Tencent (0700.HK) Stock: Gains 2.56% After $1.3B Multi-Tranche Bond Issuance Exceeds Target

TLDRs;

- Tencent raised $1.3B via offshore yuan bonds across 5-, 10-, and 30-year tranches, surpassing its $1B goal.

- Final pricing tightened by about 50 basis points, signaling strong investor demand for the tech giant’s debt.

- This marks Tencent’s first bond issuance since 2021 and its debut in the offshore yuan (dim sum) bond market.

- Stock gained 2.56% as investors welcomed Tencent’s cautious approach to financing and AI-related capital spending.

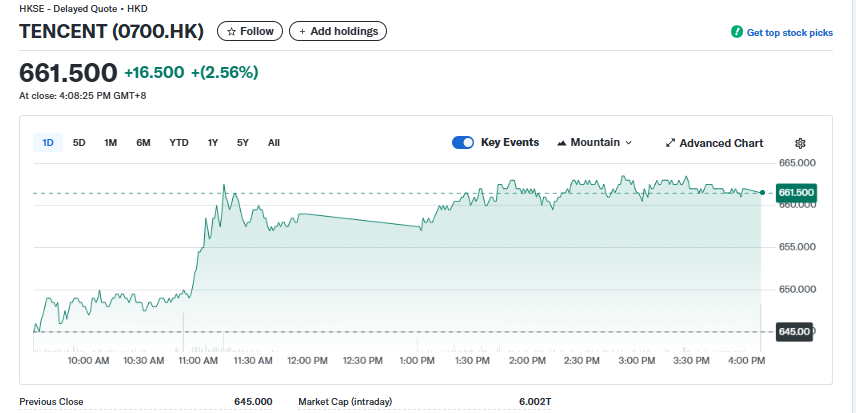

Tencent Holdings Ltd. (0700.HK) saw its stock rise 2.56% on Tuesday after the Chinese technology giant successfully raised 9 billion yuan (US$1.3 billion) through its first bond issuance in four years.

The offering, structured in three tranches of 5-, 10-, and 30-year maturities, exceeded the company’s initial target of about US$1 billion and was met with strong demand from investors.

The breakdown of the deal highlights Tencent’s effort to diversify its financing channels: the five-year tranche raised 2 billion yuan at 2.1%, the ten-year tranche secured 6 billion yuan at 2.5%, and the thirty-year tranche added 1 billion yuan at 3.1%. Final pricing came in nearly 50 basis points tighter than initial guidance, underscoring investor confidence despite a challenging macroeconomic environment.

TENCENT (0700.HK)

TENCENT (0700.HK)

First bond sale since 2021

The issuance marks Tencent’s first appearance in bond markets since 2021 and its inaugural dim sum bond (offshore yuan-denominated notes).

The move follows similar funding strategies from other Chinese tech heavyweights, including Alibaba and Baidu, who have tapped yuan-denominated instruments to strengthen their balance sheets.

Tencent has US$17.8 billion in outstanding notes, with US$500 million maturing in April 2025 and another US$1 billion due in January 2026. Analysts say the new issuance not only provides refinancing flexibility but also extends Tencent’s debt maturity profile, allowing the company to better manage its capital structure over the long term.

Capital spending cuts signal caution

The fundraising comes at a time when Tencent has significantly reduced its capital expenditures. The company’s spending dropped from 36.6 billion yuan (US$5.1 billion) in Q4 2024 to 19.1 billion yuan (US$2.7 billion) in Q2 2025.

Management has repeatedly emphasized a more cautious approach to investments, particularly in areas such as artificial intelligence, where competition with rivals like Alibaba and Baidu remains fierce.

By raising funds through yuan-denominated bonds rather than dollar notes, Tencent is aligning its financing strategy more closely with its domestic operations, reducing foreign exchange risks and signaling confidence in the yuan’s long-term stability.

Investor sentiment turns positive

The stock market reaction reflected investor approval of Tencent’s capital management strategy. Shares closed at HK$661.50, up HK$16.50, or 2.56%, following the news. Market watchers noted that the deal’s success demonstrates Tencent’s ability to secure favorable financing despite broader uncertainties in China’s technology sector and global markets.

With $1.5 billion in bonds maturing within the next two years, Tencent’s proactive fundraising ensures it can address obligations while retaining financial flexibility for strategic growth opportunities, even as it reins in aggressive spending.

The post Tencent (0700.HK) Stock: Gains 2.56% After $1.3B Multi-Tranche Bond Issuance Exceeds Target appeared first on CoinCentral.

You May Also Like

Google's AP2 protocol has been released. Does encrypted AI still have a chance?

Zama to Conduct Sealed-Bid Dutch Auction Using Encryption Tech