Solana (SOL) Price: Massive $1.55 Billion Buying Spree by Galaxy Digital Sets Stage for $300 Rally

TLDR

- Galaxy Digital purchased $1.55 billion worth of Solana in five days, marking one of the largest institutional moves for SOL this year

- Solana is forming a cup-and-handle pattern with price pressing against key $245-$250 resistance zone

- SOL currently trades at $237.24, up 6.31% in 24 hours with strong support levels at $239 and $224

- Galaxy partnered with Multicoin Capital and Jump Crypto for $1.65 billion private placement in Forward Industries, a Solana treasury company

- Technical analysis shows potential breakout could target $300-$340 range if resistance breaks

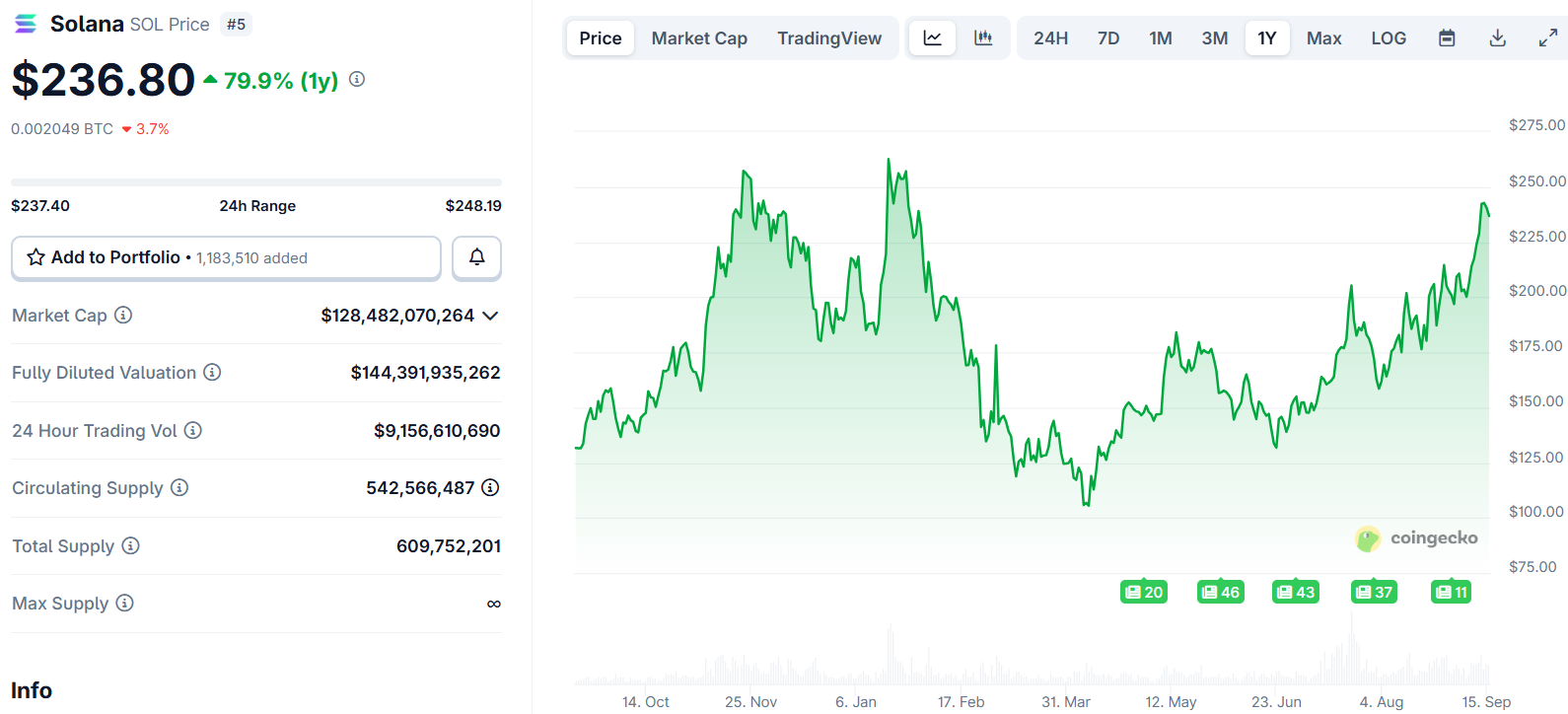

Solana is capturing widespread attention as institutional buying meets technical momentum. The cryptocurrency trades at $237.24, showing a 6.31% gain over the past 24 hours.

Solana (SOL) Price

Solana (SOL) Price

Galaxy Digital has emerged as a major catalyst behind recent price action. The investment firm purchased 6.5 million SOL tokens worth $1.55 billion across five trading days. This buying spree represents one of the largest institutional accumulations in Solana’s history.

The institutional interest extends beyond Galaxy Digital alone. The firm joined forces with Multicoin Capital and Jump Crypto for a $1.65 billion private placement round. Their target is Forward Industries, a medical device company pivoting to become a major Solana treasury holder.

Forward Industries stock reflects this crypto strategy shift. Shares rallied 16% over five trading days and gained 620% year-to-date. The company closed Friday trading at $36.10, reversing years of declining performance.

On-chain data reveals Galaxy’s aggressive accumulation pattern. The firm purchased hundreds of thousands of SOL tokens in rapid succession. Each transaction cost millions of dollars as Galaxy built its position across multiple exchanges before transferring tokens to custody firm Fireblocks.

Technical Patterns Signal Potential Breakout

Chart analysis shows Solana forming a cup-and-handle pattern approaching completion. Price action now tests the neckline resistance between $245 and $250. This technical structure suggests months of accumulation may be nearing a decisive moment.

The cup formation demonstrates steady buyer absorption at each price dip. The handle consolidation reflects healthy pause before potential continuation higher. Technical analysts view this setup as constructive for upside movement.

Measured targets from the pattern point toward $320-$340 range if breakout confirms. These levels align with longer-term Fibonacci extensions. Short-term support holds firm around $225, providing a floor for the current structure.

Support analysis identifies $239 and $224 as immediate zones to monitor. Realized price distribution data indicates low resistance overhead. This suggests the path higher could face fewer obstacles if support levels maintain.

The ascending trendline from 2021 continues supporting Solana’s price structure. Each bounce off this rising base brought SOL back to retest upper resistance ranges. Repeated pressure on resistance suggests momentum is building for larger moves.

Treasury Company Trend Gains Steam

Solana treasury companies are attracting billions in investment. DeFi Development Corp reached 2 million SOL after purchasing $117 million worth in eight days. Helius CEO Mert Mumtaz estimates these companies have raised $3-$4 billion cumulatively.

The treasury strategy reflects growing institutional confidence in Solana’s ecosystem. Galaxy Digital became the first Nasdaq-listed firm tokenized on Solana blockchain in September. This milestone demonstrates increasing integration between traditional finance and Solana infrastructure.

Solana’s total value locked hit record highs of $12 billion earlier this month. The network ranks second only to Ethereum when measuring TVL across DeFi projects. This metric underscores growing developer and user adoption.

SOL gained 17.3% over seven days and nearly 30% across thirty days according to CoinGecko data. Price performance reflects both technical momentum and fundamental developments driving institutional interest.

Galaxy Digital’s buying pattern shows no immediate signs of slowing. The firm continues accumulating large SOL positions while Forward Industries prepares for its treasury company transition.

The post Solana (SOL) Price: Massive $1.55 Billion Buying Spree by Galaxy Digital Sets Stage for $300 Rally appeared first on CoinCentral.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Raoul Pal Predicts Bitcoin’s Correlation With ISM Index