In this article:

• 1. Guide to completing the activities

• 2. Conclusion

Arc is an open L1 blockchain designed to unite programmable money and blockchain investments with real economic activity.

At the time of writing, the team has launched a public testnet where you can complete simple tasks and test the network.

The project is backed by Circle, which has raised $2.2 billion in investments from Pantera Capital, Blockchain Capital, BlackRock, and other funds

In this guide, we will look at how to perform available activities in Testnet with a view to a possible drop.

- Go to the website, connect your wallet, and add the Arc Testnet network in the lower left corner:

Add the Arc Testnet network. Data: Arc

- Next, on the page of the faucet, we request test tokens USDC and EURC. We do the same on the Sepolia network:

Requesting test tokens. Data: Circle

- We perform swaps on the Arc Testnet test network on the website, and then add liquidity in the Pools section:

We perform swaps and provide liquidity. Data: Curve

- Go to the website, click Launch App at the bottom, and bridge tokens from the Arc network to the Sepolia network:

Bridging tokens. Data: DefiOnARC

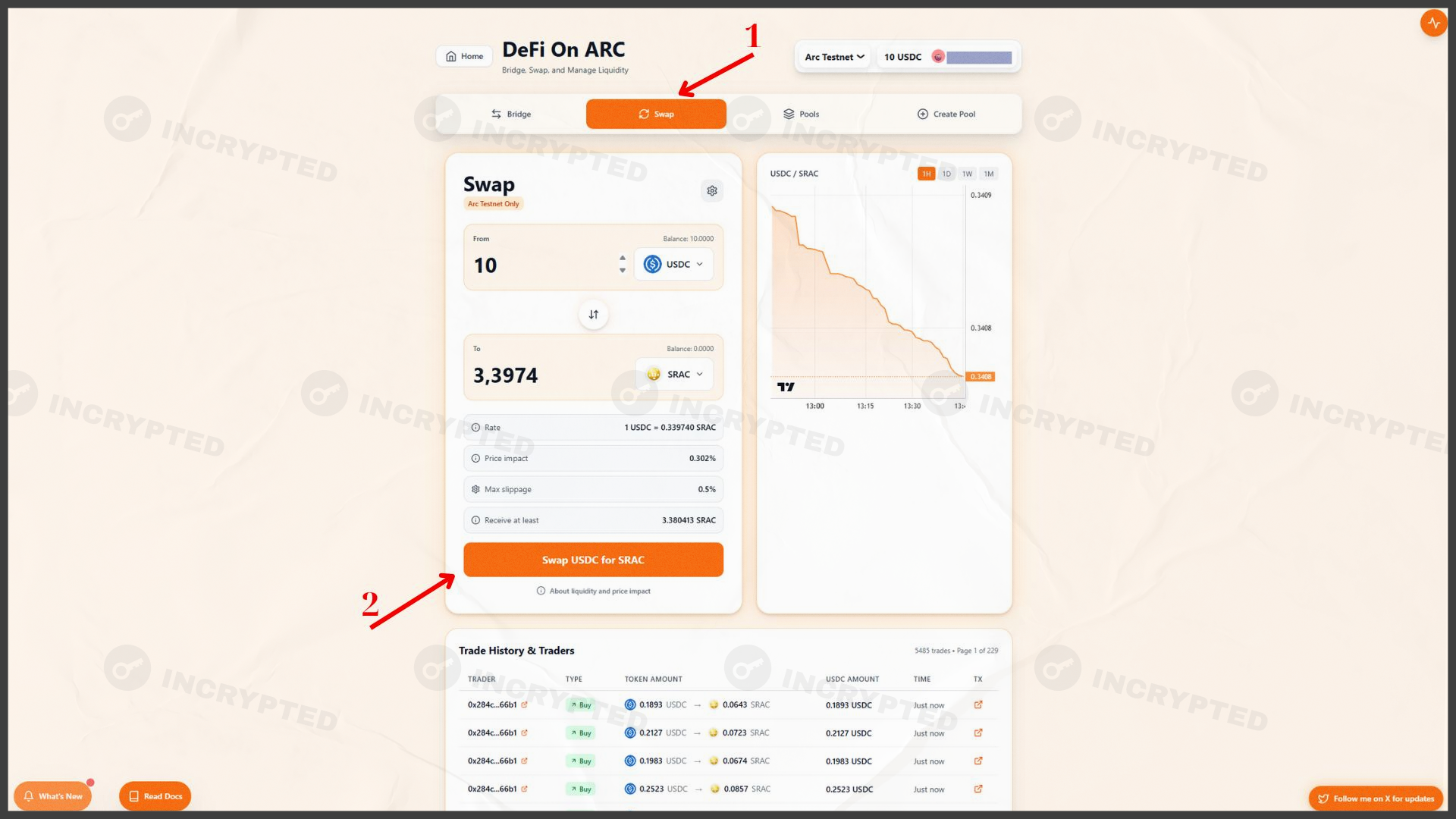

- In the Swap section, we perform swaps:

We perform swaps. Data: DefiOnARC

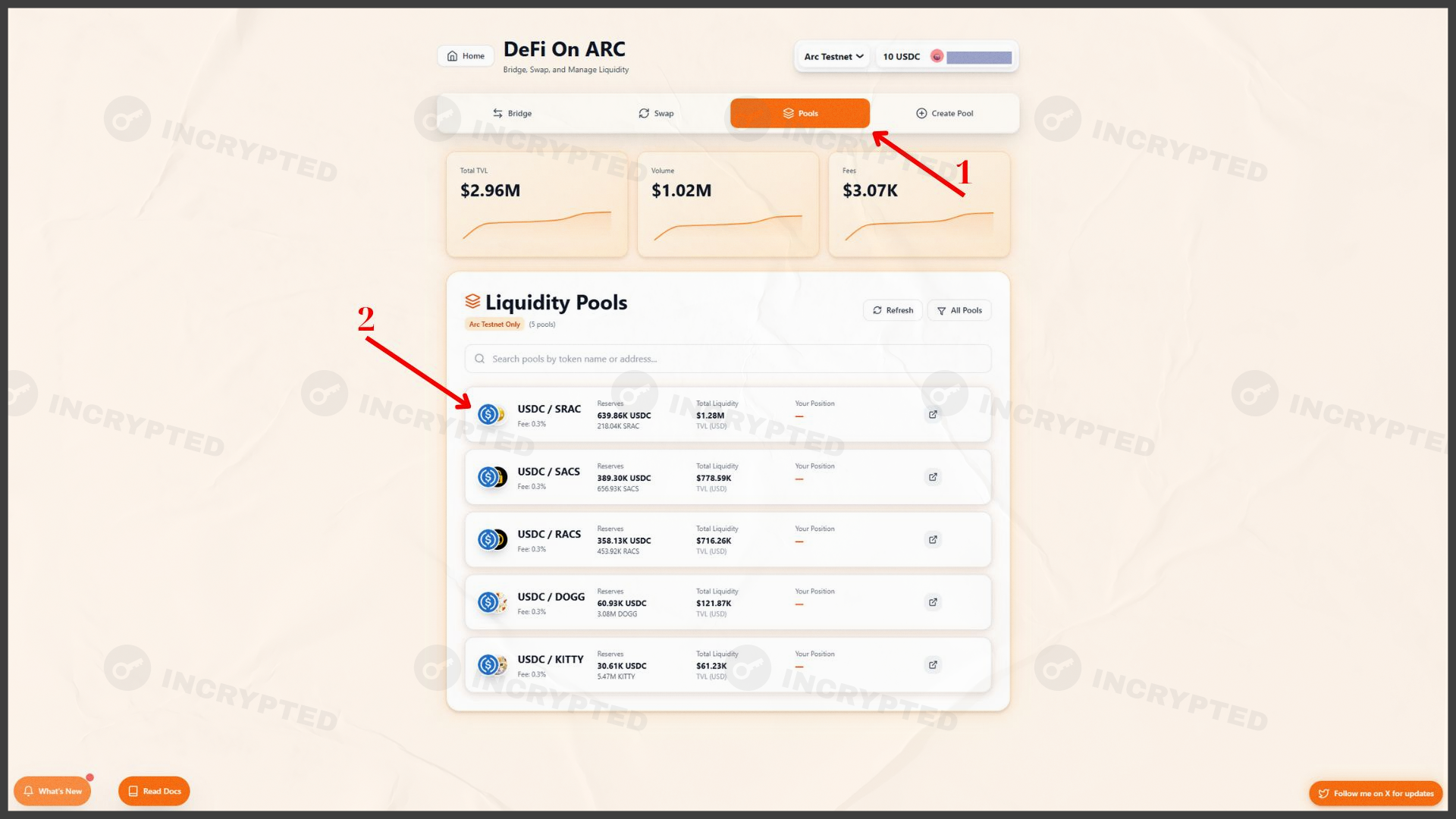

- In the Pools section, we add liquidity:

We provide liquidity. Data: DefiOnARC

- You can also mint a domain on InfinityName and deploy a contract on OnChainGm.

The activities are simple, do not take much time, and do not require any financial investment. Since Arc is a first-level blockchain, the launch of the main network will most likely be accompanied by the release of a token, which the team has mentioned several times. Therefore, a potential drop should be expected simultaneously with the launch of the mainnet.

Follow the project on social media so you don’t miss any important updates.

Highlights:

- be active on testnet;

- The project is supported by Circle.

If you have any questions while completing activities, you can ask them in our Telegram chat.

Useful links: Website | X | Discord

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Add the Arc Testnet network. Data: Arc

Add the Arc Testnet network. Data: Arc

Requesting test tokens. Data: Circle

Requesting test tokens. Data: Circle

We perform swaps and provide liquidity. Data: Curve

We perform swaps and provide liquidity. Data: Curve

Bridging tokens. Data: DefiOnARC

Bridging tokens. Data: DefiOnARC

We perform swaps. Data: DefiOnARC

We perform swaps. Data: DefiOnARC

We provide liquidity. Data: DefiOnARC

We provide liquidity. Data: DefiOnARC