Holography in Cuprates: Critical Review of Quantitative Claims

Table of Links

- Prologue

- Diagrammatic(s) Rules

- Straight-forward Eikonal

- Legacy Bosonization

- Wonton Holography

- Holographic Propagators

- Strange Cuprates

- Stranger Things

- Epilogue

Strange Cuprates

The theories of both, finite- and zero-density, spinons have been extensively discussed in the context of the ’strange metal’ phase in the underdoped cuprates and other (arguably, even stranger) heavy-fermion compounds long before the advent of holography [3]. Once there, the applied holography quickly joined the quest into the properties of this phase that had long evaded a consistent and satisfactory explanation.

\ Instead of going after the NFL fermion propagator, however, many of the holographic proposals focused on reproducing the experimental data in the cuprates - and often times even claimed achieving a quantitative agreement.

\ In light of its intrinsically unsettled status one would have thought that it might be rather detrimental for any speculative approach to seek out not a mere qualitative but an actual quantitative, down to the number, agreement between its specific predictions and some preselected sets of experimental data. In fact, if such a quantitative agreement were indeed achieved one would have even more explaining to do (first and foremost, as to why an apriori approximate approach appears to be so unexpectedly accurate?).

\ The earlier discussion of some of the popular evidence in support of condensed matter holography as well as the debunking of a number of its specific predictions [26] can be found in [34]. However, the admirable persistence with which those predictions continued to be regularly cited in the subsequent holographic literature [35] suggests that the comments of [34] might have had been (most regretfully) overlooked.

\ In fact, there is more than a single reason for which semiclassical holography (or its improvement at the level of accounting for the matter back-reaction in the HartreeFock approximation) - thus far, the only practical way of performing the holographic calculations [26–29] - would not have been expected to provide any quantitatively accurate results in the first place. There are, of course, such obvious differences from the string-theoretical holographic constructions as a low physical value of N (which, in practice, often amounts to ’spin up/down’) and the lack of Lorentz, translational, and/or rotational (as well as any super-)symmetries.

\ Arguably, though, the most important is the fact that much of the condensed matter physics operates in the intermediate - as opposed to ultra-strong - interaction regime, while it is only the latter that is supposed to have a weakly coupled gravity as its bulk dual [26]. Indeed, most solids form under the condition that its potential (interaction) and kinetic energies on average balance each other out. This suggests that the ’bona fide’ strong-coupling regime could only become attainable in some sort of a ’flat band’ scenario where kinetic energy is completely quenched or, at least, significantly diminished.

\ In light of that, it is unsurprising that much of the recent effort towards implementing such mechanism has been centered on the SYK model and its variants [31] whose ’flat band’ nature facilitates the existence of a holographic dual. A viable candidate to this role was proposed in the form of the Jackiw-Teitelboim (JT) dilatonenhanced 1 + 1-dimensional gravity [31].

\ It is worth pointing out, though, that at the practical level all the holographic matching between the SYK and JT theories has been, so far, established within their low-energy sectors that are both controlled by a single soft Schwarzian mode (’boundary graviton’). So as far as the low-energy properties of the two models are concerned, they both allow for the same (effectively 0 + 1- dimensional) description in terms of either a fluctuating 1d boundary or Liouvillian-type large-N matrix quantum mechanics [31, 36]. This is not surprising given the intrinsically non-dynamical nature of 2d (and 3d) pure gravity. Such a caveat notwithstanding, the low-energy SYK-JT equivalence has been repeatedly and staunchly referred to as a genuine example of holographic correspondence between the 1+1-dimensional bulk and 0+1-dimensional boundary theories [31].

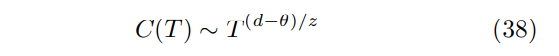

\ As to the general HV models (22) and corresponding vacuum metrics (26), the standard list of observables to be matched includes temperature-dependent specific heat

\

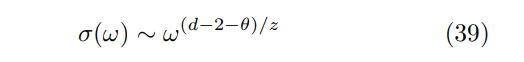

\ and frequency-dependent optical conductivity

\

\ determined by the bare scaling dimensions.

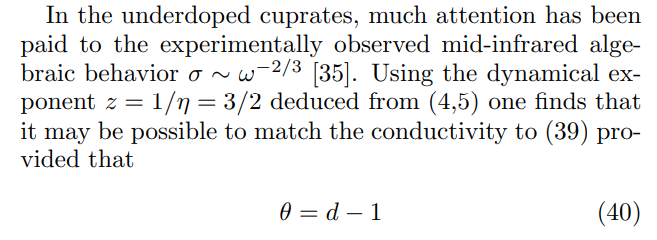

\

\ Incidentally, this value of the HV parameter was previously singled out on the basis of analyzing entanglement entropy [28]. Besides, it suggests the interpretation of d − θ as an effective number of dimensions orthogonal to the FS.

\ The other frequently invoked relation [26, 28, 29] is

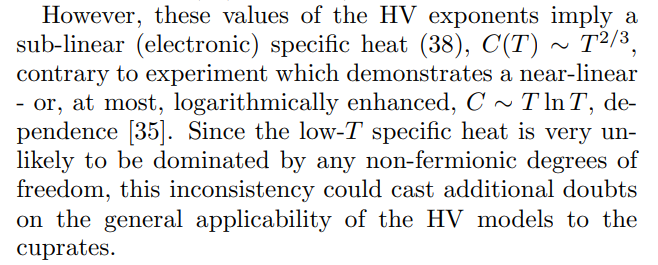

\

\ in which case the first inequality in (27) is marginally satisfied as equality. Notably, in 2d it would only be consistent with (40) for z = 3/2.

\

\ Also, from the beginning of the cuprates saga an even greater fixation has always been on the linear-T dependence of resistivity, also observed in a variety of other materials [35]. Of course, the conductivity scaling with frequency (39) does not readily translate into its temperature dependence, as it would be determined by a specific mechanism of momentum relaxation (i.e., Umklapp, phonons, and/or disorder).

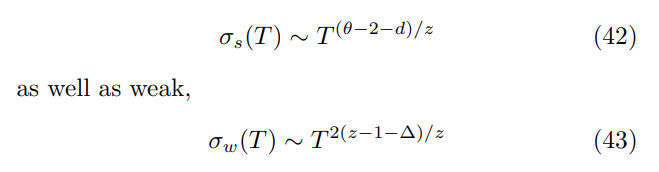

\ To this end, the use of the memory matrix technique yielded a proper conductivity scaling [26, 35] in both limits of strong,

\

\ momentum-non-conserving scattering where ∆ is the dimension of the leading translation invariance-breaking 8 operator. The formulas (42) and (43) agree for ∆ = z + (d − θ)/2 which condition coincides with that of marginal fulfillment of the Harris criterion for the disorder scattering to become a relevant perturbation.

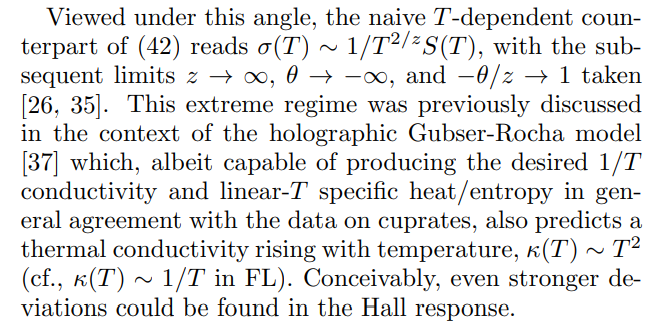

\ An alternate interpretation of the linear-T resistivity, σ(T ) ∼ 1/T , proposed in [26, 35] relates it to the FL-like entropy, S(T ) ∼ C(T ) ∼ T . This school of thought introduces the notion of inelastic ’Planckian’ scattering rate as a potentially single most important scale for thermalization/equilibration/information scrambling (albeit not a rate of momentum relaxation) in strongly interacting systems

\

\ Interestingly, it is the (admittedly, unphysical) model of [38] that so far has managed to reproduce a longer list of the power-law dependencies found in the cuprates, as compared to the competing schemes [39]. Unfortunately, such a serendipitous success does not offer any immediate insight into the underlying mechanism of the NFL behavior in the cuprates.

\ Furthermore, contrasting the large-r and -τ asymptotics (31) of the HV holographic propagators against their eikonal/bosonization counterparts in search of some agreement suggests finite positive values of θ, contrary to the ’Planckian’ scenario. This observation might further reduce the chances of constructing a consistent HV holographic model of the strange metal phase in the cuprates.

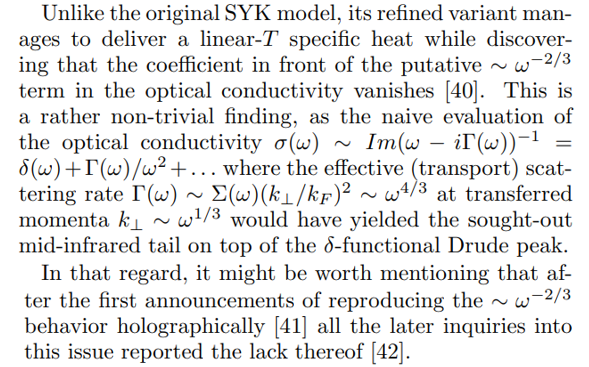

\ In part, the deficiencies of the HV-based approach have been circumvented by the arrival of the ’second SYK wave’ [40] which utilizes the Hamiltonian obtained from the conventional combination of a kinetic (quadratic) and interaction (quartic) terms by randomizing the amplitudes of either one or both of these terms a la SY K. Making such randomization spatially non-uniform one opens a channel for non-conservation of momentum which then gives rise to the linear-T ’Planckian’ rate (on top of a constant).

\

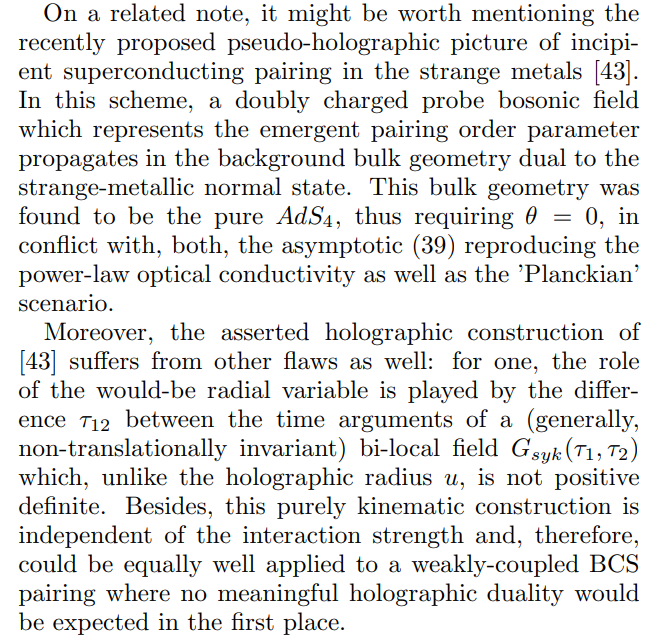

\ Of course, the very existence of different explanations (cf., for example, [35, 39] and [40]) for certain scaling laws observed in the cuprates may suggest that their ultimate interpretation is yet to be found. It would be, therefore, imperative to strive to extend the list of matching properties, akin to [38, 39] as the means of discriminating between the competing schemes.

\

\

:::info Author:

(1) D. V. Khveshchenko, Department of Physics and Astronomy, University of North Carolina, Chapel Hill, NC 27599.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

Unprecedented Surge: Gold Price Hits Astounding New Record High

USD/CNH stays below 7.0000 – BBH