Billionaire Michael Saylor’s Strategy Adds $835.6M in Bitcoin at $102K Average

Strategy, the bitcoin-focused holding company led by billionaire Michael Saylor, has expanded its already-massive BTC position with another substantial purchase during the week of November 10 to November 16, according to a regulatory filing released today.

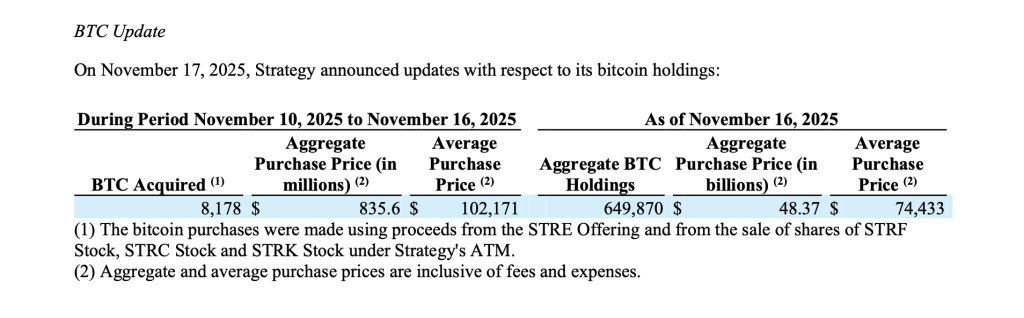

The firm acquired 8,178 BTC for $835.6 million at an average price of $102,171 per bitcoin, inclusive of fees and expenses. The latest buying spree brings Strategy’s total bitcoin holdings to 649,870 BTC as of November 16, 2025, purchased at an aggregate cost of $48.37 billion at an average price of $74,433 per bitcoin.

Aggressive Weekly Accumulation Reflects Ongoing Corporate Strategy

During the seven-day period, Strategy made one of its larger weekly purchases of 2025, continuing a consistent accumulation pattern even as bitcoin trades above the $100,000 mark. The $835.6 million outlay reflects the company’s multi-year conviction that bitcoin serves as a superior long-term reserve asset compared to cash or traditional financial instruments.

Saylor has repeatedly stated that Strategy will continue to purchase bitcoin opportunistically, using excess cash flows, debt issuance, and equity offerings. This week’s filing shows the same approach: the BTC acquisition was funded through the sale of preferred and common stock under the company’s at-the-market (ATM) programs.

Equity Sales Generate Capital for Bitcoin Purchases

To finance the latest purchases, Strategy sold multiple classes of stock across its suite of preferred and common offerings.

Between November 10 and November 16, the company issued:

- 39,957 shares of STRF (10% Series A Perpetual Strife Preferred Stock) for a notional value of $4.0 million, generating $4.4 million in net proceeds.

- 1.31 million shares of STRC (Variable Rate Series A Perpetual Stretch Preferred Stock) for a notional $131.4 million and $131.2 million in net proceeds.

- 5,513 shares of STRK (8% Series A Perpetual Strike Preferred Stock) for a notional $0.6 million and $0.5 million in net proceeds.

In total, Strategy generated $136.1 million in net proceeds from preferred stock sales during the period. While the filing notes that additional proceeds came from common stock (MSTR) sales under its ATM program, no new common shares were issued during this specific weekly window.

The fresh capital contributes to the company’s ability to sustain large-scale BTC accumulation without materially increasing debt leverage.

Bitcoin Holdings Reach Nearly $50B in Cost Basis

Following the latest purchase, Strategy now holds 649,870 BTC, one of the largest corporate bitcoin treasuries in the world. With a total cost basis of $48.37 billion, the company’s long-term average purchase price remains well below current market levels, reflecting years of steady accumulation through bull and bear cycles.

The filing reinforces Strategy’s position as a structural buyer of bitcoin, regardless of short-term price volatility. At an average purchase price of $102,171 for this week’s tranche, the firm demonstrated continued confidence in the asset even near recent cycle highs.

As the company maintains tens of billions of dollars in remaining capacity across its equity issuance programs, the latest disclosure indicates that Strategy’s bitcoin buying is far from over. Investors and analysts will be watching for subsequent filings to gauge the pace of accumulation heading into year-end.

You May Also Like

Crypto Market Prediction: Is Shiba Inu (SHIB) Saved? XRP Can Enter New Year With Bull Run, Bitcoin (BTC): There's a Problem

Ghana finalizes crypto bill; Kenya advances VASP law