Best Crypto to Buy Now: How Remittix’s Over $28M Presale Has Captured Investor Attention In 2025

If you’ve been watching the crypto space in 2025, you’ve likely noticed one presale dominating the conversation: Remittix (RTX). Let’s break down why many investors are calling it the best crypto to buy now, what makes its model compelling, and why the presale is generating so much traction.

What Remittix Is Doing Differently

Remittix is leading in a unique niche, the team calls PayFi, which literally refers to the merging of the payments and decentralized finance fields. Here’s how it works in practice:

-

You enter the recipient’s bank details.

-

Specify the amount you want to send. Remittix calculates the required crypto and displays exact fees.

-

Transfer the crypto to a unique deposit address.

-

Within the next 24 hours, the recipient receives the fiat directly in their bank account.

That’s how seamless the Remittix has made the conversion from crypto to fiat. What’s more, there are no hidden charges, and privacy measures are in place for both the sender and the receiver. This real-world utility is something most presales simply cannot offer.

Investor Attraction and Presale Metrics

Remittix’s current presale phase is demonstrating notable momentum, and the underlying factors driving this interest are increasingly clear. With over $28.1 million raised already, the team is rolling out its PayFi infrastructure to change how people use crypto for everyday payments. The crypto-to-fiat on/off-ramp sector has become one of the fastest-growing segments in the digital payments space. According to industry estimates the global crypto payment gateway market, within which on/off-ramps operate, is valued at roughly $1.5 billion in 2023, with projected annual growth of 16–20% through 2030. This growth is driven by rising crypto adoption, increased use of digital assets for remittances, and wider integration of crypto payment solutions by fintech platforms and merchants.

The already launched beta version of the Remittix wallet supports over 40 cryptocurrencies and works with more than 30 fiat currencies, making it not just a novelty but a serious payments tool.

Remittix’s ongoing $250,000 community giveaway takes their campaign effort to a whole new level, as the team seeks to reward early backers while building quality user engagement, alongside preparations for the bigger launch.

Security, Trust, and Launch Readiness

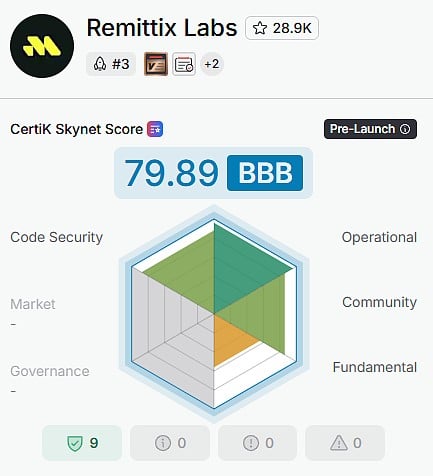

When you dig into the technical side, Remittix isn’t just talking, it’s doing. The smart contract has passed a CertiK audit, which helps build confidence around the safety of the protocol. A CertiK audit is particulary notable because it evaluates contract logic for vulnerabilities such as re-entrancy and privilege-escalation risks – common failure points in payment-focused protocols

Source: Certik Remittix Audit

Additionally:

-

They’ve incorporated features such as multi-layer encryption into their wallet, ensuring that withdrawals and “cash-outs” are secure and seamless.

-

The announced wallet launch for September 15, 2025, in its beta form, shows they’re not delaying delivery.

-

Whispers in the community suggest major centralized exchange listings are being lined up once the presale hits certain thresholds.

All of these: audited code, tangible product build-out, and a live timeline, are helping Remittix attract investors who are tired of hype-only tokens.Remittix New Updates Explained? Know What’s Coming Next

Why People are Saying It’s the “Best Crypto to Buy Now”

In 2025, the talk among savvy investors isn’t just about moonshots; it’s about useful crypto. Remittix is tapping directly into that. Rather than being another speculative altcoin, it’s positioning itself as a bridge between decentralized wallets and real bank accounts. That PayFi model, especially with XRP integration and on‑ramp support, is resonating in regions where traditional financial services are slow or expensive.

It’s not just a tool for individuals; small businesses, freelancers, and global workers could use Remittix to settle payments fast, without hidden foreign exchange fees or long wire delays.

Global remittance flows exceed $750 billion annually, and traditional channels frequently impose 5–10% fees and multi-day settlement times. The project whitepaper highlights how blockchain-based solutions are increasingly addressing these inefficiencies – particularly in regions with limited banking infrastructure.

Remittix’s PayFi model aligns with these broader usage patterns by offering faster settlement, transparent fee structures, and support for crypto assets – including stablecoins – that are already widely adopted in remittance corridors across Latin America, Africa, and Southeast Asia.

That’s a powerful narrative in today’s market. For many, that makes Remittix not just “another presale,” but one of the most compelling opportunities to buy crypto now, a project with real utility, not just talk.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Ethereum Name Service price prediction 2026-2032: Is ENS a good investment?