2026-01-07 Wednesday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

XRP ETF Inflows Beat BTC and ETH ETFs, Signaling Rising Institutional Trust

Spot XRP ETFs attracted $12.84M in a day while Bitcoin and Ethereum ETFs recorded net outflows. 21Shares’ TOXR fund began trading, adding a new U.S. spot XRP vehicle to existing BTC and ETH products. Spot XRP exchange-traded funds booked a combined daily net inflow of $12.84 million on Dec. 4, according to data from SoSoValue. [...]]]>

Share

Author: Crypto News Flash2025/12/05 21:43

Drop to $80K Still Possible if BTC Doesn’t Reclaim This Key Level Soon

The post Drop to $80K Still Possible if BTC Doesn’t Reclaim This Key Level Soon appeared on BitcoinEthereumNews.com. Home » BTC ‘; } function loadTrinityPlayer(targetWrapper, theme,extras=””) { cleanupPlayer(targetWrapper); // Always clean first ✅ targetWrapper.classList.add(‘played’); // Create script const scriptEl = document.createElement(“script”); scriptEl.setAttribute(“fetchpriority”, “high”); scriptEl.setAttribute(“charset”, “UTF-8”); const scriptURL = new URL(

https://trinitymedia.ai/player/trinity/2900019254/?themeAppearance=${theme}${extras}); scriptURL.searchParams.set(“pageURL”, window.location.href); scriptEl.src = scriptURL.toString(); // Insert player const placeholder = targetWrapper.querySelector(“.add-before-this”); placeholder.parentNode.insertBefore(scriptEl, placeholder.nextSibling); } function getTheme() { return document.body.classList.contains(“dark”) ? “dark” : “light”; } // Initial Load for Desktop if (window.innerWidth > 768) { const desktopBtn = document.getElementById(“desktopPlayBtn”); if (desktopBtn) { desktopBtn.addEventListener(“click”, function () { const desktopWrapper = document.querySelector(“.desktop-player-wrapper.trinity-player-iframe-wrapper”); if (desktopWrapper) loadTrinityPlayer(desktopWrapper, getTheme(),’&autoplay=1′); }); } } // Mobile Button Click const mobileBtn = document.getElementById(“mobilePlayBtn”); if (mobileBtn) { mobileBtn.addEventListener(“click”, function () { const mobileWrapper = document.querySelector(“.mobile-player-wrapper.trinity-player-iframe-wrapper”); if (mobileWrapper) loadTrinityPlayer(mobileWrapper, getTheme(),’&autoplay=1′); }); } function reInitButton(container,html){ container.innerHTML = ” + html; } // Theme switcher const destroyButton = document.getElementById(“checkbox”); if (destroyButton) { destroyButton.addEventListener(“click”, () => { setTimeout(() => { const theme = getTheme(); if (window.innerWidth > 768) { const desktopWrapper = document.querySelector(“.desktop-player-wrapper.trinity-player-iframe-wrapper”); if(desktopWrapper.classList.contains(‘played’)){ loadTrinityPlayer(desktopWrapper, theme,’&autoplay=1′); }else{ reInitButton(desktopWrapper,’Listen‘) const desktopBtn = document.getElementById(“desktopPlayBtn”); if (desktopBtn) { desktopBtn.addEventListener(“click”, function () { const desktopWrapper = document.querySelector(“.desktop-player-wrapper.trinity-player-iframe-wrapper”); if (desktopWrapper) loadTrinityPlayer(desktopWrapper,theme,’&autoplay=1’); }); } } } else { const mobileWrapper = document.querySelector(“.mobile-player-wrapper.trinity-player-iframe-wrapper”); if(mobileWrapper.classList.contains(‘played’)){ loadTrinityPlayer(mobileWrapper, theme,’&autoplay=1′); }else{ const mobileBtn = document.getElementById(“mobilePlayBtn”); if (mobileBtn) { mobileBtn.addEventListener(“click”, function () { const mobileWrapper = document.querySelector(“.mobile-player-wrapper.trinity-player-iframe-wrapper”); if (mobileWrapper) loadTrinityPlayer(mobileWrapper,theme,’&autoplay=1′); }); } } } }, 100); }); } })(); Summarize with AI Summarize with AI Bitcoin’s relief bounce has slowed down following an aggressive short-term rally. After jumping past key levels last week, buyers now face two major challenges: reclaiming control above resistance and dealing with weakening on-chain metrics. Technical Analysis By Shayan The Daily Chart BTC’s daily chart shows a clear bounce from the $80K demand zone, pushing price back into the $90K–$93K…Share

Author: BitcoinEthereumNews2025/12/05 21:43

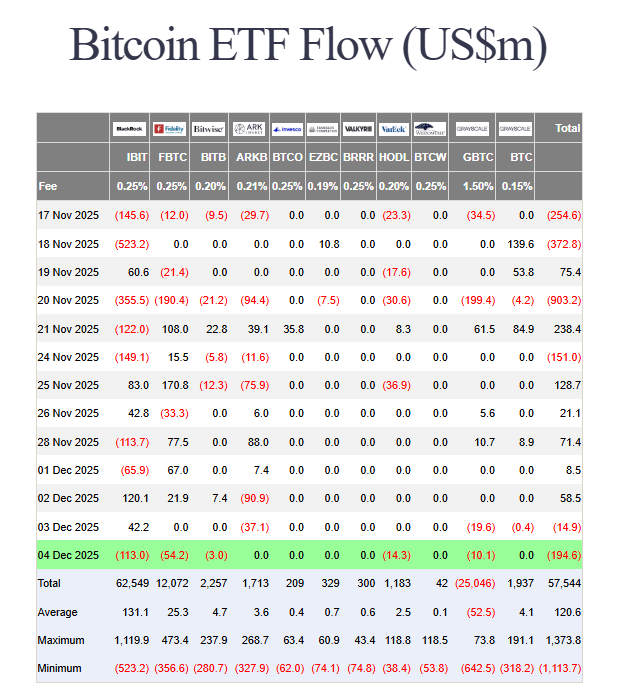

BlackRock, SpaceX Move Millions of BTC, ETH To Coinbase Ahead of US PCE Report

The post BlackRock, SpaceX Move Millions of BTC, ETH To Coinbase Ahead of US PCE Report appeared on BitcoinEthereumNews.com. Key Insights Crypto News: BlackRock moved 1,385 BTC worth $126.3 million, causing Bitcoin price to drop below $91K. BlackRock also deposited 799 ETH valued at $2.5 million to Coinbase. SpaceX transferred 1,083 BTC worth $100 million from its BTC holdings. BTC and ETH in selling pressure ahead of US PCE inflation data. In major crypto news today, the world’s largest asset manager BlackRock and Elon Musk’s SpaceX moved their Bitcoin and Ethereum holdings to Coinbase. The transfers sparked concerns in the crypto market as they were executed just before the US PCE inflation report. Are Bitcoin and Ethereum set to drop below $90,000 and $3,000 amid massive negative sentiment among institutional investors? Crypto News: BlackRock Moves Massive Bitcoin and Ethereum to Coinbase According to on-chain expert Onchain Lens, BlackRock transferred another 1,385 BTC worth almost $126.3 million to Coinbase crypto exchange. This sparked selling pressure on Bitcoin. In addition, BlackRock also deposited 799 ETH valued at $2.5 million into Coinbase. ETH price slipped almost 0.50% immediately after the transfer. BlackRock Moves BTC and ETH to Coinbase | Source: Arkham Notably, this comes despite bullish sentiment following Vanguard listing of spot Bitcoin ETFs and spot Ethereum ETFs. The timing of the transfer has raised concerns among investors as it comes ahead of the September US PCE inflation release by the U.S. Bureau of Economic Analysis. According to Farside Investors data, BlackRock Bitcoin ETF (IBIT) recorded $113 million in outflows on Thursday. Also, the BlackRock Ethereum ETF (ETHA) saw $28.4 million in inflows. SpaceX Transfers $100 Million Bitcoin to Coinbase According to Arkham International, Elon Musk’s SpaceX moved massive 1,083 BTC worth $100 million to an unknown wallet today. The on-chain expert claimed the latest transfer likely moved Bitcoin holdings to Coinbase Prime for custody. Elon Musk’s SpaceX Moved 1,083 BTC Source:…

Share

Author: BitcoinEthereumNews2025/12/05 21:42

Elon Musk’s SpaceX Moves Another $100M in Bitcoin, What’s Happening?

The post Elon Musk’s SpaceX Moves Another $100M in Bitcoin, What’s Happening? appeared on BitcoinEthereumNews.com. Elon Musk’s space exploration company, SpaceX, moved massive 1,083 BTC on Friday, according to blockchain analytics firm Arkham Intelligence. This marks the 8th Bitcoin transfer by the firm, sparking speculations within the crypto community as BTC price fell to $91K again ahead of today’s crypto options expiry and the key PCE inflation data release. Elon Musk’s SpaceX Transfers 1,083 Bitcoin SpaceX moved almost $100 million in Bitcoin to a new wallet rather than to the wallets in the previous transfers, on-chain analyst Lookonchain reported on December 5. The on-chain expert believes the latest transfer to Coinbase Prime is likely for custody purposes. Arkham transaction data revealed over 1083 BTC moved from the wallet linked to SpaceX. Unspent 283 BTC worth $31.33 moved to ‘bc1qrzg’ and spent $162.48 in BTC moved to Coinbase Prime. Also, the remaining unspent 800 BTC worth $73.73 million moved to ‘bc1qyh’ wallet. Elon Musk’s SpaceX Moves Bitcoin Holdings. Source: Arkham SpaceX primary wallet still sits on 5,012 BTC, valued at $461.7 million at the current market price. Transfers look like a pattern as SpaceX rotates part of its Bitcoin holdings into fresh wallets every few weeks. Notably, coins moved to new addresses in the last two months remain untouched. SpaceX Transfers Rate Rise After Crypto Market Crash Outflows from SpaceX to other unknown wallets have increased significantly after the October 10 crypto market crash. In the last 2 months, Elon Musk’s firm made seven transactions, of which 4 transfers were to new wallets. As CoinGape reported earlier, SpaceX moving massive Bitcoin holdings in October sparked speculation of selloffs by Elon Musk ahead of a potential market crash or strategically restructuring assets in preparation for something big. The latest transfer comes on the day of the key US PCE inflation release ahead of the FOMC Meeting that…

Share

Author: BitcoinEthereumNews2025/12/05 21:31

Bitcoin “Bear Thesis” Stays In Play With Fresh $93,500 Rejection

The post Bitcoin “Bear Thesis” Stays In Play With Fresh $93,500 Rejection appeared on BitcoinEthereumNews.com. Bitcoin (BTC) slipped from the 2025 yearly open into Thursday’s Wall Street trading session as markets reacted to US jobs data. Key points: Strong US labor-market data fails to dent hopes of a December Fed rate cut. Crypto continues to diverge from stocks amid predictions of a strong finish to 2025 for the latter. Bitcoin has multiple key resistance levels to reclaim in order to flip the bearish status quo. Fed has “no option” over rate cut Data from Cointelegraph Markets Pro and TradingView showed BTC price action weakening on surprisingly low US jobless claims. BTC/USD one-hour chart. Source: Cointelegraph/TradingView Both initial and ongoing claims came in below expectations on the day, per data from the St. Louis Fed. US weekly initial jobless claims through Nov. 29. Source: St. Louis Fed Despite this signal of labor market strengthening, and hence economic resilience, markets doubled down on expectations that the Federal Reserve would lower interest rates at its Dec. 10 meeting. The reason, analysis argued, was a widening gap between risk assets and consumer strength. “The Fed has no option: Even as inflation hits 3%, the Fed MUST cut rates to ‘save’ US consumers,” trading resource The Kobeissi Letter wrote in its latest commentary on X. “Consumers are struggling while large cap tech stocks are soaring. More rate CUTS are coming into one of the hottest stock markets in history. Own assets or be left behind.” Fed target rate probabilities for Dec. 10 meeting (screenshot). Source: CME Group FedWatch Tool A cut would notionally support further liquidity inflows into crypto and risk assets. As Cointelegraph reported, even the risk of Japan hiking rates in the near future represented a contradictory move, as its central bank finalized a $135 billion economic stimulus injection. Kobeissi described the Japanese situation as a “free-for-all.” “Japan…

Share

Author: BitcoinEthereumNews2025/12/05 21:19

Stablecoins Threaten Central Banks, Warns IMF as Hard-Money Narrative Fuels Bitcoin Hyper

