Michael Saylor Announces 10.5% STRC Monthly Dividends

Michael Saylor-led Bitcoin-focused firm Strategy has announced a 10.5% monthly dividend on its STRC stock, signaling confidence in its Bitcoin-backed financial structure. The move follows a positive Q3 report, where the company declared $3.9 billion in profits, a massive improvement from $432.6 million in losses recorded in Q3 2024.

The 10.5% dividend marks a 0.5% increase from last month’s 10.25% payout. During an interview with Mark Moss, CEO of Satsuma Technology Plc, a UK-based crypto and decentralized AI firm, in October, Saylor explained that STRC, MicroStrategy’s perpetual preferred stock is overcollateralized by its historical Bitcoin profits, to eliminate downside volatility.

The increase in dividend yield signals a more aggressive push to raise funds for more BTC purchase. Strategy currently sits on a total holdings of 640,808 BTC, with unrealized gains of $23.2 billion, according to SaylorTracker.com

Bitcoin Treasury Firms Shed $20B as Bitcoin Price Tumbles 8% in October

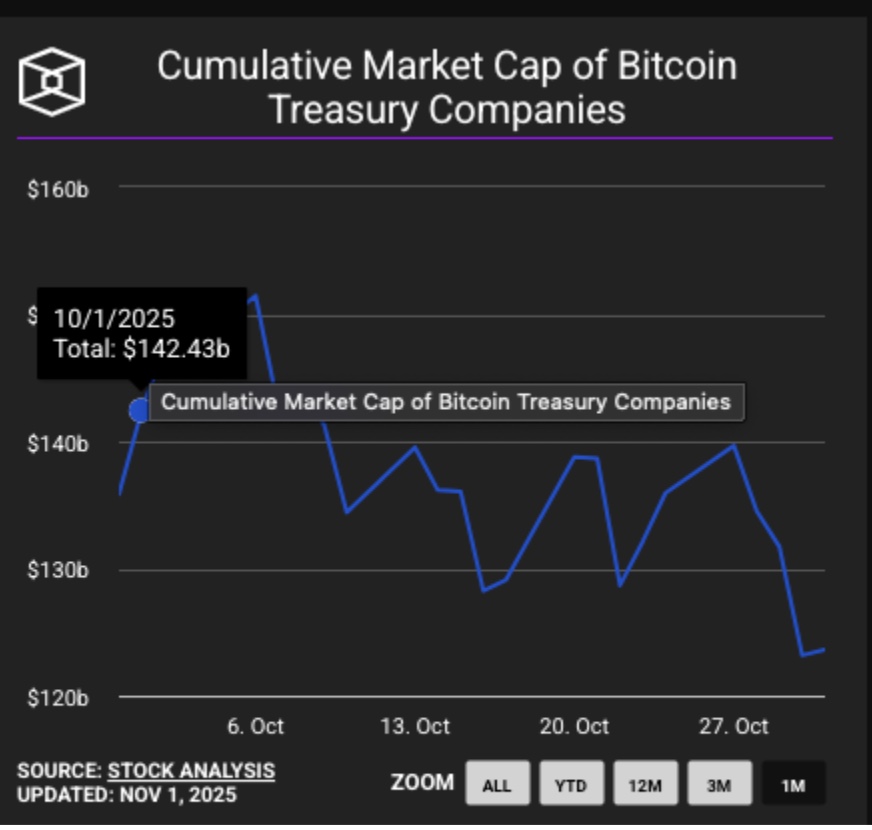

Bitcoin’s October close around $110,150 marked an 8% decline for the month, sparking a sharp selloff across Bitcoin treasury firms. Real-time data from The Block shows the aggregate market capitalization of publicly listed Bitcoin treasuries fell from $142.4 billion on October 1 to $123.6 billion by October 31, a staggering $18.8 billion haircut, representing a 13% decline, nearly double the drop in Bitcoin’s own price.

Bitcoin Treasury firms aggregate market capitalization declines $18.8 billion (13%) in October, 2025 | Source: TheBlock

This depicts heightened traditional investors’ remaining sensitivity to Bitcoin’s volatility. Crypto-exposed stocks like Marathon Digital, Galaxy Digital, and Strategy all experienced double-digit stock declines for October.

