Pleasing International Launches RWA Platform “Pleasing Golden,” Introducing Tokenized Gold (PGOLD) and Synthetic Dollar (PUSD)

The post Pleasing International Launches RWA Platform “Pleasing Golden,” Introducing Tokenized Gold (PGOLD) and Synthetic Dollar (PUSD) appeared first on Coinpedia Fintech News

Pleasing International, a licensed precious-metals enterprise based in Hong Kong, is working with LayerZero and Chainlink to launch Pleasing Golden, an RWA platform redefining how precious metals are traded, invested, and settled on-chain.

Starting with deployments on Arbitrum and ApeChain, Pleasing Golden bridges traditional commodities with blockchain technology, creating a transparent, efficient, and inclusive market for both institutional and retail participants.

Empowering a Frictionless Precious Metals Economy

Pleasing Golden’s vision is to make gold ownership open, liquid, and collaborative. Through tokenization and a suite of liquidity-sharing programs—including DeFi liquidity leasing and Tokenization-as-a-Service—the brand transforms slow, closed markets into dynamic, programmable assets that can circulate instantly among builders, traders, and holders.

For years, Pleasing International has been a cornerstone of Asia’s physical gold market. Now, through Pleasing Golden, that expertise moves on-chain—delivering institutional-grade metals trading with real-time transparency, shared liquidity, and community participation accessible to anyone, anywhere.

Pleasing Gold (PGOLD): A Digital Token Fully Backed by Physical Gold

PGOLD is the flagship token of Pleasing Golden, each representing one troy ounce of LBMA-certified physical gold. Since 2023, Pleasing International has built an integrated ecosystem of vaulting, refining, logistics, and distribution, partnering with leading operators across the APAC region.

Unlike traditional gold-backed products, PGOLD brings physical ownership on-chain, powered by LayerZero’s omnichain framework for cross-chain interoperability. Holders can acquire PGOLD through a Chainlink-powered spot market (public launch in late Q4) or by trading directly on decentralized exchanges.

Each PGOLD token provides verifiable ownership of real gold while enabling holders to share in:

- Warehouse and redemption fees from physical operations

- Institutional turnover revenues from B2B circulation

- On-chain trading fees from liquidity pools

The instant settlement between PGOLD and PUSD lets users switch seamlessly between gold and dollar exposure—eliminating traditional delays and unlocking real-time capital efficiency across global markets.

Strategic Advantage: The Gold Corridor Connecting Asia and the Middle East

While most gold-backed tokens originate in Western markets, global demand for physical gold is increasingly shifting east. A major opportunity lies in creating a compliant and efficient gold-token bridge between Asia and the Middle East—the world’s two most active bullion centers.

Headquartered in Hong Kong and connected through established networks across Dubai and the broader APAC region, Pleasing Golden sits at the heart of this emerging Gold Corridor. PGOLD is designed to power this next era of digitized real-world gold through:

- Direct physical ownership: each PGOLD represents 1 oz of LBMA-certified gold securely stored in institutional vaults.

- Unlimited physical redemption: holders can redeem PGOLD for allocated bars of nearly any size in Hong Kong, with expansion planned across greater APAC and Dubai.

- Fractional access and 24/7 liquidity: trade gold globally from as little as 0.01 oz, powered by Chainlink data and infrastructure.

- Instant settlement: PGOLD can be converted into stablecoins in real time, providing seamless transitions between gold and stable exposure.

- Transparent reserves: real-time proof-of-reserve, independent verification, and institutional-grade custody.

By connecting regulated bullion markets with blockchain networks, PGOLD transforms gold—long seen as a static, siloed asset—into a globally programmable store of value for institutional finance and the next generation of digital-native users.

