Trillion-dollar market demand: Can the Bitcoin on-chain economy become the next hot narrative?

By Felix, PANews

Since its creation in 2009, Bitcoin, the first decentralized digital currency, has evolved from a niche experiment into a significant global store of value and settlement network, and has now grown into an asset class valued at approximately $2 trillion. Despite Bitcoin's numerous achievements, new investors eager for higher returns may not be able to achieve the same high returns as early investors at the current high Bitcoin price.

Beyond passive asset appreciation, earning income from Bitcoin has become a major market demand. Data shows that over 98% of Bitcoin is currently idle. Unleashing its potential and transforming Bitcoin from a centralized store of value to a distributed internet infrastructure used by billions of people is crucial for its development to reach new heights.

Perhaps inspired by the emergence of DeFi on Ethereum, the idea of building DeFi on Bitcoin emerged. Starting with tokenized Bitcoin, Bitcoin has gradually transformed from a static asset to programmable capital. Since the emergence of WBTC in 2019, the market has spawned 50 versions of tokenized Bitcoin across over 20 blockchains. After six years of infrastructure development (from WBTC to transparent, permissionless solutions), the technology has made tremendous strides, including cross-chain protocols, custody solutions, and regulatory frameworks. The current value of tokenized Bitcoin on-chain has reached $40.18 billion.

The first "Bitcoin On-Chain Economic Report" was released, and capital is consolidating around three major competitive advantages.

As more and more Bitcoin holders switch to other blockchain networks to unlock new features and realize returns, the development of the on-chain Bitcoin economy is gradually moving beyond its "grassroots" experimental stage. However, research on the Bitcoin on-chain economy has yet to form a systematic and organized form.

Zeus Network, a Bitcoin infrastructure builder, recently released its inaugural "On-Chain Bitcoin Economy Report." The report comprehensively analyzes the Bitcoin on-chain economy, highlighting the growing importance of blockchain platforms adopting differentiated development strategies based on their respective strengths, leading to a gradual emergence of a survival of the fittest.

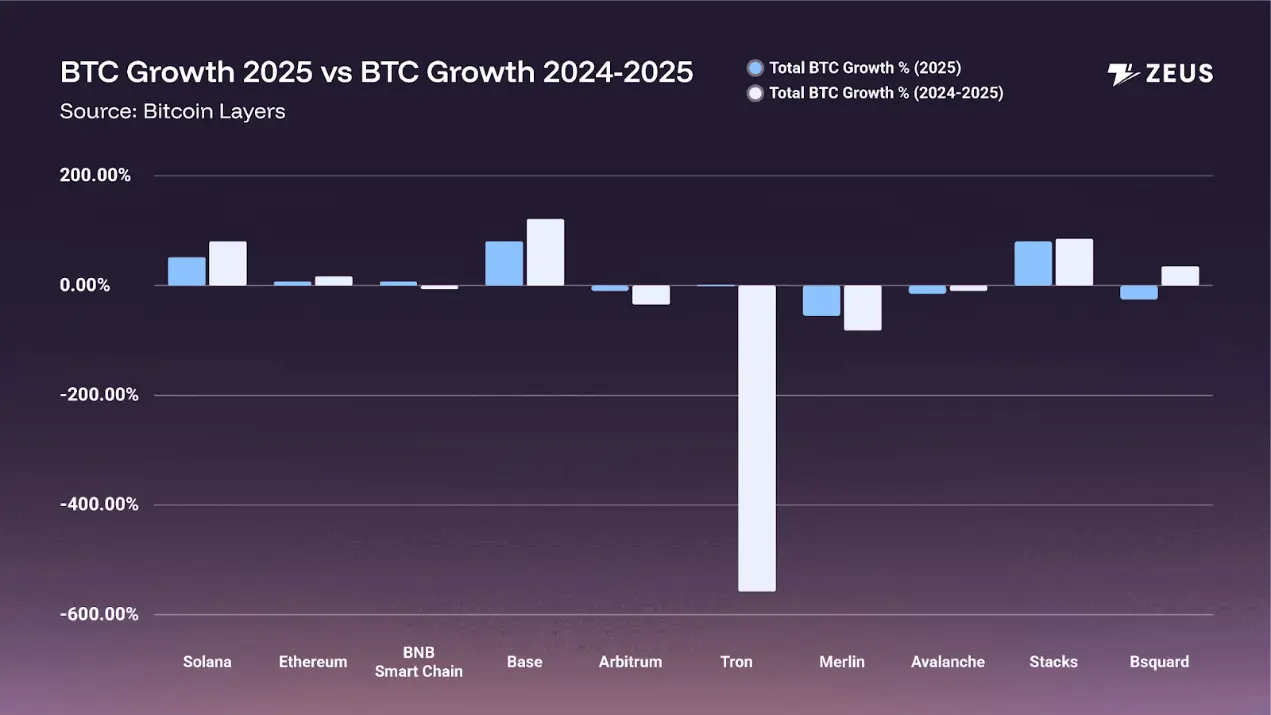

The "On-Chain Bitcoin Economic Report" shows that the top four blockchains (Base, Ethereum, Stacks, and Solana) will increase by more than 26,000 BTC in 2025, while the bottom five blockchains will lose a total of more than 8,000 BTC.

