Bitcoin Fear Index Crashes to Yearly Low — Bitwise Urges Accumulation as Bitcoin Hyper ($HYPER) Gains Steam

KEY POINTS:

$BTC shows resilience despite volatility as it plummeted to ≈$103K, rebounded to ≈$116K, stabilized around ≈$109K – all within just one week.

$BTC shows resilience despite volatility as it plummeted to ≈$103K, rebounded to ≈$116K, stabilized around ≈$109K – all within just one week.

With the Crypto Fear and Greed Index plunging to 22 from last week’s 71, Bitwise sees this panic as a prime buying phase.

With the Crypto Fear and Greed Index plunging to 22 from last week’s 71, Bitwise sees this panic as a prime buying phase.

Investors are turning to emerging presale opportunities like Bitcoin Hyper ($HYPER), which is gaining traction as a hedge against market volatility.

Investors are turning to emerging presale opportunities like Bitcoin Hyper ($HYPER), which is gaining traction as a hedge against market volatility.

Following the sharp market crash on October 10th, $BTC wasn’t spared – dipping to a low of $103,133 alongside most major cryptocurrencies. But true to its resilient nature, Bitcoin bounced back fast, climbing to $116,044 within just three days (October 13th) before cooling off again to around $108,138 at the time of writing.

Some analysts consider $BTC’s price weakness a late-stage symptom of market exhaustion before a rebound. That coupled with the Crypto Fear and Greed Index plunging to 22, you can’t help but wonder – is the market giving you mixed signals, like that one date who kept you guessing all night?

Not really. Sure, sentiment has flipped sharply bearish – but that’s exactly what we’ve seen before major rebounds. Just think back to April of this year – $BTC briefly dipped below $74K, a textbook case of market fatigue right before recovery kicked in.

Source: CoinMarketCap

So, the Bitwise analysts aren’t really wearing any magic lenses to see an opportunity here.

According to the asset manager’s analysts, the underwhelming $BTC price action is largely due to renewed US-Chine trade tensions, and nothing crypto-specific.

Their report notes a record $11B decline in Bitcoin perpetual futures open interest – the steepest drop on record, which suggests that forced liquidations have now ‘exhausted selling pressure.’

As Bitwise’s in-house Cryptoasset Sentiment Index also hit its lowest level since 2024, the company remains optimistic as it believes that such extreme fear often precedes strong Q4 rallies.

That being Bitwise’s stance, let’s take a look at what on-chain data suggests.

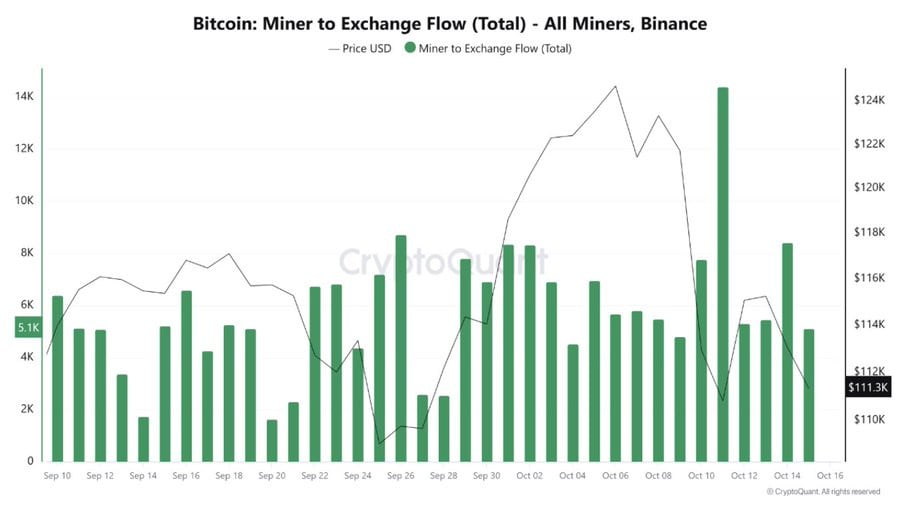

Glassnode data shows that smaller holders are ramping up accumulation, offsetting the slowdown in whale buys – a clear sign that retail confidence is creeping back in. On the flip side, CryptoQuant reports that nine miners have transferred around 51K $BTC to exchanges, likely to liquidate or hedge, adding potential sell pressure to the mix.

Source: X/@Cryptoquant

Fixing Bitcoin’s Bottleneck – Bitcoin Hyper ($HYPER) Promises Near-Zero Fees and Instant Transactions

$BTC – the pioneer of cryptocurrencies and the spark that ignited the $3.78T revolution – remains the undisputed #1 digital asset, firmly holding its place at the top. However, its native blockchain, Bitcoin, ranks at #13 on CoinMarketCap, in terms of total value locked, far below its contemporaries like Ethereum and Solana.

Why hasn’t the Bitcoin blockchain kept pace with the dominance of its native coin? For starters, Bitcoin’s average throughput is just seven transactions per second (TPS), a stark contrast to Solana’s max theoretical TPS of 65.K. This makes it ill-equipped to handle high traffic volumes.

Additionally, confirmations can take over 10 minutes, and users often incur steep fees for everyday transactions.

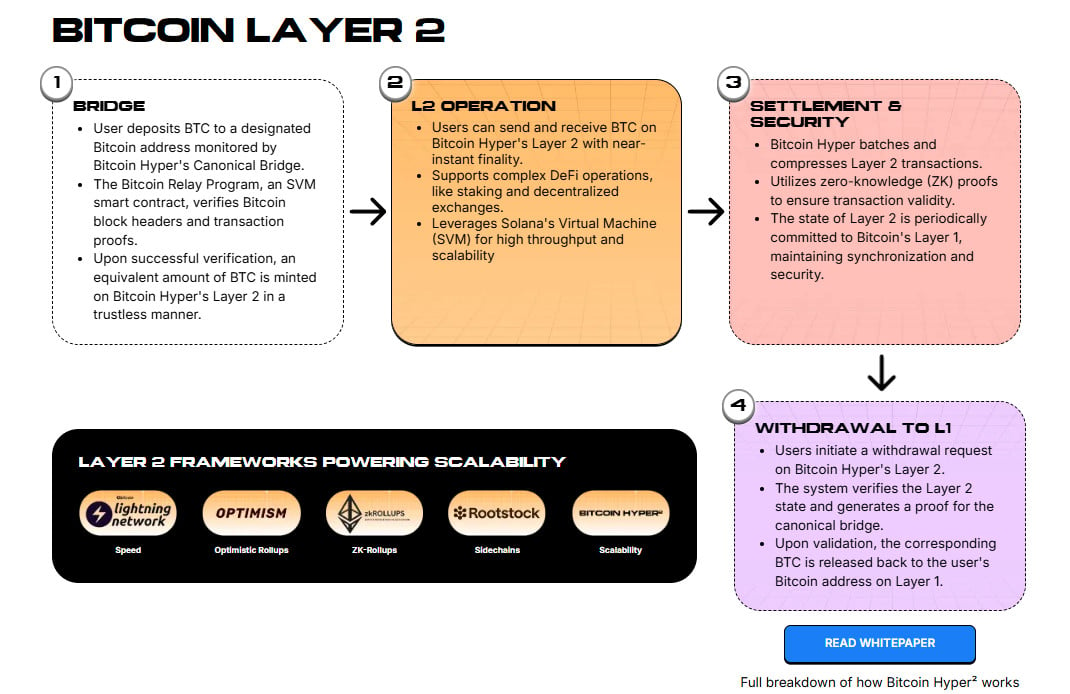

That’s where Bitcoin Hyper ($HYPER) plans to step in with its all-in-one solution – a Layer-2 model featuring a canonical bridge and Solana Virtual Machine integration to fix all of Bitcoin’s ailments.

Bitcoin Hyper will enable super-fast transactions through parallel execution of decentralized applications, digital assets, and on-chain functionalities. The canonical bridge will mint your deposited $BTC onto Hyper’s Layer-2 as wrapped $BTC, which you can use for interacting with dApps.

Discover more about Hyper’s Layer-2 solution in our comprehensive Bitcoin Hyper Review.

Discover more about Hyper’s Layer-2 solution in our comprehensive Bitcoin Hyper Review.

Investors’ growing conviction in this Layer-2 solution is reflected in its presale – the project has already raised $ 23.95M. Whales are also adding to Hyper’s kitty. We’re talking about the likes of $379.9K and other big buys.

Investors’ growing conviction in this Layer-2 solution is reflected in its presale – the project has already raised $ 23.95M. Whales are also adding to Hyper’s kitty. We’re talking about the likes of $379.9K and other big buys.

Right now, $HYPER costs just $0.013125, and the dynamic staking APY is at 49%. However, our $HYPER price prediction believes this token has the potential to climb to $0.20 by year-end – a 1,424% gain from current levels.

Ready to join the presale? Our step-by-step guide explains how to buy $HYPER.

Ready to join the presale? Our step-by-step guide explains how to buy $HYPER.

Don’t forget, though, presale prices go up in stages, while the APY lowers as more holders stake their tokens. With the next price jump due later today and staking rewards waning by the minute, don’t just watch the market recover – be a part of it.

Grab your $HYPER tokens before the next price increase.

You May Also Like

XRP Bulls Gain Confidence as Social Sentiment Turns Positive

The HackerNoon Newsletter: Cypherpunks Write Code: Zooko Wilcox Zcash (9/21/2025)

![[Two Pronged] Has my fate made me end up with the same type of woman every time?](https://www.rappler.com/tachyon/2025/12/two-pronged-2-Factor-Authentication-relationship.jpg)