Survey Finds 54% of Firms Plan Stablecoin Adoption by 2026; Best Wallet Token Presale Nears $16M

Per an EY-Parthenon survey, 54% of business leaders who have yet to touch stablecoins plan to do so by 2026.

Why the change of heart? Lower transaction costs and faster cross-border payments are the main reasons organizations are turning to stablecoins.Since crypto wallets play a key role in enabling stablecoin transactions, choosing the right one matters. One option we like is Best Wallet, thanks to its ease of use and security.

Its native token, $BEST, also deserves a shout-out. It’s close to raising nearly $16M on presale, as it supports the wallet’s developments and grants holders low gas fees.

Only 13% of Firms Use Stablecoins, But 41% Report Big Savings

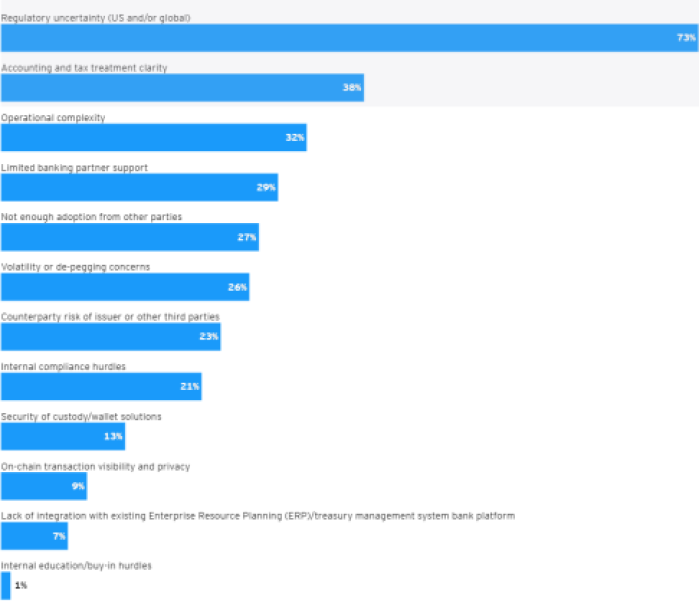

The report found that, right now, only around 13% of financial institutions and international corporations use stablecoins. One of the main reasons for them not doing so boils down to regulatory uncertainty.

Yet, this percentage is on the rise following the passage of the GENIUS Act on July 18. It gives institutions greater regulatory clarity and, thus, confidence to move forward with adopting these digital assets.

And it’s no wonder stablecoins are attracting attention. Among current users, 41% said they’ve saved over 10% in costs compared to traditional payment methods.

The top use case for stablecoins is cross-border supplier payments, which account for 62% of implementations.

The reason is that they’re 1:1 backed by reserve assets (often the US dollar) for stability. Yet, they have faster settlement times compared to traditional international transfers.Out of the stablecoins available, US-dollar-pegged ones are the go-to choice. $USDC is the clear frontrunner with 77%, followed by $USDT at 59%.

If these stablecoins are top of your radar, Best Wallet is a great way to manage, buy, and sell them.

Store Top Stablecoins & Cryptos on Best Wallet

Available on Google Play and iOS, the Best Wallet app is a great way to manage, buy, sell, and swap various types of cryptos while out and about.

The mobile app already supports over 1K+ assets across top chains like Ethereum, BNB Chain, and Polygon. This includes top stablecoins like $USDC and $USDT, plus leading cryptos like $BTC, $ETH, and $BNB.

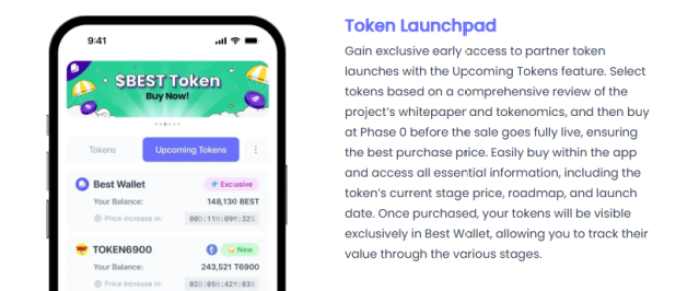

It takes pride in making crypto activities simple. Check out its built-in launchpad, for instance. It gives you access to the best crypto presales. And that’s not to mention its swap engine, which scans 330+ DEXs and 30 bridges to find you the best rates.

And all is achieved with security intact. Because Best Wallet’s non-custodial, it ensures that you, and only you, have access to your private keys.

Also helping prevent unauthorized access are extra layers of protection like 2FA, biometrics, and local encryption.

Even if you lose account access, you can rest easy knowing that you can restore your assets through encrypted cloud backups.

The app also has lots to look forward to in the pipeline, including an NFT gallery, intel market analytics, and a rewards hub.

$BEST will make this possible, as a quarter of its total token supply is set aside for product development.

Holding $BEST also grants governance rights, reduces gas fees, and offers staking rewards at an 83% APY.

So far, $BEST has raised over $15.9M on presale, backed by three major investors ($70.2K, $91.1K, and $59K).

You can buy $BBEST for as little as $0.025655. Following the upcoming app developments, the cost could increase to $0.072 this year, making now a great time to join before it possibly spikes by over 180%.

Want to learn more? Check out our Best Wallet guide.

Authored by Leah Waters, Bitcoinist – https://bitcoinist.com/stablecoin-adoption-rises-best-wallet-nears-16m

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?