Bitcoin Eyes Liquidity Race As Fed Injects $29 Billion While China Floods Markets

The Federal Reserve (Fed) injected $29.4 billion into the US banking system through overnight repo operations on Friday, the largest single-day move since the dot-com era. At the same time, China’s central bank deployed a record cash infusion to reinforce its domestic banking sector.

These coordinated liquidity moves signal a turning point for global risk assets, especially Bitcoin (BTC). Traders are closely monitoring how central banks act to stabilize markets ahead of 2026.

Fed’s Liquidity Move Highlights Market Tension

The Fed’s unusually large overnight repo operation followed sharp Treasury sell-offs and reflected growing stress in short-term credit markets.

Overnight repos enable institutions to exchange securities for cash, providing immediate liquidity in times of tight market conditions. The October 31 injection set a multi-decade record, even compared to the dot-com bubble era.

Many analysts interpret this move as a clear response to stress in Treasury markets. When bond yields rise and funding becomes more expensive, the Fed often steps in to limit systemic risks.

These interventions also expand the money supply, a factor that often correlates with rallies in risk assets such as Bitcoin.

Meanwhile, Fed Governor Christopher Waller recently called for an interest rate cut in December, indicating a potential shift toward more accommodative policy.

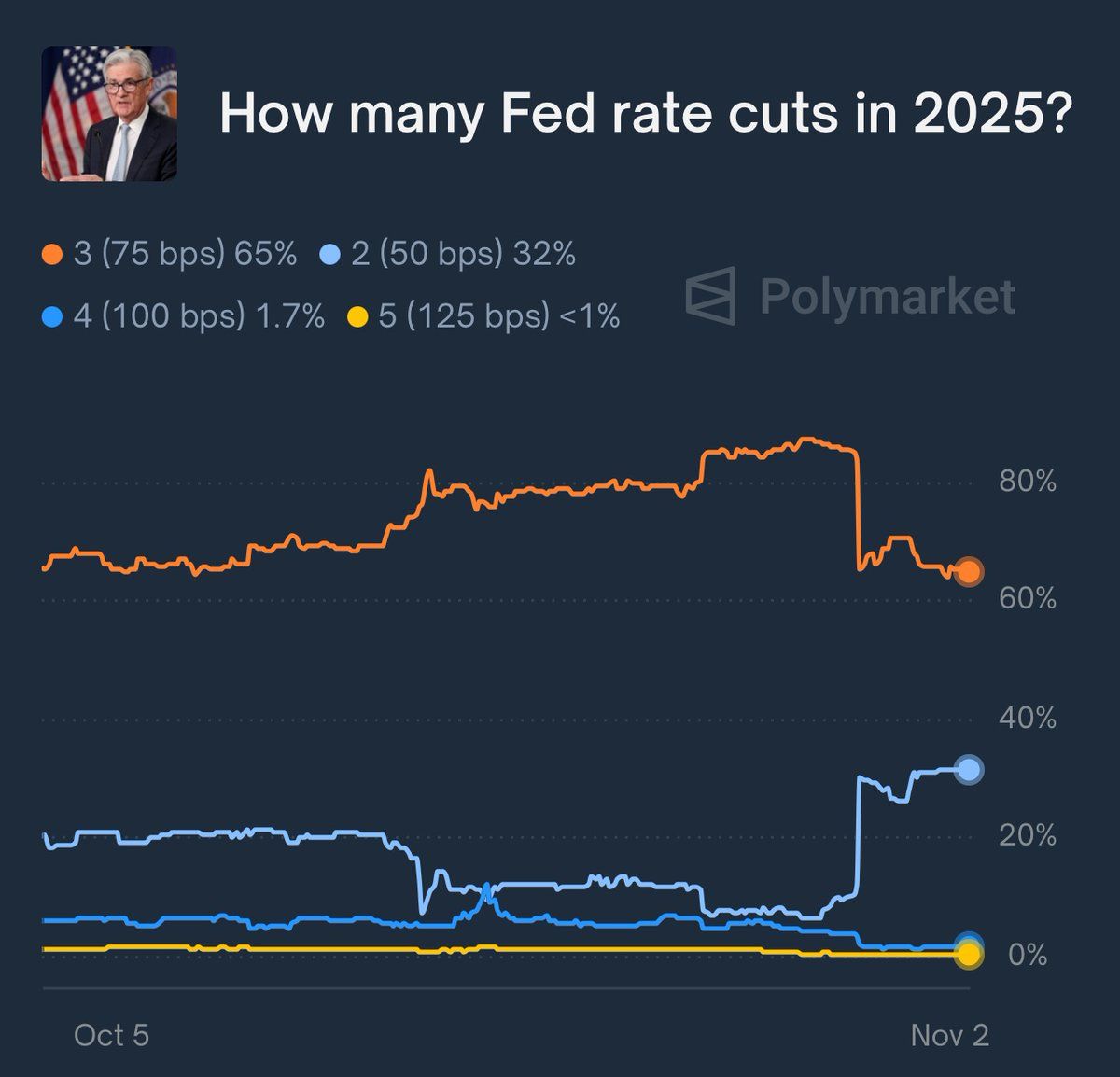

This contrasts with earlier hawkish remarks from Fed Chair Jerome Powell, whose caution has fueled market uncertainty. Polymarket data now puts the odds for a third 2025 rate cut at 65%, down from 90%, showing shifting expectations for monetary policy.

Probability for three Fed rate cuts in 2025 falls from 90% to 65%. Source: Roundtable Space

Probability for three Fed rate cuts in 2025 falls from 90% to 65%. Source: Roundtable Space

If the Fed fails to meet these expectations, markets could face a sharp downturn. Investors have already priced in easier policy, and any reversal might cause capital to exit riskier assets.

The difficult balance between liquidity injections and rate policy highlights the Fed’s challenge as it manages inflation and financial stability.

China’s Record Cash Infusion Boosts Global Liquidity

Meanwhile, China’s central bank also executed a record cash injection into domestic banks, aiming to support economic growth amid softening demand. The People’s Bank of China (PBOC) increased liquidity in a bid to keep lending active and prevent credit tightening. This action comes as Beijing addresses deflation and a weakened property sector.

