3 Best Meme Coins for Explosive Gains in 2025

Meme coin prices started September slowly, but things are getting exciting. It’s not just about the recent price gains – it’s about the upcoming catalysts that could send the market skyrocketing.

Traders are anticipating interest rate cuts at next week’s FOMC meeting; publicly listed companies continue to sink billions into crypto treasury reserves every week; the US president’s family just launched a new cryptocurrency (WLFI); and institutional adoption keeps growing.

But most importantly of all, analysts believe a Dogecoin ETF could be approved this week. This would provide a channel for institutional money to flow directly into the meme coin market – something that could make the coming months some of the most explosive on record.

With that in mind, let’s look at the three best meme coins to buy now. We’ll analyze branding and narratives, community interest, industry trends, and tokenomics to find projects with the biggest potential. Let’s get started.

Snorter

While the biggest meme coins by market cap – Dogecoin, Shiba Inu, and Pepe – may be based outside of Solana, the fact remains that the Solana blockchain has made more meme coin traders wealthy this cycle than any other network. That’s because Solana has become the go-to chain for launching meme coins, thanks to launchpads like Pump.fun, LetsBonk, and Sugar.

However, the increasing number of tokens released on these platforms makes it difficult for traders to find the coins with the most potential. That’s why smart money traders use automated tools – and Snorter (SNORT) is bringing these tools to everyone. It’s a meme coin trading bot featuring copy trading, automated token sniping, rug pull detection, limit orders, dynamic stop-losses, and more.

The SNORT token also offers real benefits, including trading fee discounts, higher staking yields, and governance rights. This indicates potential for long-term price growth.

SNORT is undergoing a presale, allowing investors to buy in from the start. The presale has already raised $3.8 million, making it one of the biggest ongoing meme coin fundraises and suggesting that Snorter could achieve massive gains when its token becomes available for trading.

Visit Snorter Token Presale

PEPENODE

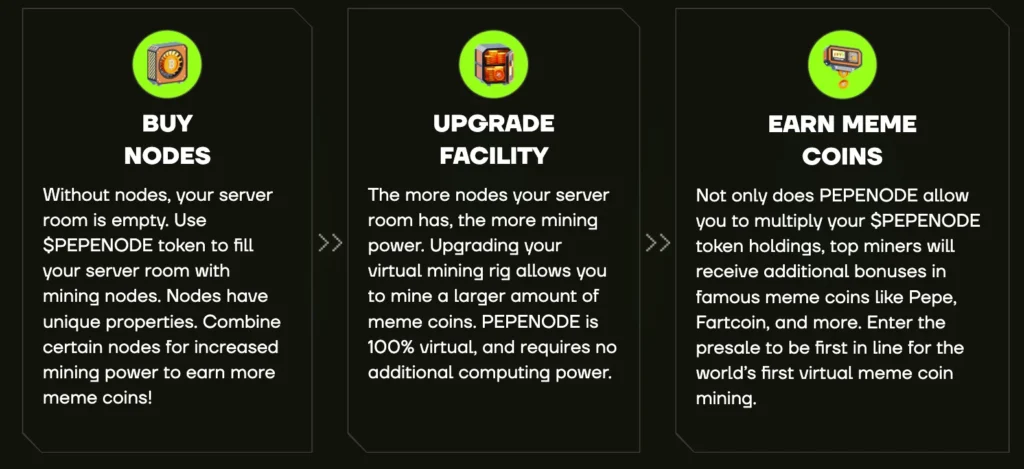

With thousands of meme coins launched daily, projects that truly want to stand out can’t just rely on hype and branding – they need to do something innovative, and PEPENODE is a prime example of that.

Mining is the backbone of crypto, allowing network participants to earn rewards by verifying and recording transactions. But imagine if you could earn mining rewards without the hassle of expensive mining hardware. That’s what PEPENODE is doing with its gamified virtual mining experience.

It’s a Pepe-themed crypto mining minigame featuring a real in-game economy where PEPENODE is the utility token. Users will spend it to buy and upgrade Miner Nodes that generate more mining power, and that will enable them to earn PEPENODE and even other meme coins like Pepe.

The project is currently in presale and has raised $900,000 so far, demonstrating impressive investor interest given it only launched in late August. So with solid community support and a promising use case, it looks like PEPENODE is gearing up for a major breakout once it hits exchanges.

Visit PEPENODE Presale

Dogecoin

The Rex-Osprey DOGE ETF is expected to gain approval following the firm’s filing for a Dogecoin fund as a 1940 Act product. The unorthodox “Act 40” route will speed up the approval process, with analysts widely suggesting it could go through as early as this week.

So not surprisingly, Dogecoin is on the rise – and its price has increased by 13% over the past week. However, the key price target everyone is watching for this cycle is $1, leaving room for up to a 4x increase from today’s price of $0.25.

Considering Bitcoin hit its $100K target this cycle partly due to ETF tailwinds, it wouldn’t be a shock if Dogecoin followed suit and hit $1. Dogecoin’s price chart looks ready to take off – and with a potential ETF approval on the way, this could be a prime setup to take DOGE to new heights.

That said, Dogecoin’s growth would likely be a major boost for strong low-cap meme coins like Snorter and PEPENODE as well, possibly resulting in far more explosive gains.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis