Bitcoin Newbie Whales Now Sitting On $6.9 Billion In Losses, Most Since 2023

On-chain data shows the recent bearish Bitcoin price action has put the network’s short-term holder whales into a significant unrealized loss.

New Bitcoin Whales Have Dived Underwater

In a new post on X, on-chain analytics firm CryptoQuant has discussed about the latest trend in the profit-loss situation of the short-term holder Bitcoin whales. The “short-term holders” (STHs) broadly refer to the BTC investors who purchased their coins within the past 155 days.

The STH whales (or “new whales”) are the holders with 1,000+ BTC (equivalent to $110.8 million at the current exchange rate) who got into the market during the last five months.

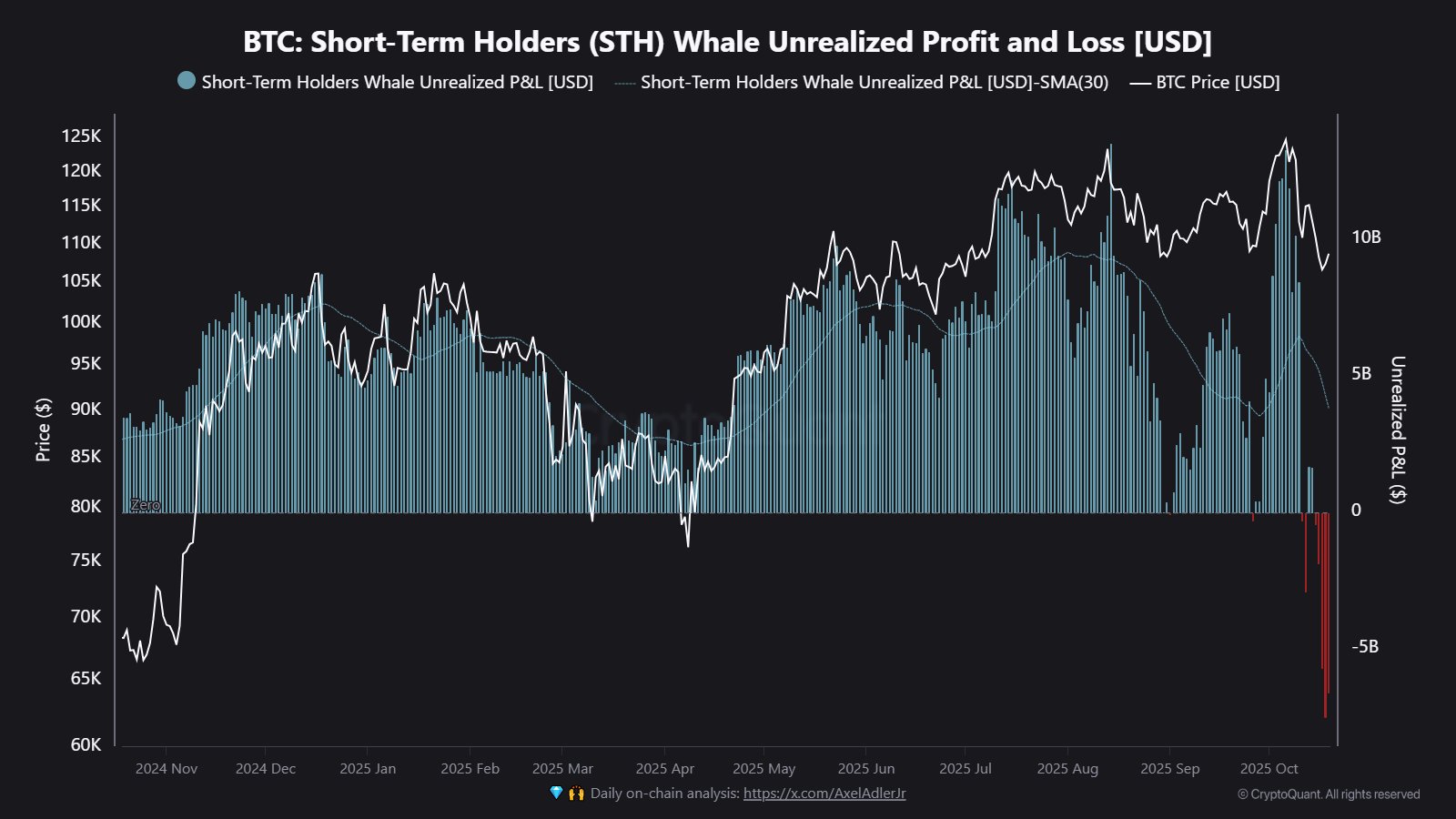

Now, here is the chart shared by the analytics firm that shows the trend in the net unrealized profit/loss held by the STH whales over the past year:

As displayed in the above graph, the Bitcoin STH whales have seen their profit-loss balance lean heavily into the underwater territory following the recent bearish wave in the cryptocurrency’s price. This means that the members of this cohort are now carrying a heavy amount of net loss.

