Goldman Sachs bets on Bitcoin ETFs; Telegram whales eye this Solana-based presale

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Goldman Sachs loads up on safe, regulated Bitcoin ETFs, crypto-native whales are chasing bolder bets, like APORK, a memecoin mixing virality with real utility.

Table of Contents

- Why does Goldman Sachs bet on the BTC ETF?

- What is it about APORK that attracts the Telegram Whales?

In February 2025, we saw that Goldman Sachs make a significant investment in Bitcoin ETFs, as it increased its holdings in the iShares Bitcoin Trust (IBIT) by 28%. For a firm that manages billions in client capital, Bitcoin (BTC) via ETF is the safest way to offer exposure in the crypto market to its consumers.

Why does Goldman Sachs bet on the BTC ETF?

Because it is most likely a safer bet. It’s regulated by the SEC, and the assets are custodied by trusted third parties like Coinbase. In fact, everything from liquidity to tax treatment is structured in a way that they don’t touch private keys. And they do it all in clean, auditable ways.

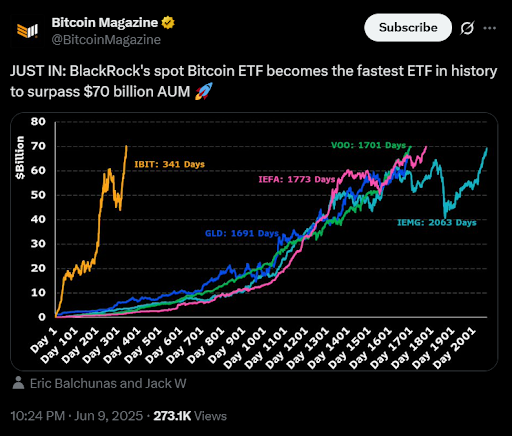

For firms as large as Goldman Sachs, it’s about parking large amounts of money into an asset they believe is now legitimised. In fact, in early June, we saw that the Bitcoin ETF surged past $70 billion in assets under management (AUM), reaching the milestone in just 341 trading days.

But the Telegram whales, or the big analysts that assess communities of fast-moving private groups filled with crypto-native players, don’t have to stick to less risky assets just to play it safe. Many are leaning toward something much louder, faster, and looser: memecoins with utility, like APORK.

What is it about APORK that attracts the Telegram Whales?

What we have seen over the years is that whales don’t have compliance departments and don’t need to wait for ETFs. What they care about is multipliers, narrative momentum, early access, and spotting trends.

What makes it stand out?

Its core idea is to build a memecoin that monetizes attention, not just speculation. APORK does this through three layers of engagement:

- Meme culture: It uses humor, branding, and virality to attract attention.

- Through GambleFi games, staking, deflation, and reward tiers, it ensures users have reasons to stay.

- With CommunityFi, users earn coins for holding and for spreading the word and adding value to the community.

This trifecta makes APORK a hybrid: part meme, part GameFi, part DeFi.

Solana’s memecoin sector exploded in late 2023 and early 2024 thanks to the platform’s ultra-low fees, fast confirmation times, and strong Telegram-native community support. But most of these coins were short-lived pumps with no real matter. There were very few coins that timed its virality right in the markets.

In this sense, APORK could be:

- Solana’s first GambleFi-meme hybrid

- A blueprint for sustainable memecoin design

As the Solana market shows maturity and saturation of old memecoins, it surely looks like Angry Pepe Fork could be the one to pump up the markets again.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

👨🏿🚀TechCabal Daily – When banks go cashless

Strategic Expansion: Bitwise’s Pivotal Acquisition of Staking Platform Chorus One Reshapes Institutional Crypto