The size of the PBOC’s move is comparable to its responses during past crises. By supplying extra funds, the central bank wants to lower borrowing costs and stimulate credit growth.

Such stimulus also expands global money supply and could contribute to asset inflation in stocks and cryptocurrencies.

Historically, simultaneous liquidity boosts by the Fed and PBOC have preceded major Bitcoin rallies. The 2020-2021 bull run happened alongside aggressive monetary easing after the COVID-19 outbreak.

Crypto traders now watch for a similar trend, as increased liquidity can lead investors to seek alternative assets that hedge against currency devaluation.

Macro analysts describe the situation as a “liquidity tug-of-war” between Washington and Beijing. The Fed is balancing inflation and financial stability, while the PBOC seeks to promote growth without fueling further debt. The outcome will influence risk appetite and set the tone for asset performance in 2025.

Bitcoin’s Macro Outlook Depends on Ongoing Liquidity

Bitcoin’s price has remained steady in recent weeks, staying within a narrow band as traders weigh the impact of central bank actions.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

The pioneer crypto shows signs of consolidation, with Coinglass data indicating open interest dropped from above 100,000 contracts in October to near 90,000 in early November. This decrease signals caution among derivatives traders.

Despite subdued activity, the environment could become positive for Bitcoin if global liquidity continues to grow. Lower inflation in the US, paired with an expanding money supply, favors risk-taking.

Many institutional investors now consider Bitcoin a store of value, especially when monetary expansion puts pressure on the purchasing power of traditional currencies.

However, Bitcoin’s rally may depend on the decisions of central banks. If the Fed reduces liquidity too soon through scaled-back repo operations or unexpected rate hikes, any positive momentum could quickly vanish.

Likewise, if China’s stimulus fails to revive its economy, global risk sentiment may weaken, impacting speculative assets.

The next several weeks will show whether central banks maintain liquidity support or prioritize inflation control. For Bitcoin, the outcome could decide if 2026 brings another strong bull run or just continued consolidation.

You May Also Like

Cardano Eyes $1.50, While $0.0058 Layer Brett Targets $1 in 2025

Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves