From Crypto to Real Estate: Dubai vs Abu Dhabi Investors Show Unique Approaches, Shared Optimism

Dubai, United Arab Emirates – September 15, 2025: Dubai and Abu Dhabi investors exhibit similarities and distinct investment patterns according to the latest research from trading and investing platform eToro. The survey of 1,000 UAE investors found that where the two converge most clearly is in their confidence in the UAE economy and its long-term growth outlook.

George Naddaf, Managing Director at eToro (MENA), shares: “Although Dubai and Abu Dhabi investors take varied approaches to portfolio goals and values, eToro’s retail investor research indicates a shared confidence in the resilience of the UAE economy and the sectors underpinning its expansion. This confidence is further reinforced by the strong dividends delivered by the market, which remain a central catalyst for sustained investor optimism.”

Asset classes of choice

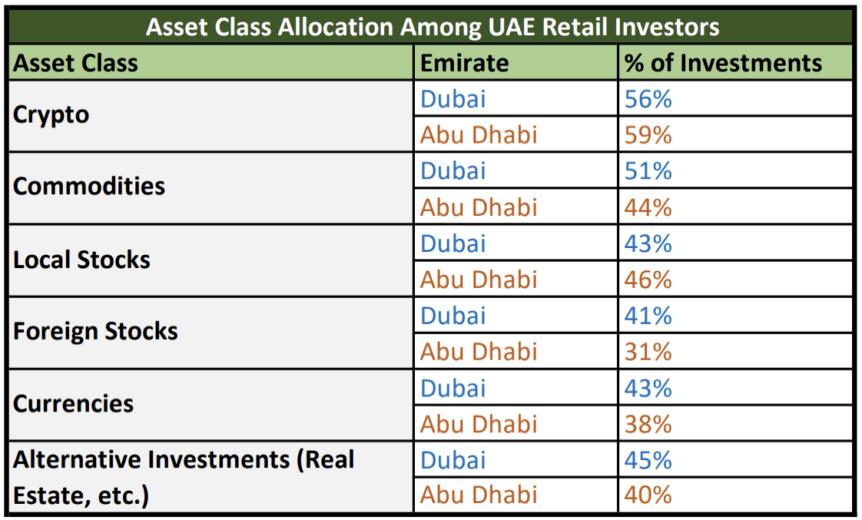

The survey found crypto to be the most popular asset class in both emirates. Commodities follow as the second-most popular asset class in Dubai, whereas in Abu Dhabi it is local stocks. However, Dubai investors are more likely to invest in a wider range of asset classes compared to Abu Dhabi investors.

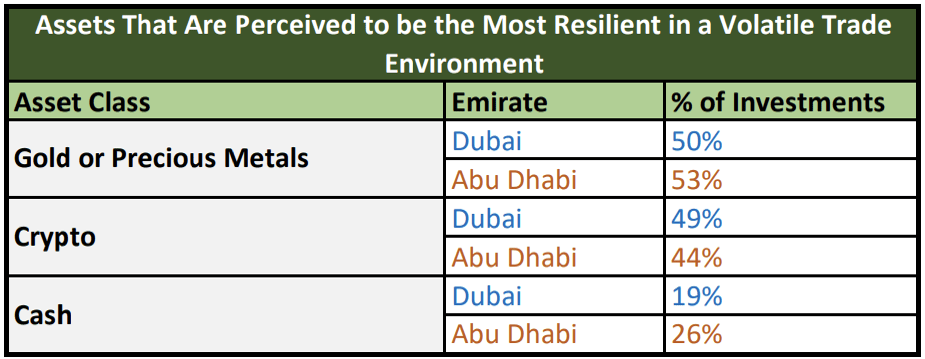

George Naddaf explains, “What’s striking is Dubai’s appetite for diversification, with stronger participation across commodities, foreign stocks, currencies, and alternatives. Although Abu Dhabi investors are more likely to invest in crypto, when asked what asset is most resilient in a volatile market, Dubai investors are more likely to lean toward crypto, while Abu Dhabi investors show a stronger preference for gold and believe cash is king.”