Source: 2025 On - Chain Bitcoin Economy Report ( Zeus Network )

The report mentioned that Bitcoin Capital is currently consolidating around three major competitive advantages: native Bitcoin integration (Stacks), mature user base access (Base), and superior DeFi performance (Solana).

Among them, Base, driven by the advantage of Coinbase's user base, achieved a growth rate of 99.83%, providing convenient bridge access to millions of users and a way for institutional clients to deploy Bitcoin. Its outstanding performance shows that mature platforms have significant competitive advantages compared to pure technical solutions.

Stacks followed closely behind with a growth rate of 79.65%, indicating a strong market preference for Bitcoin-aligned infrastructure that maintains a closer connection to the base layer while supporting programmability.

The head platform effect is also gradually emerging. Compared with the more mature platforms mentioned above, weak participants such as Tron (-541%) and Merlin (-80%) have fallen sharply, which may indicate that the market is consolidating around mature solutions.

Notably, Solana achieved a 76.56% growth rate, highlighting the performance advantages of blockchain. Bitcoin holders prioritize practical advantages such as speed, low costs, and robust DeFi functionality when choosing where to effectively deploy their assets.

Currently, the Bitcoin tokenization options on the Solana platform have increased from 2 (WBTC and tBTC) in August 2024 to 8 in August 2025, forming a comprehensive ecosystem consisting of 21 projects, covering 4 DEXs (APOLLO, HawkFi, Jupiter and Meteora), 12 DeFi protocols (including btcSOL, Drift, Kamino, Orca and Raydium, etc.), 4 infrastructure projects (Portal/Wormhole, Zeus Network, Threshold) and 1 DAO (MonkeDAO).

Among them, APOLLO, as the first Bitcoin on-chain exchange on the Solana platform, plays an important role in expanding the influence of native Bitcoin on Solana.

Exchange APOLLO and the re-staking model btcSOL expand user base and application scope

Zeus Network, the permissionless Bitcoin infrastructure protocol on the Solana platform, is committed to accelerating the development of Bitcoin's on-chain economy and applications. It not only launched zBTC, the first permissionless Bitcoin on Solana, but also released a series of dApp products, expanding zBTC's user base and application scope. Its role on the Solana platform is becoming increasingly prominent.

In March 2025, Zeus Network released APOLLO Mainnet v1, the first Bitcoin on-chain exchange on Solana, designed to provide a seamless, permissionless way to trade and manage assets.

As the flagship dApp of the Zeus Network, APOLLO allows Bitcoin holders to trade, exchange, and earn various Bitcoin variants on-chain, unlike centralized platforms, without intermediaries or restrictions. By introducing zBTC, an asset pegged 1:1 to Bitcoin, APOLLO seamlessly integrates Bitcoin liquidity into the Solana ecosystem, providing retail, developer, and institutional investors with a trustless, decentralized solution to unlock Bitcoin's full potential in DeFi.

Notably, APOLLO also launched the Earn feature in August, providing users with a way to earn income. On APOLLO Earn, users can choose from lending, liquidity pools, or staking strategies, each integrated with protocols currently supporting zBTC. Going forward, APOLLO will continue to collaborate with DeFi protocols to update Earn and introduce new strategies, providing users with more diverse Bitcoin income options.

Following the launch of APOLLO, Zeus Network's second dApp, btcSOL, a restaking model, launched in July, providing Solana users with a convenient, permissionless way to access BTCFi. btcSOL allows holders of SOL or LST-SOL (Solana's liquidity staking token) to stake their tokens and accumulate BTC. The system automatically converts the staked tokens into btcSOL restaking tokens based on a price index, generating on-chain returns that are automatically converted to zBTC.

Additionally, btcSOL has partnered with Marinade Finance, a liquidity staking platform on Solana. 5.5% of users' staked SOL will be continuously converted into zBTC, allowing users to steadily increase their Bitcoin exposure without any additional steps. btcSOL v1.5, released on September 9th, also added jupSOL and kySOL. Currently, users can accumulate zBTC (Solana's native Bitcoin) by staking SOL, mSOL, JupSOL, and kySOL.

Despite the fierce competition in the Bitcoin tokenization market, Zeus Network has found a differentiated market position through unique design choices and functional positioning. With its technological advantages, strong team and partner network, and the support of the Solana ecosystem, it has the potential to occupy a significant market share in this field.

However, like all blockchain projects, Zeus Network faces certain risks and challenges, such as the risk of security vulnerabilities, regulatory uncertainty, market acceptance, and partial dependence on the continued growth and success of the Solana ecosystem.

In the future, Zeus Network plans to achieve multi-chain expansion and integrate more blockchain networks in addition to Bitcoin and Solana. In addition, it plans to cultivate a thriving developer community by releasing programming libraries and developer tools, and gradually achieve decentralized governance.

Conclusion

Bitcoin's transformation into a yield-generating asset is no longer a question of "if," but "when." Not only are institutions creating their own branded, wrapped Bitcoins, but the emergence of permissionless infrastructure also allows any community, protocol, or collective to create a transparent, verifiable representation of Bitcoin tailored to their specific needs. Zeus Network, by innovatively addressing the cross-chain communication issues between Bitcoin and Solana, offers a promising solution for unlocking Bitcoin's enormous potential value.

Related Reading: Permissionless Bitcoin on Solana: Zeus Network Launches APOLLO Platform and zBTC

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index