Aptos Price Prediction 2025: Can APT Repeat ICP’s Explosive Rally from $3 zone?

The post Aptos Price Prediction 2025: Can APT Repeat ICP’s Explosive Rally from $3 zone? appeared first on Coinpedia Fintech News

As the Aptos price prediction 2025 gains momentum, investors are revisiting APT’s long-term value following a period of significant price decline. With Aptos crypto trading above $2.50, alongside strong fundamentals such as rising revenue, good TPS performance, and other positive user metrics, the project appears primed for a significant recovery as fundamentals strengthen across the ecosystem.

APT’s Current Scenario Mirrors ICP’s Recent Breakout

Recent market attention has shifted toward base-layer protocols that operate as foundational infrastructure for decentralized applications. Following ICP’s explosive early-November rally from $2, many now expect Aptos crypto to follow a similar trajectory, given its comparable utility as a high-performance base layer.

Similarly, in another post shared on October 31, sentiment pointed to a clear disconnect between fundamentals and valuation. APT price is currently sitting at its lowest valuation in the past four years, despite continuous ecosystem expansion. The post suggests that sentiment could recover soon.

Based on this, the post stated, a move toward $5–$6 in the coming sessions could be possible if momentum persists. Additionally, a price of $8-$10 is a possibility if a similar price recovery is observed, as ICP has recently demonstrated.

Fundamental Growth Signals the Early Phase of a Comeback

Another post highlights recent data that suggests that APT’s fundamentals are strengthening at an impressive pace. Application revenue has climbed steadily throughout the year, peaking in October, with expectations of hitting a new all-time high by mid-November.

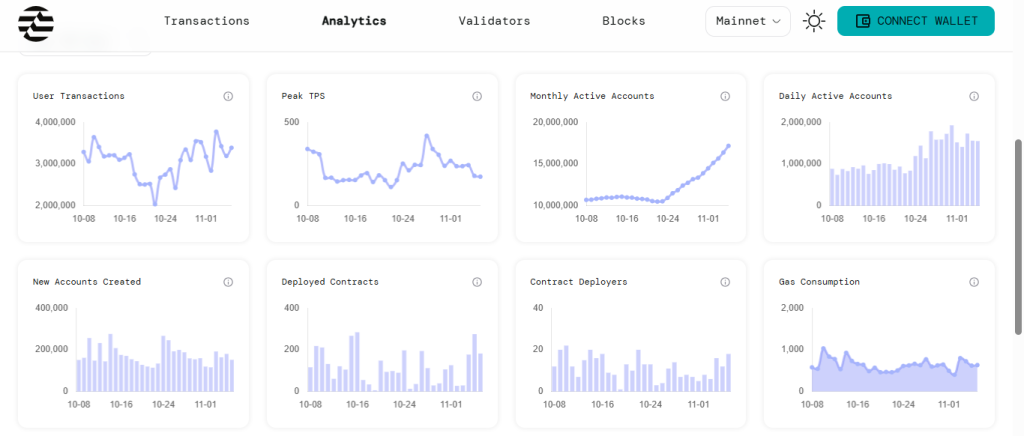

Meanwhile, other on-chain activity continues expanding like user transactions rose from 2 million to 3.3 million over the past 30 days.

Similarly, the Monthly active accounts jumped from 10.5M to 17.17M, demonstrating powerful user growth. Also, daily active accounts remain above 1.5M, reflecting strong network engagement.

This level of user activity is rarely seen in tokens trading in a continuous multi-month downtrend.

High TPS Ranking Enhances Long-Term Outlook

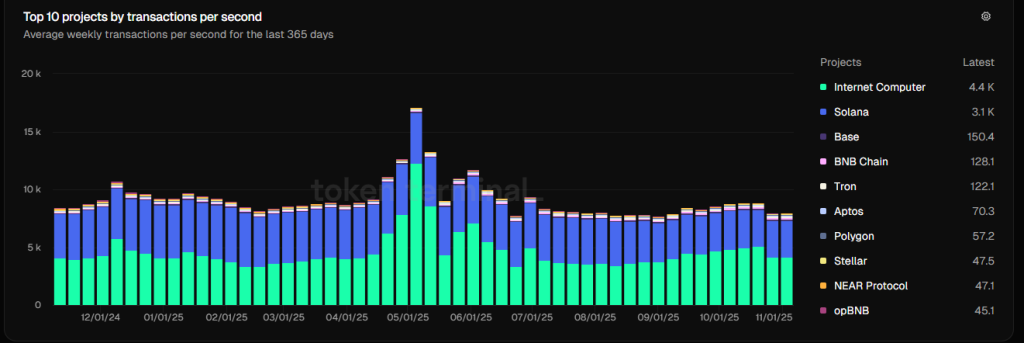

Moreover, the Token Terminal’s data places Aptos among the top 10 blockchains by transactions per second (TPS). Ranked 6th globally at 74.1 TPS, APT crypto stands among the most efficient smart contract platforms based on average weekly throughput over the last year.

This performance underscores why many believe the current Aptos price chart does not reflect the project’s true strength. High TPS, growing adoption, and rising revenue create a compelling backdrop for the Aptos price forecast heading into 2025.

With APT consolidating near $2.50- $3.00, it shows similarities to ICP before its explosive run. According to the Aptos price prediction 2025 outlook, the market may be approaching a turning point where fundamentals are outweighing short-term sentiment.

You May Also Like

Xsolla Expands MTN Mobile Money Support to Congo-Brazzaville and Zambia, Enhancing Access in Fast-Growing Markets

iGMS Introduces AI-Driven Pro+ Plan, Cutting Host Workloads by Up to 85%