Sector allocations and regional biases

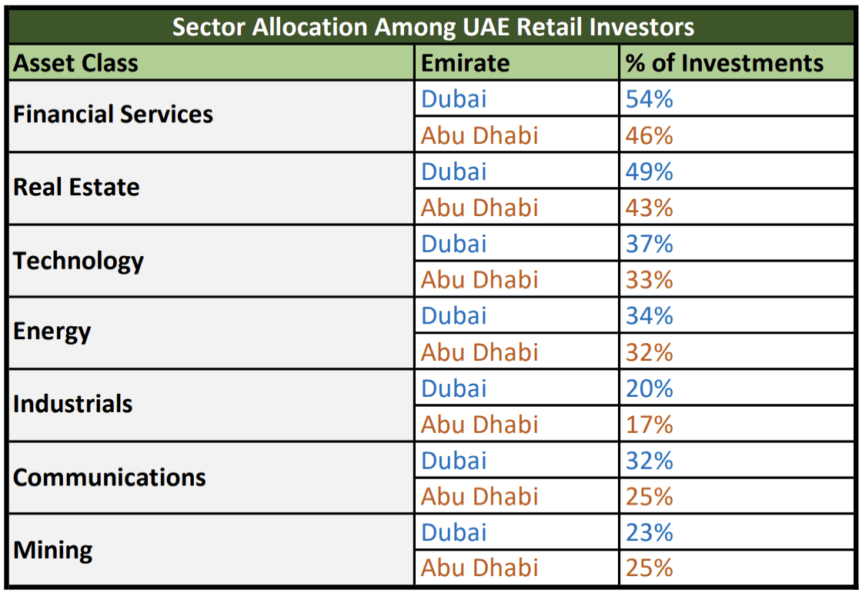

Sector allocations in both emirates mirror each other, highlighting a strong tilt toward financial services, real estate, and technology. Still, Dubai investors are more likely to invest in a wider range of sectors reflecting greater diversification. The only sector that Abu Dhabi investors favour more than Dubai investors is mining.

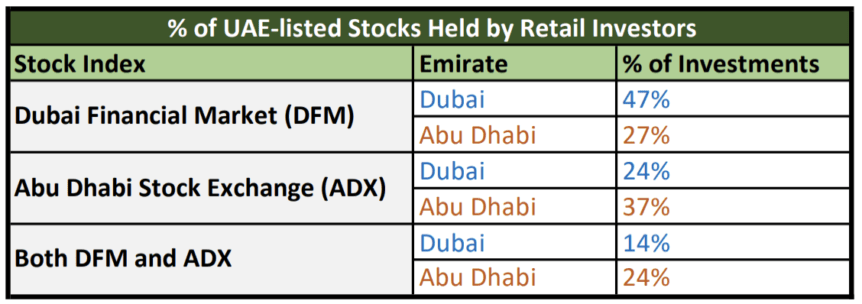

While there is high engagement with UAE stock markets, which are heavily dominated by favoured sectors like finance and industrials, there is a clear home bias. Dubai investors show stronger preference for DFM stocks, while Abu Dhabi investors favour ADX. However, more investors in Abu Dhabi hold both, versus those in Dubai. That means Abu Dhabi investors back UAE stocks more, with 88% invested, compared to 85% of Dubai investors – nonetheless a very high percentage.

George Naddaf adds: “Sector-wise, investors in both cities are heavily weighted toward rapidly growing sectors in the UAE, but Dubai portfolios show broader sector spread with more allocating across energy, industrials, and communications. This paints a picture of two investor groups who are confident in the same growth engines, but express it through different strategies.”