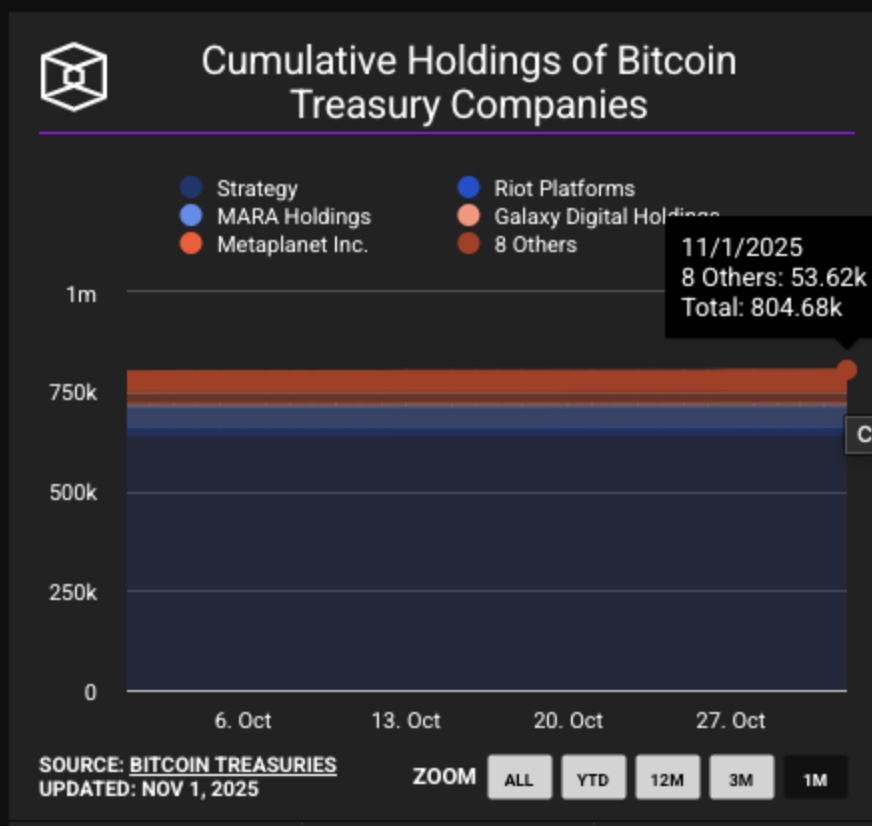

Total BTC held by Bitcoin treasury firms increased by 3970 BTC ($437.8 million) in October 2025 | Source: TheBlock

Yet, the stock price downturn did not deter the buying frenzy. The total Bitcoin held by treasury firms increased from 800,710 BTC to 804,680 BTC, representing a rise of 3,970 BTC, worth approximately $437.8 million at the October closing price.

This countercyclical buying pattern reinforces institutional confidence in Bitcoin as a strategic treasury asset, despite frugal Fed talk and geopolitically-charged crypto derivatives market turbulence in October.

Looking ahead, market-leader Strategy’s aggressive intent to raise liquidity for additional Bitcoin purchases could spur fresh entrants to keep up demand in November.

Early Investors in Profit as Best Wallet Presale Approaches $17M

Best Wallet (BEST) is a custodial crypto wallet designed to integrate multi-chain support and institutional-grade multi-signature protection.

With AI-powered features, the project is positioned to disrupt the $26 billion custodial wallet market.

Best Wallet Presale

The Best Wallet presale has now surpassed $16.8 million, marking one of the strongest early-stage fundraising cycles in 2025. Tokens are currently priced at $0.026. Interested participants can access exclusive presale bonuses through the official Best Wallet website.

nextThe post Michael Saylor Announces 10.5% STRC Monthly Dividends appeared first on Coinspeaker.

You May Also Like

Zero Knowledge Proof Auction Limits Large Buyers to $50K: Experts Forecast 200x to 10,000x ROI

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!