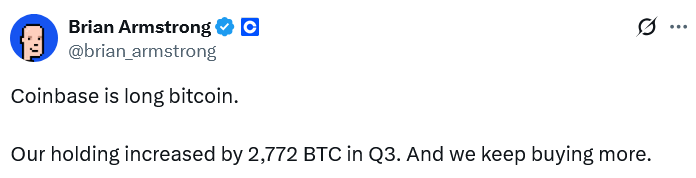

Coinbase Boosts Bitcoin Holdings by 2,772 BTC in Q3: Here’s What It Means

Coinbase has demonstrated a strong commitment to expanding its cryptocurrency holdings and diversified offerings in Q3, signaling its strategic move to position itself as an all-encompassing digital asset exchange. The company’s increased Bitcoin accumulation, combined with their efforts to broaden DeFi and tokenized asset services, indicates a continued focus on reinforcing its presence in the rapidly evolving crypto markets.

- Coinbase’s Bitcoin holdings increased by 2,772 BTC in Q3, now totaling 14,548 BTC valued at $1.57 billion.

- The platform’s Q3 financials showcase a net income of $432.6 million and total revenue reaching $1.9 billion, driven by transaction and subscription fees.

- Coinbase is actively building its “Everything Exchange” vision, including expanding tradable assets, derivatives, stablecoins, and tokenized stocks.

- Institutional activity remains robust, with Coinbase managing over $300 billion in assets under custody and 80% of trading volume coming from institutional clients.

- Activity on Coinbase’s Layer 2 Ethereum network, Base, is gaining traction with increased trading and new features like fast transaction preconfirmation.

Coinbase’s Bitcoin reserves grew by 2,772 BTC during the third quarter, reflecting its expanding focus on holding long-term digital assets. Currently, Coinbase’s Bitcoin holdings stand at approximately 14,548 BTC, worth around $1.57 billion, as reported in its latest quarterly earnings. The firm’s financial results also emphasize a dramatic rise in profitability, with net income soaring over five times year-on-year to $432.6 million and total revenue reaching $1.9 billion—a 55% increase from the previous year.

This growth was largely driven by transaction revenue, which hit $1.05 billion, and a 34.3% increase in subscription-based income, including stablecoin and blockchain rewards, totaling $746.7 million. Coinbase continues to diversify its offerings, aiming to become an “Everything Exchange,” with efforts to increase the number of tradable cryptocurrencies, expand derivatives trading, and establish new pillars like tokenized stocks and prediction markets.

Another key aspect of Coinbase’s strategic vision involves advancing stablecoin adoption via Circle’s USDC, alongside expanding into tokenized stocks, prediction markets, and creating an ecosystem for early-stage token sales. The market reacted positively to the news, with Coinbase shares rising nearly 3% in after-hours trading following a slight decline during regular trading hours.

Coinbase continues to chalk up institutional revenue

In Q3, Coinbase’s purchases of Bitcoin worth $299 million highlight its dedication to accumulating BTC as a core asset. The platform also maintains its role as a custodian for Wall Street asset managers offering Bitcoin exchange-traded funds (ETFs).

Source: Coinbase

Source: Coinbase

Institutional clients continue to dominate Coinbase’s trading volume, accounting for 80% of the $295 billion in activity during the third quarter. Its assets under custody surpassed $300 billion, setting another record high. Notably, Ethereum (ETH) trading volume on Coinbase is rising rapidly; ETH now makes up 22% of transaction volume, approaching Bitcoin’s 24%, a significant shift after ETH’s share lagged behind in previous quarters.

Adoption on Base continues to unfold

Efforts to expand activity on Coinbase’s Layer 2 Ethereum network, Base, are gaining momentum, with increases across trading, payments, lending, and social applications. The platform also introduced Flashblocks, a feature enabling transaction preconfirmation with 200-millisecond block times to improve scalability and user experience.

During the earnings call, Coinbase CEO Brian Armstrong avoided disclosing any definitive plans regarding a potential launch of a Base token, leaving the door open for future development within its evolving blockchain ecosystem.

This article was originally published as Coinbase Boosts Bitcoin Holdings by 2,772 BTC in Q3: Here’s What It Means on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?