Portfolios and priorities

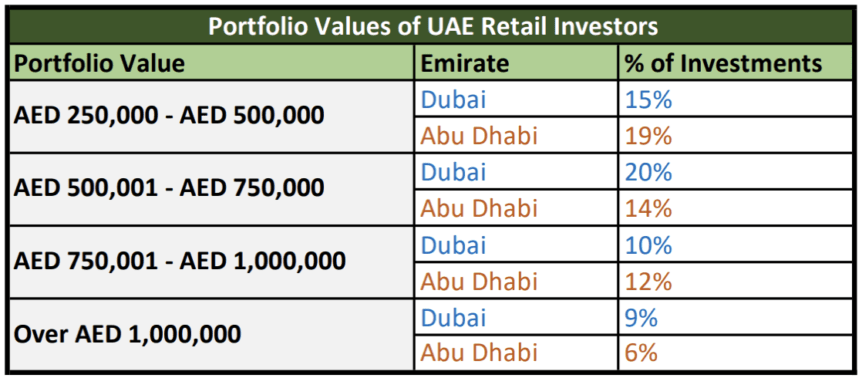

Portfolio values in Dubai skew larger than those in Abu Dhabi, as nearly 9% exceed AED 1 million. On the flip side, portfolios in Abu Dhabi cluster around mid-range levels, with only 6% surpassing AED 1 million.

In Dubai and Abu Dhabi, retail investors’ top three priorities are the same: to achieve financial independence, provide long-term security, and supplement income. Where it diverges is that whilst Abu Dhabi investors are more likely to do it to fund retirement and future plans like a mortgage or their children’s schooling, Dubai investors are more likely to invest for financial independence and early retirement.

Although this suggests Abu Dhabi investors are mostly long-term planners, 13% of them say they “invest for fun”, compared to just 9% in Dubai. This suggests a more exploratory streak among a segment of investors, despite the broader conservative tone.

Where they align: optimism about UAE real estate, tech, finance and energy

Despite their divergences, Dubai and Abu Dhabi investors converge in key areas. Both hold strong confidence in the UAE economy and the long-term performance of locally listed companies. Both investor bases also show similar optimism in the UAE’s growth sectors. In Dubai, retail investors are most optimistic about investments in the real estate (56%), technology (50%), financial services (39%), and energy (37%) sectors over the next 12 months. Abu Dhabi investors are closely aligned, with optimism at 55% for real estate, 44% for both technology and financial services, and 38% for energy. This points to a clear consensus among UAE retail investors, who see these sectors as the main drivers of growth in the next 12 months.

George Naddaf concludes: “When you look at the bigger picture, the message from investors in both emirates is clear. Retail investors see the UAE as a market that offers both resilience and opportunity — and that’s a powerful foundation for sustained growth. As local sectors like real estate, technology, and energy continue to grow and attract capital from retail investors, individuals are actively shaping the UAE’s trajectory as a resilient, next-generation investment hub.”

The survey, commissioned by the trading and investing platform eToro, sampled 1,000 retail investors residing in the UAE. The survey was conducted from July 10, 2025 – July 21, 2025 and carried out by research company Appinio. Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment or equivalent. They did not need to be eToro users.

Media Contacts:

etoro@golin-mena.com

About eToro

eToro is a trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is a group of companies that are authorised and regulated in their respective jurisdictions. The regulatory authorities overseeing eToro include:

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Services Authority (FSA) in the Seychelles

- The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) in the UAE

- The Monetary Authority of Singapore (MAS) in Singapore

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Regulation and License Numbers

Middle East

eToro (ME) Limited, is licensed and regulated by the Abu Dhabi Global Market (“ADGM”)’s Financial Services Regulatory Authority (“FSRA“) as an Authorised Person to conduct the Regulated Activities of (a) Dealing in Investments as Principal (Matched), (b) Arranging Deals in Investments, (c) Providing Custody, (d) Arranging Custody and (e) Managing Assets (under Financial Services Permission Number 220073) under the Financial Services and Market Regulations 2015 (“FSMR”). Its registered office and its principal place of business is at Office 207 and 208, 15th Floor Floor, Al Sarab Tower, ADGM Square, Al Maryah Island, Abu Dhabi, United Arab Emirates (“UAE”).

This article was originally published as From Crypto to Real Estate: Dubai vs Abu Dhabi Investors Show Unique Approaches, Shared Optimism on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income