Ethereum Founder Vitalik Defends Coinbase’s New Blockchain Amid Controversy – What’s Going On?

Ethereum co-founder Vitalik Buterin defended Coinbase’s Base blockchain against criticism, emphasizing that Layer 2 solutions provide genuine security guarantees through Ethereum’s base layer rather than operating as “glorified servers.”

His comments addressed growing confusion about L2Beat’s role as a security assessment platform and misconceptions about Layer 2 custody models.

Buterin clarified that Base maintains non-custodial properties where users retain ultimate control over their funds through smart contract logic on Ethereum’s main chain.

The defense came amid broader discussions about Ethereum’s economic sustainability and infrastructure development ahead of the December 3 Fusaka upgrade.

The intervention occurred as Layer 2 networks face scrutiny over centralized features while providing enhanced user experiences.

Recent incidents, including Sony’s Soneium censorship attempts and the dYdX v3 shutdown, have highlighted both the risks and protective mechanisms built into modern L2 architectures.

Meanwhile, Ethereum’s on-chain revenue fell 44% to $14.1 million in August despite ETH reaching new highs, which has raised questions about the network’s long-term economic model as Layer 2 adoption reduces base layer fee generation.

Real-World Proof: When Layer 2 Security Actually Works

The dYdX v3 shutdown provided concrete evidence of Layer 2 escape mechanisms functioning as designed.

When the decentralized exchange ceased operations, users accessed over $70 million in trapped funds through StarkEx’s built-in “Escape Hatch” system, with $30 million successfully withdrawn using L2Beat’s open-source interface.

The escape process required users to submit three Ethereum transactions, each accompanied by a Merkle proof verifying their asset state.

While technically complex, the mechanism operated without requiring permission from dYdX operators, validating Buterin’s claims about Layer 2 non-custodial properties.

Similarly, Sony’s Soneium network showed censorship resistance when the company attempted to block “unapproved” tokens at the RPC level.

A developer bypassed the sequencer entirely by forcing transactions through Ethereum’s main chain, proving that OP Stack architecture prevents permanent censorship, regardless of operator intentions.

The incident destroyed early token positions worth thousands of dollars before the workaround emerged.

However, the successful bypass validated OP Stack’s design philosophy that forces all Layer 2 networks to inherit Ethereum’s core security properties, including transaction finality guarantees.

These real-world examples support Buterin’s argument that Layer 2 solutions represent genuine extensions of Ethereum rather than independent systems with custody risks.

The concrete pathways implemented in smart contract logic have proven functional under stress conditions, including operator shutdowns and attempts at censorship.

Ethereum Seeks Sustainable Revenue Beyond Speculation

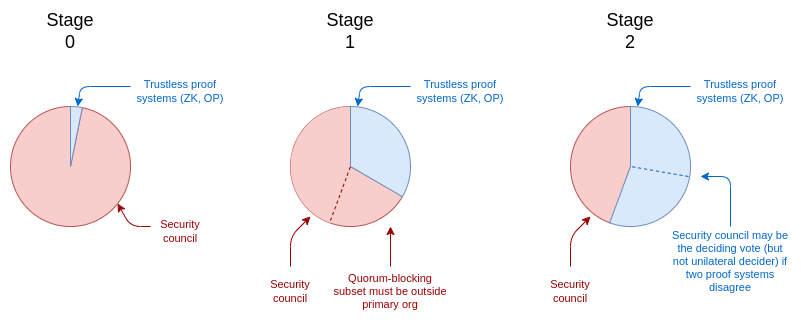

Notably, Buterin also highlighted L2 security, and his mathematical framework for Layer 2 security stages reveals why gradual progression from centralized control to full decentralization makes sense.

His analysis shows that Stage 1 rollups with 75% security council override requirements provide optimal security when proof systems remain unproven.

However, Stage 2 systems should only be activated once sufficient mathematical confidence in the underlying cryptographic systems is achieved.

Source: Vitalik’s Blog Post

Source: Vitalik’s Blog Post

The security council model requires quorum-blocking minorities outside primary organizations to prevent unilateral censorship or fund theft.

This distributed governance approach strikes a balance between innovation speed and user protection during the maturation process of complex cryptographic systems.

The Fusaka upgrade scheduled for December 3 supports this evolution through infrastructure improvements that enhance both Layer 2 capabilities and mainnet sustainability.

Blob capacity expansions and PeerDAS implementation will reduce costs for rollups while maintaining security guarantees that distinguish Ethereum from competitors offering less rigorous decentralization paths.

Growing development efforts focus on improving Ethereum’s foundation for low-risk applications that Buterin envisions as the network’s economic future.

These initiatives aim to create sustainable revenue streams that support innovation without relying on speculative trading or compromising the principles that make Ethereum a valuable decentralized platform.

Furthermore, Buterin recently proposed low-risk DeFi protocols as Ethereum’s potential revenue anchor, comparing the model to Google Search’s role in funding broader company operations.

He argued that protocols offering stable yields around 5% on blue-chip stablecoins could provide economic sustainability without compromising the network’s ethical foundations.

The proposal addresses Ethereum’s economic challenges as Layer 2 adoption reduces base layer revenues.

August’s 44% revenue decline to $14.1 million occurred despite ETH hitting new highs, which has now put more pressure on the tension between scaling success and mainnet profitability.

You May Also Like

BitGo expands its presence in Europe

Top political stories of 2025: The Villar family’s business and political setbacks