What to Know: IMF concerns about dollar stablecoins eroding local currencies reinforce the appeal of scarce, non-sovereign assets like Bitcoin in a fragmented monetary system. Bitcoin’s base layer remains constrained by slow confirmations, fee volatility, and minimal smart contract support, creating renewed interest in specialized Layer 2 infrastructure. Competing Bitcoin scaling projects, from Lightning to sidechains, are racing to capture BTC liquidity as programmable capital for payments and DeFi. Bitcoin Hyper uses an SVM-based Layer 2 anchored to Bitcoin to deliver extremely low-latency smart contracts, targeting DeFi, gaming, and high-speed BTC payments. Stablecoins are a threat. At least that’s according to the International Monetary Fund (IMF). In a recent report, the IMF shared concerns that dollar-backed stablecoins might hollow out weaker local currencies and dilute central banks’ control over domestic liquidity. If a digital dollar reaches everyone’s smartphone, what happens to the Peruvian sol, Nigerian naira, or Turkish lira? The report also discussed the positives of stablecoins like cheaper and quicker payments, and a simpler UX, so it wasn’t all doom and gloom. However, the warning does not just read as a technocratic worry. It reinforces a deeper macro story that crypto has been circling for a decade: demand for scarce, non-sovereign assets that cannot be printed at will, especially Bitcoin. In a world of increasingly digital dollars, Bitcoin’s hard cap can look less like a curiosity and more like a hedge. That backdrop is why attention keeps shifting from ‘number goes up’ to ‘what actually gets built on top of Bitcoin.’ If you believe Bitcoin will matter more as a neutral reserve asset, then the highest-beta plays sit in the infrastructure that makes $BTC programmable, spendable, and usable in DeFi at scale. In that lane, Bitcoin Hyper ($HYPER) is trying to position itself as a key liquidity rail. It pitches itself as the first Bitcoin Layer 2 using the Solana Virtual Machine (SVM), aiming to merge Bitcoin’s hard-money appeal with Solana-style throughput and developer tooling. Why Bitcoin Layer 2 Infrastructure Is Back In Focus When a body like the IMF flags dollar stablecoins as a systemic risk for smaller economies, it implicitly admits that monetary power is splitting. You are not just choosing between local cash and a bank account anymore; you are choosing between local fiat, dollar tokens, and non-sovereign assets like Bitcoin at the tap of an app. That split has pushed capital toward Bitcoin itself, but it has also exposed how limited the base layer is for real-world usage. On-chain Bitcoin still moves with minutes-long confirmation times, variable fees, a slow 7 TPS rate, and almost no native smart contract support. Competing Bitcoin scaling efforts have rushed to fill that gap. Lightning Network pursues off-chain payment channels for instant $BTC transfers, while projects like Stacks and Rootstock lean on sidechains and alternative virtual machines to bring DeFi into the Bitcoin orbit. In that growing field, Bitcoin Hyper ($HYPER) is standing out to turn dormant $BTC liquidity into programmable capital using Solana Virtual Machine (SVM) tech and a canonical bridge. See how to buy into the action with our ‘How to Buy Bitcoin Hyper’ guide. How Bitcoin Hyper Tries To Turn $BTC Into High-Speed Capital For years, the crypto trilemma suggested you couldn’t have speed, security, and decentralization in one place. Bitcoin Hyper ($HYPER) challenges that by changing the geometry of the network. Instead of forcing Bitcoin to be fast, Bitcoin Hyper accepts Bitcoin as the heavy, secure anchor (Settlement Layer). It then attaches a Ferrari engine on top: a modular SVM Layer 2 (Execution Layer). What does this unlock? Rust-based Smart Contracts: Developers can build complex dApps (Gaming, NFT, DEXs) identical to Solana’s ecosystem. Latency: Sub-second finality that beats Solana’s own benchmarks. Security: State is periodically anchored back to $BTC, preserving the ‘hard money’ thesis. The market is voting with its wallet. The presale has breached $29M, with whales accumulating and making purchases as large as $500K. With a price point of $0.013375 and high-APY staking currently at 40%, Bitcoin Hyper is positioning itself as the execution layer for the next bull run. Our experts predict $HYPER possibly reaching $0.08625 by the end of 2026. If you invested today, that means a potential ROI of over 544%. Don’t miss the upgrade. Buy your $HYPER today. Remember, this isn’t intended as financial advice, and you should always do your own research before investing. Authored by Aaron Walker , NewsBTC — https://www.newsbtc.com/news/imf-warns-stablecoins-threaten-banks-boosting-bitcoin-hyper-layer-2

Share

Author: NewsBTC2025/12/05 21:12

Aave V4 to Bring Native Bitcoin Collateral Through Babylon’s Trustless Vaults

TLDR: Native Bitcoin enters Aave lending through Babylon vaults with no wrapping and no centralized custody. Testing for the Bitcoin Spoke begins in Q1 2026 with a targeted April rollout pending governance. BTC-backed lending passed one billion dollars this year based on Babylon’s reported figures. Babylon’s trustless systems already activate billions in BTC, expanding Bitcoin’s [...] The post Aave V4 to Bring Native Bitcoin Collateral Through Babylon’s Trustless Vaults appeared first on Blockonomi.

