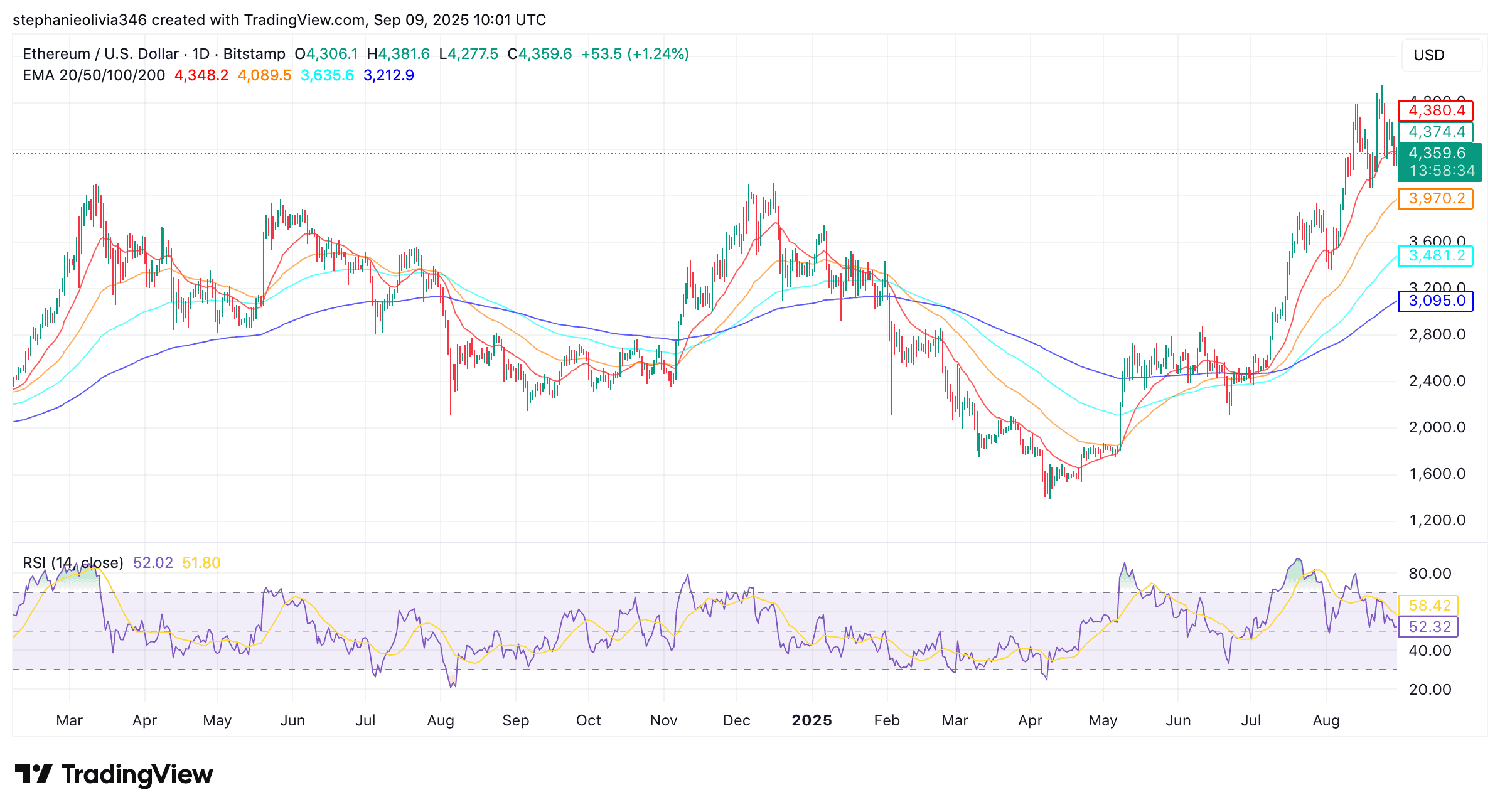

- Monthly MACD crossover and RSI near 52 show ETH may have more room to climb.

- ETH defends 50-day EMA at $4,164, maintaining strong support across all key moving averages.

Ethereum Shows Monthly MACD Crossover

Ethereum (ETH) has printed a fresh crossover on the monthly MACD indicator, which some market analysts see as a potential turning point. Crypto trader Merlijn The Trader called the move a “monster ignition” and pointed to the completion of a multi-year consolidation phase.

Remarkably, the MACD crossover on the monthly chart is considered rare, especially following a three-year squeeze. The last time this occurred was before the 2020–2021 rally, where Ethereum moved sharply higher over several months. ETH is now trading near a key level of $4,450, which marks the top of its long-standing resistance range.

Ethereum’s recent breakout and pullback appear similar to its price behavior during the 2020–2021 cycle. Back then, ETH broke out of a long downtrend, retested its breakout level, and then started a steep climb to new highs.

Charts shared by Merlijn The Trader show that Ethereum has again broken above a downward trendline and returned to test former resistance near $3,650–$4,000. The trader noted, “2021 gave us the pattern. 2025 gives us the chance,” suggesting that the setup may lead to a repeat of previous price behavior.

While comparisons to past cycles offer perspective, Ethereum would still need to confirm strength above $4,450 to open the door for further upside.

ETH Holds Strong as Momentum Builds

ETH recently bounced from its 50-day exponential moving average, which is now acting as support around $4,164. The ability to stay above this level shows that buyers are still active and defending key zones.

Notably, the price is also positioned above all other major EMAs (20, 50, 100, and 200), which gives it a strong technical base. Holding these levels often reflects trend stability and provides structure for future moves.

Source: TradingView

Source: TradingView

Meanwhile, the daily Relative Strength Index (RSI) sits at 52. This neutral zone shows that the market is balanced, with neither strong buying nor selling pressure. In previous market cycles, similar RSI levels during uptrends allowed for gradual price increases without the need for a deep correction.

As of press time, Ethereum was priced at around $4,360. It has gained 1% in the last 24 hours, while showing a slight weekly decline. Trading volume over the past day is $30.36 billion.

The post ETH MACD Crossover Sparks Talk of 2021-Style Rally appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)