More specifically, the STH whales are holding about $6.95 billion in unrealized loss, which is the largest for the group since October 2023, about two years ago. This indicates significant pressure among big-money investors, especially considering that the STHs control a notable chunk of the whale Realized Cap.

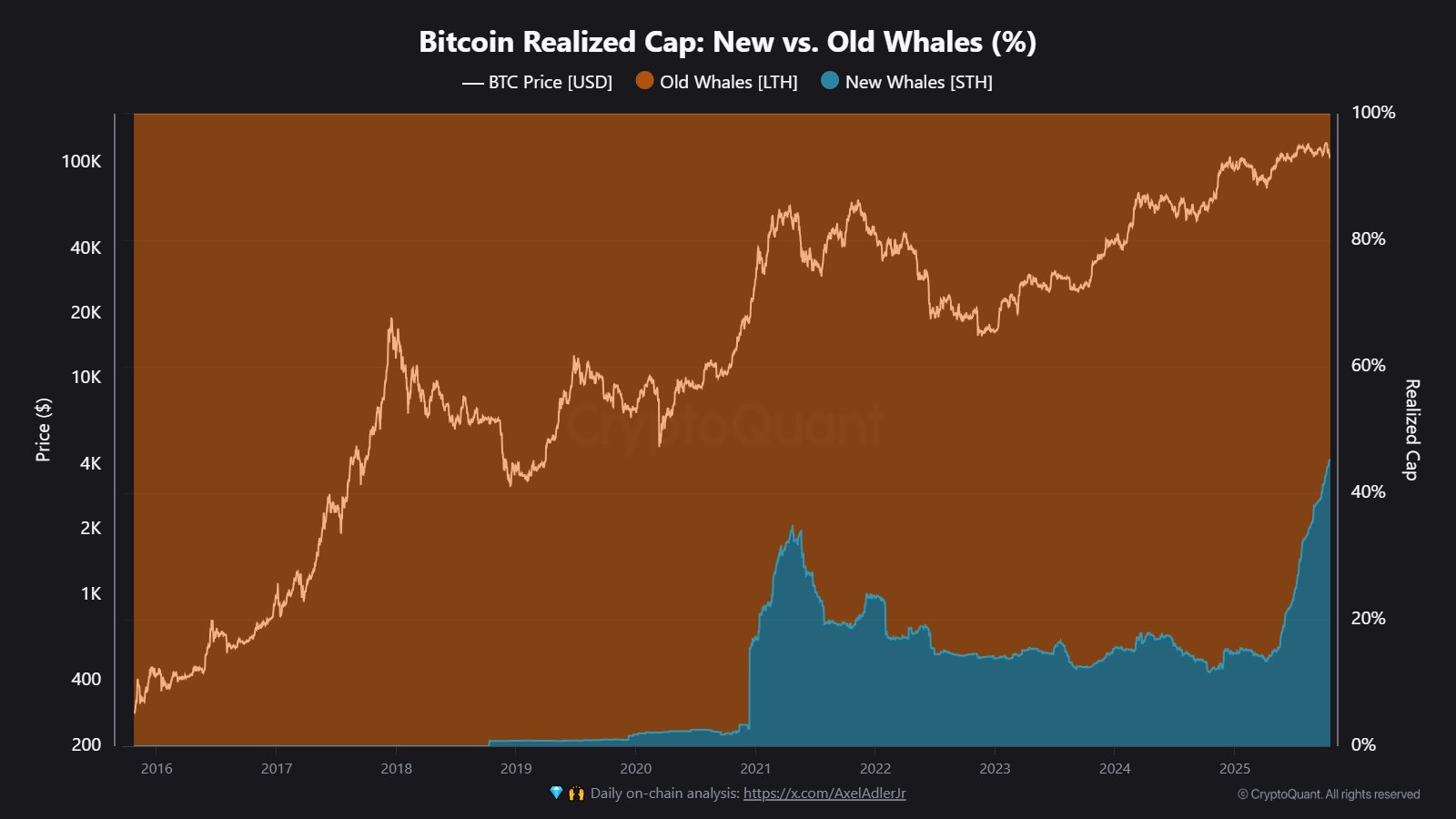

The Realized Cap is an indicator that basically measures the total amount of capital that Bitcoin investors have put into the cryptocurrency. The Realized Cap of the new whales, in particular, corresponds to the big-money capital that came into the network during the past 155 days.

From the above chart, it’s apparent that the new whales today control around 45% of the total whale Realized Cap, which is a new record. Considering that the cohort as a whole is underwater, this capital is naturally being held at a net loss now.