Share

Author: Blockonomi2025/12/05 21:09

Bitcoin To Reach $180,000 By End Of 2026 ⋆ ZyCrypto

The post Bitcoin To Reach $180,000 By End Of 2026 ⋆ ZyCrypto appeared on BitcoinEthereumNews.com. Advertisement     Bitcoin could extend its recent rebound after posting a 7% daily gain on Wednesday, with 2026 likely to be the crypto’s most bullish year yet. Ripple CEO Brad Garlinghouse cited regulatory progress and institutional interest as the secret sauce for Bitcoin hitting $180,000 by the end of 2026. BTC Destined For $180K By 2026-End During a recent panel discussion alongside Solana Foundation President Lily Liu and Binance co-CEO Richard Teng as part of Binance Blockchain Week, Ripple boss Brad Garlinghouse boldly projected that the Bitcoin price could grind all the way to $180,000 per coin before the end of next year. “I’ll go out on a limb, and I’ll say Bitcoin $180,000, December 31, 2026,” Garlinghouse postulated, indicating strong optimism about the alpha cryptocurrency’s long-term price trajectory. Bitcoin was trading for $93,216 at publication time, up a meagre 0.1 percentage over the past 24 hours period, CoinGecko data shows. The leading crypto hit a record peak of $126,080 just two months ago before sagging. The Ripple CEO expects 2026 to be the most bullish year for the crypto industry to date due to several factors. Advertisement   “There are so many macro factors that are continuing to provide tailwinds for this industry that, as we go into 2026, I don’t remember being this optimistic in the last handful of years,” he opined. First, Garlinghouse notes that after years of being hostile to the crypto sector, the United States has finally achieved regulatory clarity under the Trump administration. This drastic regulatory change, according to him, is significantly undervalued. Garlinghouse then highlighted that renowed Wall Street giants are now foraying the market. Franklin Templeton, BlackRock, and now even Vanguard, which previously held a long-standing anti-crypto stance, is now allowing its 50 million clients to invest in regulated…

Share

Author: BitcoinEthereumNews2025/12/05 20:52

Metaplanet Raises $50M to Buy More Bitcoin, Stock Reacts

The post Metaplanet Raises $50M to Buy More Bitcoin, Stock Reacts appeared on BitcoinEthereumNews.com. Key Insights Metaplanet has raised $50 million in funding to buy more Bitcoin. Metaplanet and MTPLF stocks grabbed interest from investors. Bitcoin price plunges to $91K due to volatility ahead of the FOMC Meeting. Metaplanet, aka Asia’s MicroStrategy, on Friday said it has raised $50 million in funding to buy more BTC. This update comes as the firm looks to restart Bitcoin accumulation for the next year, following a recent pause. The MTPLF stock dropped 0.76% as Bitcoin price tumbled under $91K today, and the new loan announcement was made after market close. In an official announcement on December 5, Metaplanet disclosed $50 million in funding secured by the firm by leveraging its existing Bitcoin holdings as collateral. The firm will primarily use the funds for acquiring more Bitcoin. Notably, the 2026 target under the Bitcoin acquisition strategy is 100,000 BTC. Metaplanet will also use the funds for Bitcoin income generation business expansion and share repurchases. As per official statement from the firm, “Funds allocated to Bitcoin Income Generation business will be used as collateral for selling bitcoin options to earn premium income.” Metaplanet Raise $50 Million in Funding | Source: Metaplanet In addition, the Bitcoin treasury company will shift to a conservative financial policy by drawing limited funds. This development comes in the light of Bitcoin price facing significant volatility. As of now, the company has drawn a total of $280 million under the $500 million credit facility, including the $50 million loan. This comes following the firm borrowed another $130 million against its Bitcoin holdings. Metaplanet said it plans additional BTC purchases, income-generation activities, and potential share buybacks with the loan. MTPLF Stock Pumps as mNAV Reclaims 1x Metaplanet’s enterprise value has increased to a level in line with its Bitcoin holdings. As a result, the firm’s mNAV…

Share

Author: BitcoinEthereumNews2025/12/05 20:45

CZ and Peter Schiff Engage in Contentious Gold Vs. Bitcoin Debate

Binance founder Changpeng Zhao (CZ) and prominent Bitcoin critic Peter Schiff held an anticipated debate at Binance Blockchain Week, pitting digital versus traditional assets. While the discussion was cordial, it shed light on fundamental distinctions between Bitcoin (BTC) and gold as stores of value – including an unexpected agreement among participants that Schiff would admit … Continue reading "CZ and Peter Schiff Engage in Contentious Gold Vs. Bitcoin Debate" The post CZ and Peter Schiff Engage in Contentious Gold Vs. Bitcoin Debate appeared first on Cryptoknowmics-Crypto News and Media Platform.

Share

Author: Coinstats2025/12/05 20:12