New coin issuance platform Soar: rejecting air coins and reconstructing token issuance logic with contractual constraints

By Eric, Foresight News

An account named X was registered two months ago. The token issuance platform Soar, which has less than 2,000 followers, became popular because of an article with over 350,000 views (https://x.com/LaunchOnSoar/status/1965476405455864175).

In this article, Soar openly criticizes the current chaos in the cryptocurrency market, pointing out three important issues: the issued tokens have no real value, the lack of transparency in token sales, and the founders have no motivation to focus on long-term value because their holdings are too low.

Soar is attempting to revolutionize the industry with a patent-pending token standard and a new platform. Currently, the project team has only provided a conceptual overview of the new token standard and has stated that further explanation will be provided before its official release. For now, I will describe Soar's operating mechanism based on the information currently available.

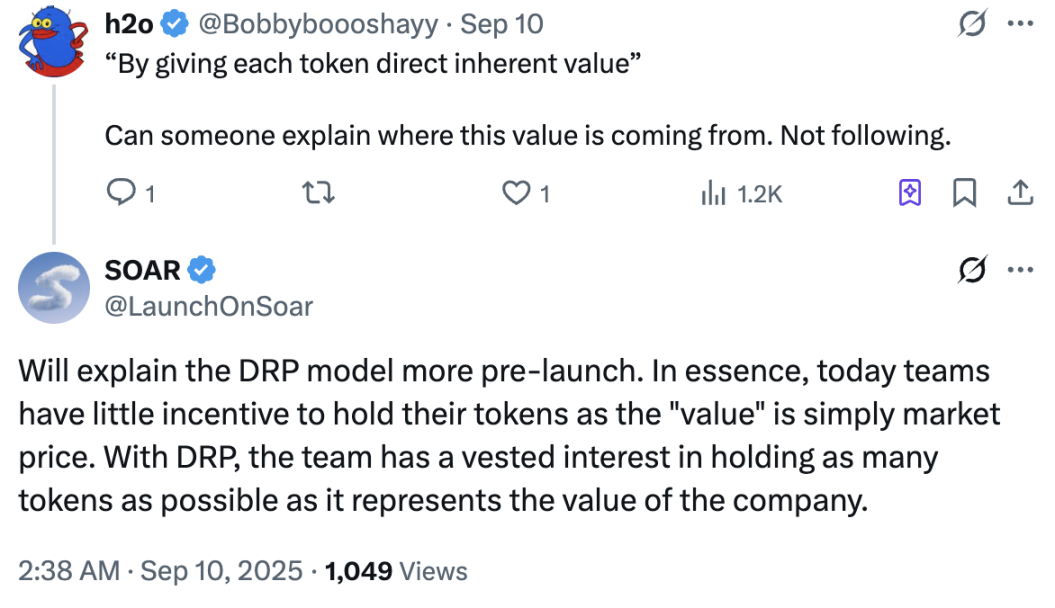

Soar's new token standard is called DRP (Digital Representation of Participation), which roughly translates to "digital representation of participation." Soar offers a rather obscure explanation of the DRP mechanism:

- Tokens deployed through the DRP standard are not, and will never be, any form of equity, either in nature or in fact;

- They represent only certain value relations: values that are retained, or that should be attributed elsewhere;

- This relationship is governed by a private contract (the “Agreement”) between the party deploying the tokens (the “Issuer”) and the entity providing access to the DRP Standard (the “Provider”);

- Under the DRP standard, the issuer loses a certain amount of value when deploying tokens, but can regain that value at any time by reclaiming the tokens;

- After the initial deployment, the Issuer must wait for a period of time before releasing any of the Tokens it holds onto to the market (the “Holding Period”);

- After the Holding Period, whenever the Issuer releases previously held Tokens, it must clearly disclose to the outside world the number of Tokens it intends to release and the reasons for the release ("Disclosure");

- After any disclosure, the issuer must wait for a further period before releasing the tokens to the market;

- At any point in time, the agreement automatically reflects the relative value between the issuer and the provider, and has specific trigger conditions ("events"), once triggered, the relevant value will be automatically settled between the two parties;

- The DRP standard also includes many other mechanisms/features to improve transparency, strengthen accountability, and create a balance of incentives between token holders and issuers.

Under this standard, the company acts as the token issuer and Soar acts as the DRP standard provider:

- The company itself holds a certain number of such tokens, which represents the value retained by the company at any point in time;

- The portion of tokens not held by the company at any point in time (i.e., held by external parties) corresponds to the value that the company no longer retains or controls at that point in time;

- Pursuant to the private contract, Soar is entitled to, and the Company shall pay to Soar in priority, the value not retained by the Company;

- In the event of a Company Liquidity Event, Soar becomes the recipient of such value and may decide how to dispose of it at its sole discretion.

Generally speaking, tokens issued using the DRP standard must establish a "value relationship" at the outset of issuance. This value relationship means the token must represent a specific value, such as the company's value, and cannot simply be launched as a governance token. Furthermore, this value relationship is contractually bound in advance.

However, Soar also stated that this token will not be equity. The author speculates that Soar aims to launch a token that can represent the specific value of an entity but is not subject to traditional equity restrictions, so as to clearly solve the problem of "what exactly" the issued token is in the early stage.

After the tokens are issued, the issuer must hold them for a period of time before they can start selling them. Before selling, they need to disclose the intention to sell and the specific quantity. Even after the disclosure is completed, they still need to wait for a period of time before they can officially sell them.

The most difficult part of the DRP mechanism is the value that the token issuer (the so-called company) must pay to Soar when certain conditions are triggered. I believe this mechanism is similar to the "privatization and delisting" of listed companies in the stock market: if a listed company wishes to privatize and delist, it must repurchase publicly issued shares to reduce the public holdings below the exchange's regulations. In Soar's design, tokens not held by the "company" will be the company's responsibility in the event of liquidation. This significantly prevents manipulation.

Soar explicitly stated that the design of DRP draws on some of the regulations of the traditional securities market, blocking the practice of arbitrarily issuing tokens and then selling them and then Rugging them at the root, so that tokens issued based on this standard must represent actual value and strictly comply with pre-sale disclosure guidelines.

Without additional information from Soar, this is the best conclusion we can draw at this point. I've always believed that the key prerequisite for the next altcoin bull market is to address the question of "what exactly do altcoins represent?" Currently, many projects issue tokens whose value cannot be linked to their actual value, and no project clearly explains what their tokens represent. These issues are likely the biggest obstacles facing investors who favor cryptocurrencies but currently only choose Bitcoin.

Although the Soar mechanism design standards are very strict, whether the designed standards are implemented through a "gentleman's agreement" or at the smart contract level; if the "company" is liquidated, how to ensure that the "company" will be responsible for the tokens circulating externally, we need to wait for the project to provide more information.

You May Also Like

Coinbase Joins Ethereum Foundation to Back Open Intents Framework

Jett Nisay, endorser of Marcos impeach complaint, is a public works contractor