The recent growth in the Realized Cap of the STH whales has come as the long-term holders (LTHs), covering investors with a holding time greater than the STH upper limit of 155 days, have been participating in distribution.

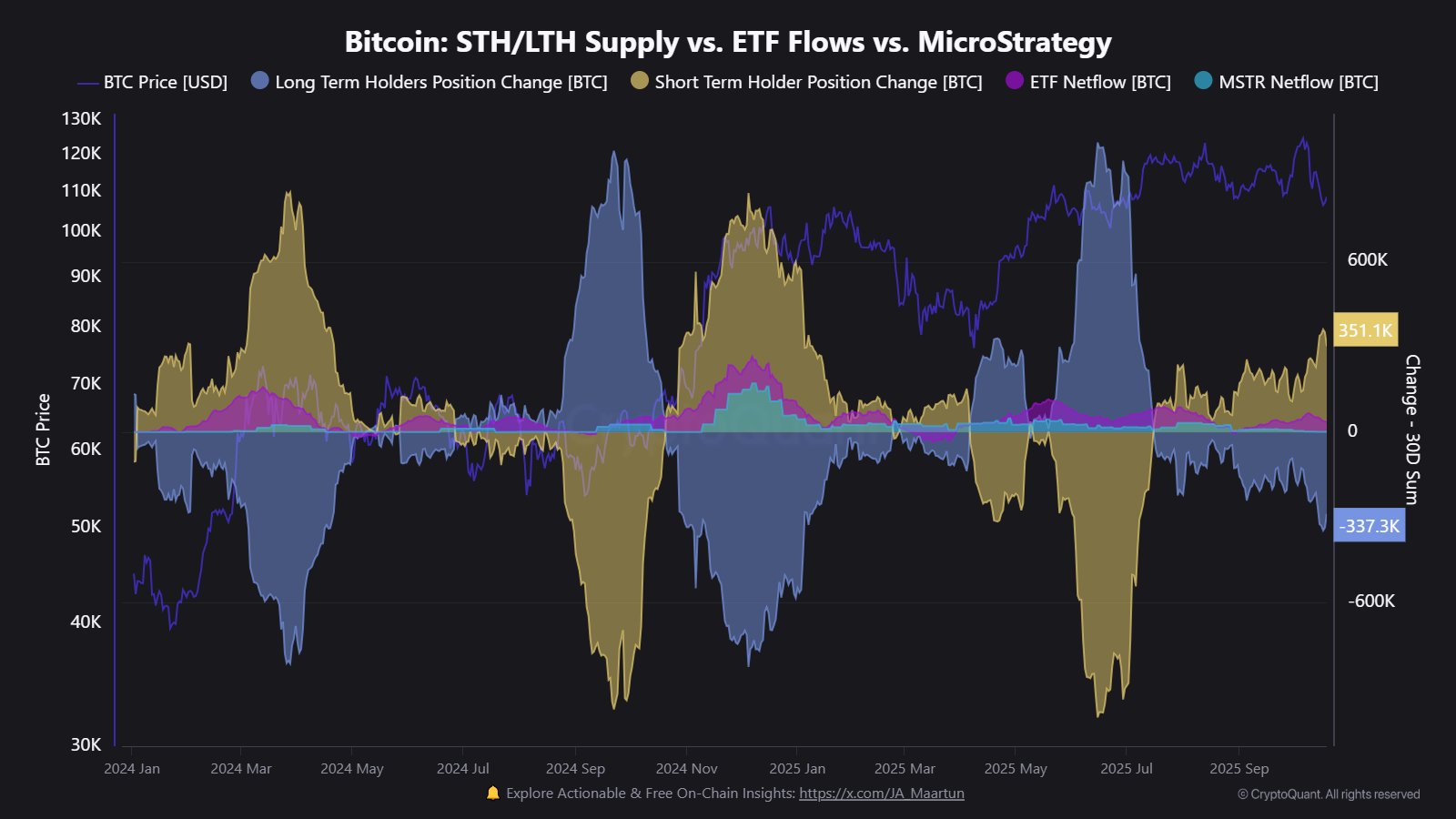

As the chart shared by CryptoQuant community analyst Maartunn shows, 337,300 BTC has exited the wallets of the Bitcoin LTHs over the last 30 days.

So far, new capital has been coming in to absorb this selloff from the HODLers, but with the STH whales now under pressure, demand for the cryptocurrency may be starting to weaken.

BTC Price

At the time of writing, Bitcoin is trading around $111,000, down 1.7% over the last week.

You May Also Like

$2.2 Billion BTC & ETH Options Expiry Kicks Off 2026 Volatility Test

Coinbase Slams ‘Patchwork’ State Crypto Laws, Calls for Federal Preemption