Polygon Dominates RWA Market With $1.1B TVL, New Dune Report Shows

The Polygon POL $0.25 24h volatility: 1.1% Market cap: $2.64 B Vol. 24h: $106.13 M network is securing a significant position in the rapidly growing tokenization space, now holding over $1.13 billion in total value locked (TVL) from Real World Assets (RWAs).

This development comes as the network continues to evolve, recently deploying its major “Rio” upgrade on the Amoy testnet to enhance future scaling capabilities.

This information comes from a new joint report on the state of the RWA market published on Sept. 17 by blockchain analytics firm Dune and data platform RWA.xyz.

The focus on RWAs is intensifying across the industry, coinciding with events like the ongoing Real-World Asset Summit in New York.

Sandeep Nailwal, CEO of the Polygon Foundation, highlighted the findings via a post on X, noting that the TVL is spread across 269 assets and 2,900 holders on the Polygon PoS chain.

Key Trends From the 2025 RWA Report

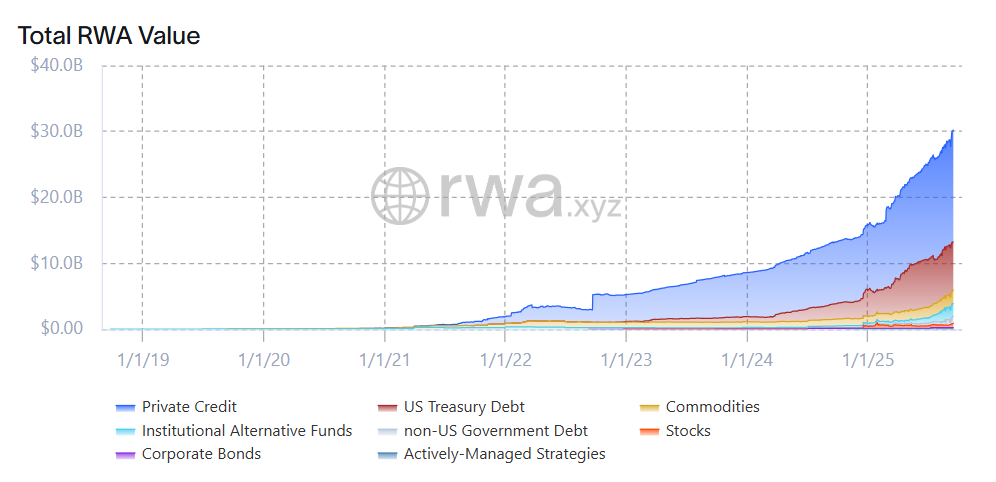

The joint publication, titled “RWA REPORT 2025,” offers a comprehensive look into the tokenized asset landscape, which it states has grown 224% since the start of 2024. The report identifies several key trends driving this expansion.

According to its authors, the initial success of tokenized U.S. Treasuries provided a credible foundation for the sector, proving product-market fit.

The report indicates that capital is now flowing into higher-yield assets like private credit and bonds as onchain investors move up the risk curve.

Another significant trend is the accelerating integration of these assets with DeFi protocols, where they are increasingly used as collateral, transforming them into programmable “building blocks” for onchain finance. Readers can explore these findings and more in the full RWA Report 2025.

Polygon’s Strength and Competition

Total RWA value. | Source: rwa.xyz

The report’s data shows Polygon’s main strength is in the tokenized global bonds market, where it commands a 62% share. This figure is particularly notable when compared to Ethereum ETH $4 487 24h volatility: 1.2% Market cap: $541.58 B Vol. 24h: $29.65 B , which, despite leading in overall tokenized assets, represents only 5% of the global bonds market.

While Polygon shows dominance in this niche, it faces competition from other ecosystems, including Solana SOL $234.8 24h volatility: 0.9% Market cap: $127.59 B Vol. 24h: $7.76 B , which has also seen significant growth in its RWA market, reaching a $500 million valuation earlier in the month.

Polygon is also a leading network for tokenized U.S. T-Bills, holding about a 29% share of the TVL for Spiko’s U.S. T-Bill token (USTBL).

This trend reflects a broader push from traditional finance to adopt blockchain, with major players like Nasdaq also filing with the SEC to enable the trading of tokenized securities.

As stated in the Dune report by Aishwary Gupta, Polygon’s Global Head for RWA, the industry is moving beyond pilots to real products that unlock liquidity and provide on-chain transparency.

nextThe post Polygon Dominates RWA Market With $1.1B TVL, New Dune Report Shows appeared first on Coinspeaker.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?