Michael Saylor’s Strategy Adds $836M in Bitcoin Despite Market Volatility

Highlights:

- Michael Saylor’s Strategy added $836M in Bitcoin, extending its streak of acquisitions.

- Strategy now holds 649,870 BTC, valued at $48.37 billion at an average price of $74,433.

- The company raised funds for the purchase through preferred stock issuance, avoiding common share sales.

The prominent corporate Bitcoin holder, Strategy, made another major acquisition last week. The company added 8,178 more BTC to its collection for $835.6 million at an average price of $102,171 per coin. The total Bitcoin holdings of the company grew to 649,870 BTC, valued at $48.37 billion, for an average price of $74,433 per coin following this latest purchase.

This acquisition happened at a time when the cryptocurrency market was undergoing significant volatility. The price of Bitcoin has recently declined from highs of $107,000 to $93,000. As of this writing, BTC is trading around $93,619, down by almost 1% over the last 24 hours. Despite these fluctuations, Strategy has continued, showing its confidence in Bitcoin as a store of value.

Strategy used its preferred stock issue to fund this bitcoin purchase instead of relying on the sale of common shares. The company raised $704 million through its STRE (Steam) offering and another 136.1 million from its sales of STRC, STRF, and STRK preferred stocks. This strategy gave the firm the ability to avoid diluting current shareholders through the issuance of more common stock, which would have been detrimental to the current performance of MSTR stock.

Strategy Remains Confident Amid Stock Price Pressure

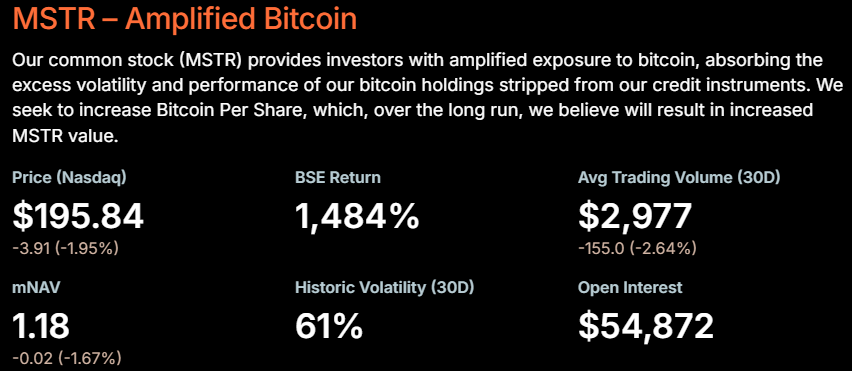

Strategy adding $836M in Bitcoin coincides with the sustained pressure on the company’s stock price. MSTR stock has declined sharply and has lost more than 30% of its value over recent months. Currently, MSTR stock is trading at around $195, a drop of 1.45% since the previous close.

In addition, the purchase occurred as the firm saw its market Net Asset Value (mNAV) decline over the last few months. Its mNAV has plummeted to 0.94 compared to the year-to-date high of more than 3. However, the metric has recovered to 1.18 as of this writing.

Source: Strategy

Source: Strategy

However, Michael Saylor and his team have reaffirmed their commitment to Bitcoin. The company has been purchasing Bitcoin on a daily basis regardless of the market fluctuations. Recently, Saylor refuted claims that the company was selling its Bitcoin during the price drop, noting that the company has been steadily buying additional BTC.

Bitcoin Strategy Continues Despite Market Skepticism

Peter Schiff, a renowned Bitcoin skeptic, recently raised questions about the strategy used by Michael Saylor. Schiff denounced the financial framework of Strategy, labeling it a fraud. According to him, the company will find itself in financial instability due to its overdependence on high-yield preferred shares. As Schiff points out, the business model of the company has the potential to create a death spiral in case investors lose their confidence and offload their holdings within the preferred shares.

Even with these criticisms, Strategy stands firm in its belief that Bitcoin is a valuable asset. The firm has amassed Bitcoin over the years, including in both bull and bear market cycles.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Why Are Disaster Recovery Services Essential for SMBs?