Bitcoin OG Whale Who Predicted Last Crash Opens $392M Short — Is Another Crash Coming?

The post Bitcoin OG Whale Who Predicted Last Crash Opens $392M Short — Is Another Crash Coming? appeared first on Coinpedia Fintech News

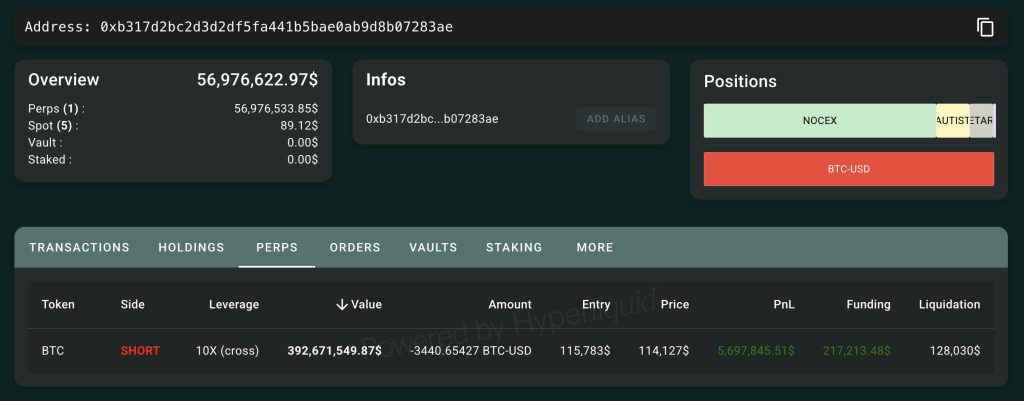

A legendary Bitcoin OG whale, known for perfectly shorting Bitcoin and Ethereum before the recent market crash, has once again entered the market and is again shortening Bitcoin with a massive 3,440 BTC ($392 million) short at a 10x leverage.

Now, the re-entry of this whale has raised eyebrows. Many in the crypto space are worrying is another crypto crash is coming, or just a daring bet riding on market fear?

BitcoinOG whale Shorting BTC Again

According to on-chain data, this Bitcoin OG whale has opened a massive short position on Bitcoin at an average price of around $115,783 per BTC, with a liquidation level near $128,000 on Hyperliquid, a high-risk trading platform.

Analysts point out that 10x leverage means even minor drops could lead to eye-popping gains, but a price rebound could clear out millions.

Interestingly, the whale’s short comes right after he profited $192 million shorting the previous crash triggered by Trump’s surprise China tariff.

Placing another massive short so soon has raised eyebrows across the crypto community. Many see it as a warning signal, especially since the trade appeared just as Bitcoin slipped to $112,700, reflecting a drop of 2%.

On-Chain Indicators of Market Stress

Several key factors from macroeconomic, technical, and on-chain are fueling fears that another sharp correction could be imminent.

- Large Bitcoin transfers to exchanges spiked above $2 billion, a common sign of selling pressure.

- Data from Derive.xyz showed heavy “put” buying from traders in bitcoin and ether, with CME futures open interest hitting record highs near $39 billion.

- The Spent Output Profit Ratio (SOPR) for short-term holders fell below 1.0, indicating many are selling at losses, a sign of capitulation phases.

- Stablecoin outflows totaling $8 billion have drained buying power from exchanges, limiting liquidity for price support.

Community Divided Over Whale’s Intentions

Crypto traders on X are split. Some believe this whale might have inside information, given the precision of previous trades. Others think it’s simply a high-stakes gambler who thrives on volatility.

As of now, Bitcoin is trading around $112765, reflecting a slight drop. However, technical analysis highlights $105,000 as strong short-term support for BTC, with $118,000–$124,000 seen as the next major resistance zones.

You May Also Like

CME Group to launch options on XRP and SOL futures

Bipartisan Bill Targets Crypto Tax Loopholes and Stablecoin Rules: Report