Chainlink (LINK) Poised for Breakout From $13–$26 ‘No-Trade’ Zone

Chainlink (LINK) is trading near $15 at press time, down slightly over the last day but still holding a weekly gain of over 9%.

The price remains within a defined range that analysts say could dictate the next breakout.

Price Structure Tightens Ahead of Key Break

A long-term symmetrical triangle has formed on the weekly LINK/USDT chart. This pattern has developed over several years, with lower highs and higher lows. Ali Martinez pointed out that the $13–$26 range has become a “no-trade” zone. He noted that the next major price move will likely come once LINK exits this range.

The asset has tested both sides of the triangle but has not yet broken out. The structure is now approaching its final stages. A clear break above $26 or below $13 could define the next trend. Until that happens, the token is expected to remain inside this tightening range.

Near-Term Trend Holds Above Support

On the daily chart, LINK is moving between its 9-day and 21-day moving averages, sitting at $15 and $17 respectively. A close above $17 could open the path to higher levels, while a drop below $15 would weaken the setup.

Source: TradingView

Source: TradingView

MACD data shows the indicator line has crossed above the signal line, while both remain in negative territory. This early move may suggest momentum is shifting, but further confirmation is still needed. CRYPTOWZRD noted that the price must stay above $16 to open up targets toward $20.

The outlook remains tied to Bitcoin’s broader direction for now.

On-Chain Data and Developments

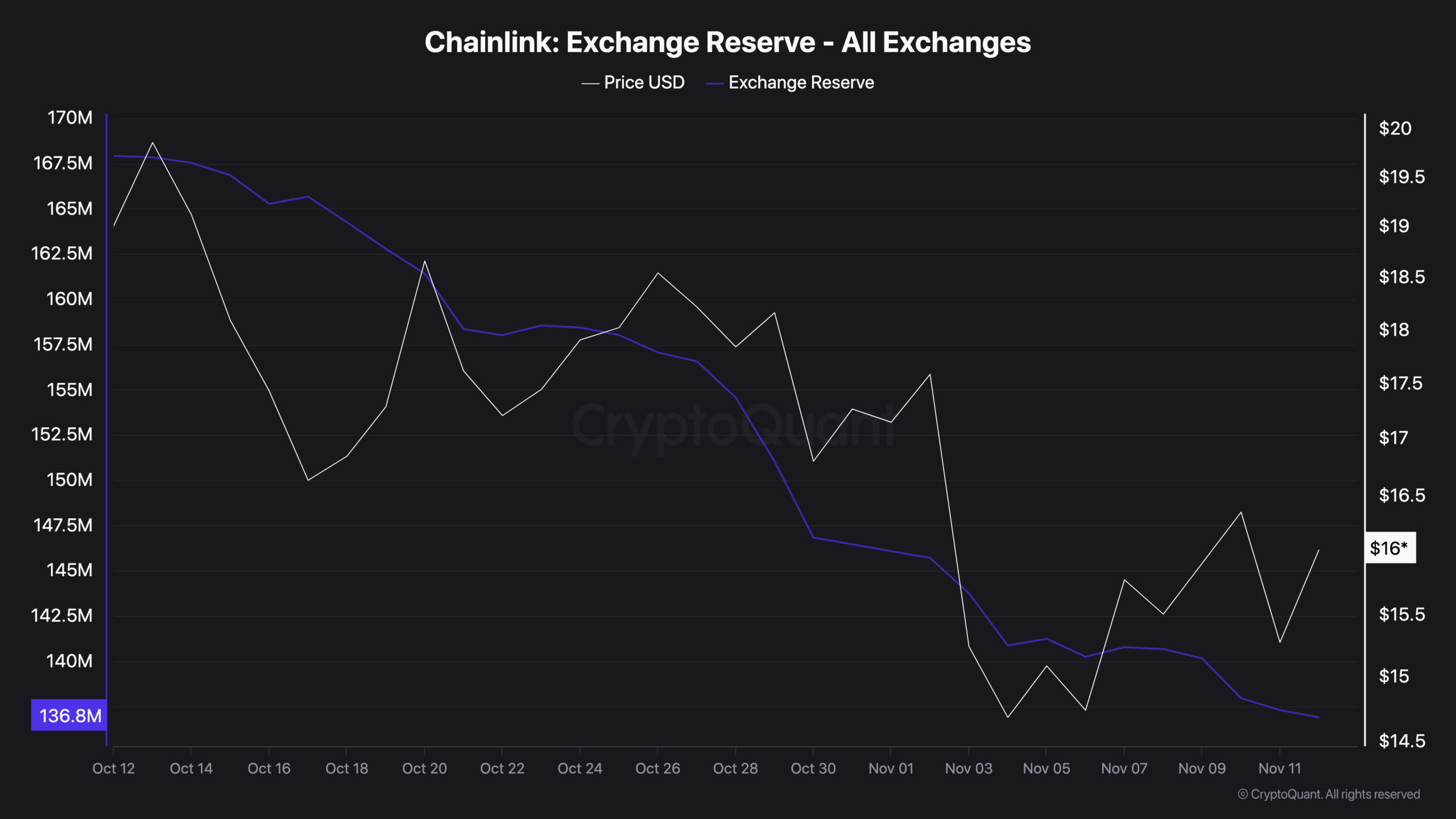

Data from CryptoQuant shows that LINK’s exchange reserves fell from around 167 million to 136.8 million tokens between October 12 and November 12. This reduction suggests many holders are moving tokens off exchanges, likely for storage or long-term positions.

Source: CryptoQuant

Source: CryptoQuant

This trend usually points to lower selling pressure. However, LINK’s price has not followed with a strong uptrend, indicating the market is still waiting for confirmation before reacting.

Meanwhile, Bitwise’s proposed spot Chainlink ETF (CLNK) is now listed on the DTCC’s pre-launch list. This follows its August registration with the SEC. As reported by CryptoPotato, the listing suggests the fund may be approaching launch.

Separately, Chainlink also began its Rewards Season 1 campaign. Eligible stakers can earn points from nine projects by allocating “Cubes” between November 11 and December 9. Token rewards will unlock from December 16 over a 90-day period.

The post Chainlink (LINK) Poised for Breakout From $13–$26 ‘No-Trade’ Zone appeared first on CryptoPotato.

You May Also Like

Wall Street Bets on XRP: Adoption-Driven Peak by 2026

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings