Ethereum (ETH) Price: Whales Accumulate 218K ETH as U.S-China Tensions Ease

TLDR

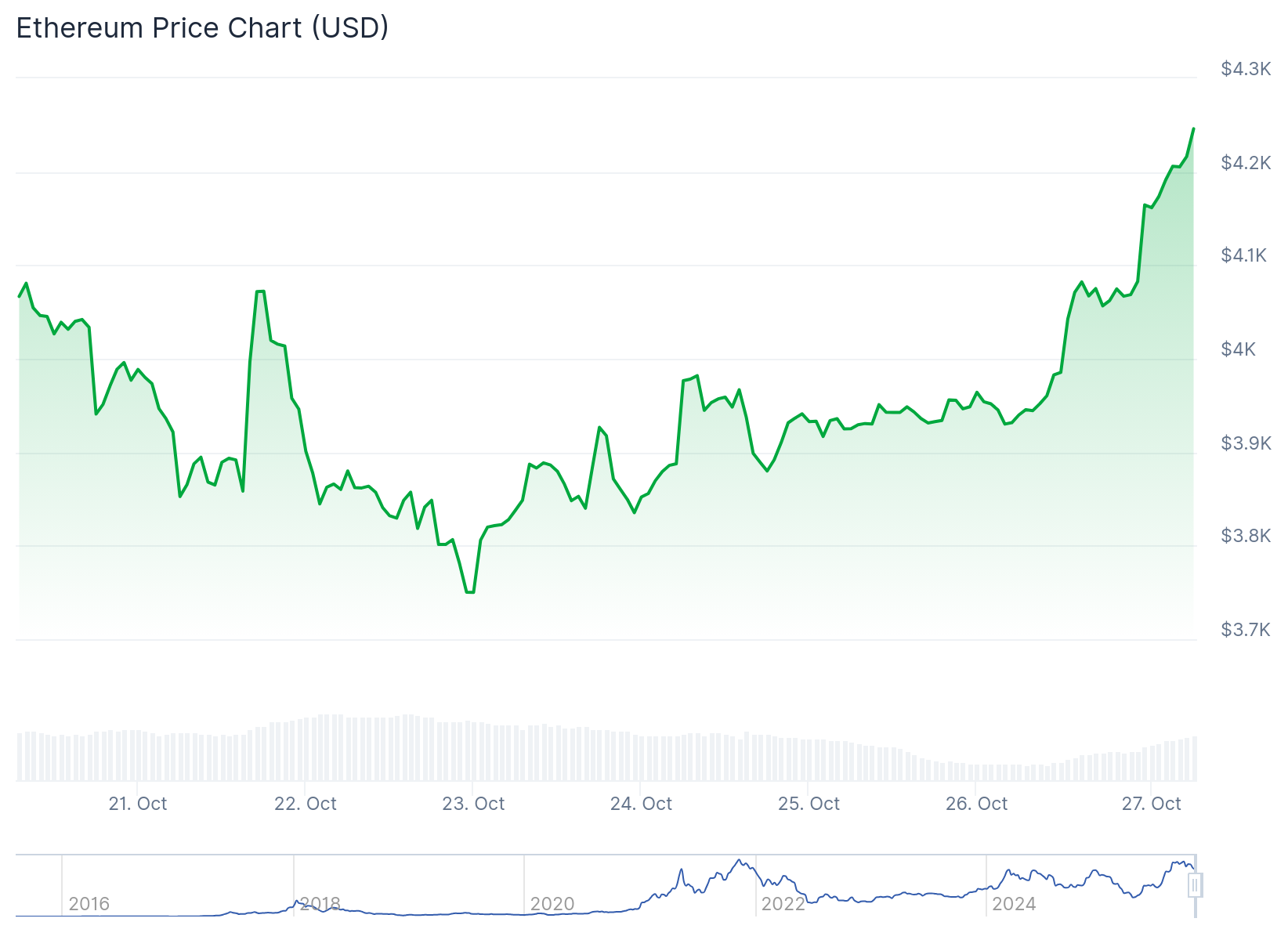

- Ethereum price recovered above $4,000 on October 26, rising 10% from its seven-day low of $3,811, driven by optimism around Trump’s Asia visit and upcoming trade talks with China’s Xi Jinping scheduled for October 30.

- Ethereum treasury firms now hold 3.2 million ETH (0.40% of total supply), surpassing Bitcoin corporate holdings of 0.36%, making ETH more attractive due to staking yields of 3-4% APY and reduced energy consumption.

- Bear traders deployed $650 million in short contracts around the $4,150 resistance level, with the long-to-short ratio falling to 0.82 as investors hedge against potential price reversals.

- Ethereum whales and sharks holding 100-10,000 ETH accumulated 218,470 ETH in the past week after dumping 1.36 million ETH between October 5-16 during the market downturn.

- ETH faces key resistance at $4,150 with lighter opposition until $4,240, while support sits near $3,911 where bulls have deployed $1.5 billion in long contracts.

Ethereum price climbed back above $4,000 on Sunday, October 26, reaching $4,099 after posting a 10% gain from its seven-day low of $3,811. The recovery came as Trump began his Asia visit, which started positively with a peace treaty signing between Cambodia and Thailand in Malaysia on Saturday.

Ethereum (ETH) Price

Ethereum (ETH) Price

The weekend gains reflected broader market strength. All top 10 cryptocurrencies, including Bitcoin, Solana, and XRP, posted consecutive green days over the weekend.

Market optimism centered on Trump’s upcoming trade talks with China’s Xi Jinping, scheduled for Friday, October 30 in Korea. The peace treaty signing eased geopolitical tensions ahead of the high-stakes meeting.

Ethereum stabilized near $4,077 at press time on Sunday after rejecting the $4,099 intraday peak. Trading volume jumped 54% in 24 hours while open interest increased by 5.88%.

Corporate Holdings Shift to Ethereum

Ethereum treasury firms maintained aggressive accumulation through October’s volatility. Publicly-listed companies holding ETH have now surpassed their Bitcoin counterparts in supply dominance.

Data from Artemis shows that digital asset treasury firms held 3.2 million ETH as of October 23. This represents 0.40% of total supply, exceeding Bitcoin’s corporate holdings of 640,040 BTC, which account for 0.36% of the 19 million BTC in circulation.

Tom Lee’s Bitmine led the corporate accumulation trend. The shift reflects growing demand for Ethereum treasury positions in 2025, boosted by the crypto regulatory framework and ETH ETF staking approval.

Ethereum’s Proof-of-Stake transition reduced energy consumption by 99% while introducing yield-bearing features. This combination makes ETH attractive to corporations with sustainable energy mandates.

Art Malkov, strategic advisor at Electroneum, explained that yield drives corporate decisions. ETH staking currently provides 3-4% APY, offering a revenue-generating alternative to cash reserves.

“Corporate treasuries are fiduciaries first,” Malkov said. “The green credentials primarily serve to satisfy ESG checkboxes that allow institutional entry.”

Bears Deploy $650M in Short Contracts

Despite the weekend rally, derivatives data shows bearish positioning. The long-to-short ratio fell to 0.82, indicating more short contracts opened than long ones.

Short contracts exceeding longs during a rally suggests investors are bracing for a potential reversal. Traders appear to be hedging against risks from Trump’s China meeting and the upcoming Federal Reserve rate decision.

Bears concentrated roughly $650 million in short contracts around the $4,150 level. This accounts for 76% of the $840 million in total short leverage deployed within 24 hours.

If Ethereum breaches $4,150, it faces lighter opposition until the $4,240 zone. Failure to break above $4,100 could trigger liquidations back toward support near $3,911, where bulls deployed approximately $1.5 billion in long contracts.

Whale wallets holding 100 to 10,000 ETH began rebuilding positions after dumping roughly 1.36 million ETH between October 5 and 16. These large holders accumulated 218,470 ETH in the past week, according to Santiment data.

The selling pressure between October 5-16 reflected clear risk-off behavior. Ethereum’s price dropped from highs around $4,740 on October 7 to as low as $3,680 on October 11 during this period.

Collective holdings of whale and shark addresses rebounded to approximately 23.05 million ETH after bottoming out in mid-October. This represents roughly one-sixth of the coins previously sold.

Institutional inflows into Spot Ethereum ETFs have returned. The accumulation reduces circulating supply available on exchanges and lowers selling pressure heading into November.

The post Ethereum (ETH) Price: Whales Accumulate 218K ETH as U.S-China Tensions Ease appeared first on CoinCentral.

You May Also Like

Cardano Eyes $1.50, While $0.0058 Layer Brett Targets $1 in 2025

Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves