Google Adds Stablecoin Support to New AI Payment System, Partners with Coinbase and Ethereum

Google announced Tuesday that it has added stablecoin support to its new payment framework, designed to allow seamless transactions between AI applications.

According to a September 16 Fortune report, Google’s new AI payment protocol supports both stablecoins and conventional payment methods, including credit and debit cards.

For stablecoin integration, Fortune reported that Google partnered with crypto exchange Coinbase, which operates its own AI and crypto payment platform.

Google Stablecoin Support Set to Trigger a ‘Ground-Up’ Payment Shift

The tech giant also worked with other blockchain companies, including the Ethereum Foundation.

Beyond crypto partnerships, Google consulted over 60 organizations for other aspects of the payment protocol, including Salesforce, American Express, and Etsy.

“We built this from the ground up to incorporate both legacy and existing payment infrastructure capabilities alongside emerging features like stablecoins,” James Tromans, head of Web3 at Google Cloud, told Fortune.

Google stated that the stablecoin integration initiative stemmed partly from the rise of AI “agents.”

Tech industry leaders anticipate that AI systems will increasingly interact directly with other AI systems, eliminating human intermediaries in many transactions.

The newly launched payment protocol ensures that transactions between AI agents remain safe, secure, and aligned with human intentions, according to Tromans.

Google stands among the more vocal Big Tech companies expressing interest in stablecoins, one of the most active sectors in crypto and Silicon Valley, particularly amid a more crypto-friendly presidential administration in the U.S.

In June, Cryptonews reported that Apple, X, and Airbnb were engaged in preliminary discussions with crypto firms about integrating stablecoins into their payment infrastructure.

The report indicated that Stripe, Worldpay, and other processors were approached to provide back-end support for stablecoin settlements.

In August, Google Cloud was reportedly progressing in the development of Layer-1 blockchain, the Google Cloud Universal Ledger (GCUL), designed for financial institutions to support tokenized assets, settlements, and Python-based smart contracts.

“Biggest Upgrade Since SWIFT”: Google Already Accepting Stablecoin Payments

Google Cloud currently accepts stablecoin payments from select clients using PayPal’s PYUSD, according to Rich Widmann, head of Web3 strategy at Google Cloud.

“Stablecoins represent probably one of the most important payment upgrades since the SWIFT network,” said Widmann.

A comprehensive report shared with Cryptonews shows that stablecoins can process payments up to 13 times cheaper than traditional banks while settling within seconds.

The report positions them as a “new financial operating system” that eliminates intermediaries and transforms global value exchange.

Stablecoins are projected to handle $1 trillion in annual payment volume by 2030 and could constitute 10% of the U.S. money supply.

Source: McKinsey & Company

Source: McKinsey & Company

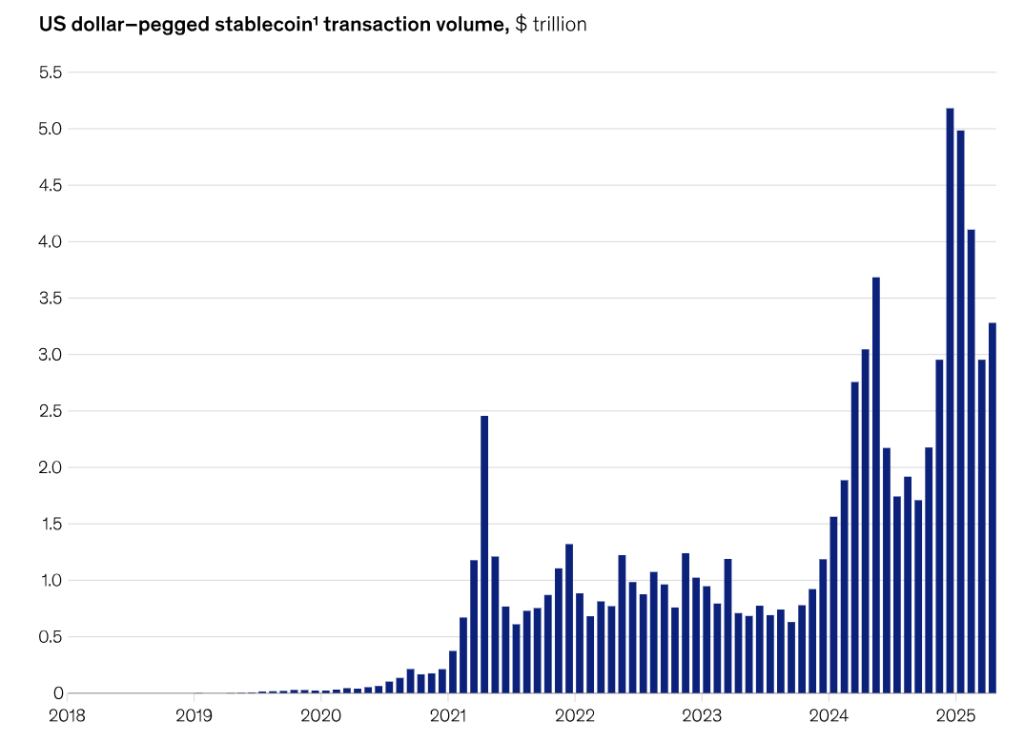

The stablecoin market has grown from $4 billion in 2020 to over $280 billion today, with monthly settlement volumes reaching $1.39 trillion in the first half of 2025.

Major stablecoin issuers now rank 17th globally in U.S. Treasury holdings, exceeding countries like South Korea, Germany, and Saudi Arabia in their influence on government debt markets.

However, the Bank Policy Institute, joined by the American Bankers Association and other groups, is looking to interrupt the stablecoin growth

The groups recently urged the U.S. Congress to strengthen GENIUS Act regulations, warning that regulatory gaps could allow stablecoin issuers to offer yields that might trigger $6.6 trillion in deposit outflows from traditional banks.

The banks contend that stablecoin yield programs could increase “deposit flight risk” during economic stress, resulting in tighter credit conditions and higher borrowing costs.

However, Coinbase has published a detailed response to banking industry assertions, calling the “deposit erosion” narrative a “myth” designed to protect banks’ $187 billion annual payment processing revenue stream.

The company argues that most stablecoin activity occurs internationally, strengthening the U.S. dollar’s global position without materially impacting domestic deposits.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Ethereum Price Closer to $4,000 Breakout as ETH Whales go on Buying Spree