Pleasing USD (PUSD): A Synthetic Dollar Financing the Precious Metals Economy

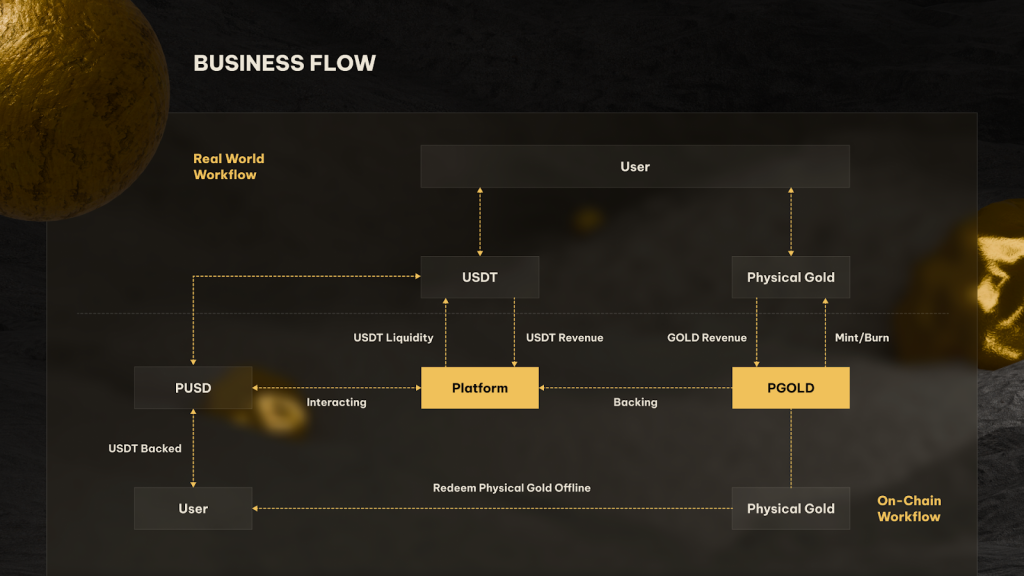

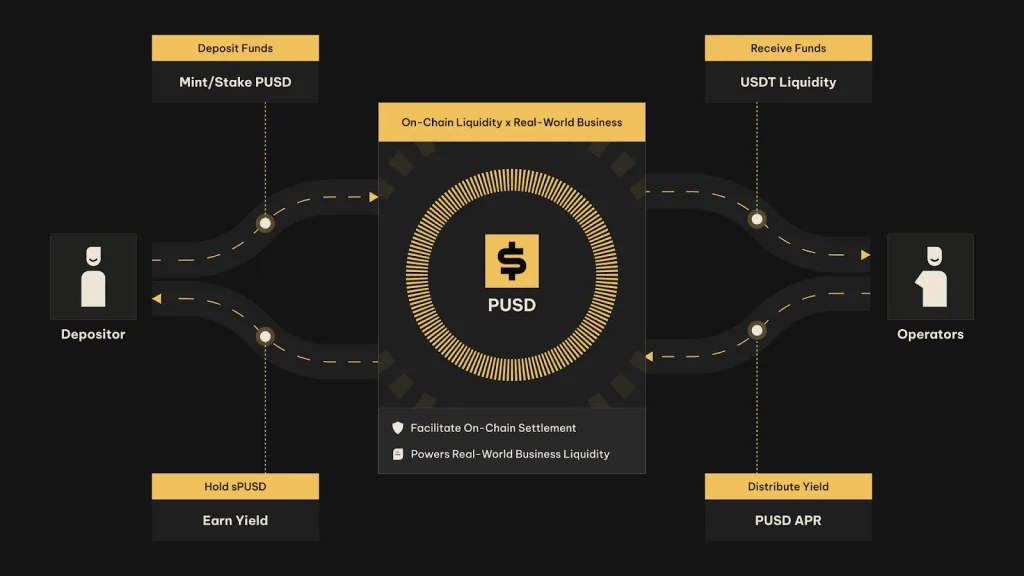

PUSD is Pleasing Golden’s synthetic stablecoin connecting on-chain liquidity with the physical gold ecosystem. Backed by a hybrid reserve of USDT collateral and tokenized metal exposure, PUSD enables real-time financing and settlement throughout the network.

The model connects:

- Depositors — deposit USDT, receive PUSD, and stake it into sPUSD for yield.

- Investors — traders or asset managers seeking stable liquidity with gold-linked returns.

- Operators — metals participants using PUSD to unlock working capital and accelerate settlement.

The PGOLD PUSD loop allows 24/7 convertibility, enabling instant movement between stable and metal-backed value—reducing settlement times from days to seconds. PUSD is fully redeemable for USDT at any time, ensuring stability and flexibility while maintaining a direct bridge between blockchain liquidity and real-world assets.

PUSD loop allows 24/7 convertibility, enabling instant movement between stable and metal-backed value—reducing settlement times from days to seconds. PUSD is fully redeemable for USDT at any time, ensuring stability and flexibility while maintaining a direct bridge between blockchain liquidity and real-world assets.

Together, PGOLD and PUSD form a real-time financial rail where gold and dollar liquidity coexist—powering a new cross-regional economy spanning Asia and the Middle East.

From Web2 Leadership to Web3 Innovation

With Pleasing Golden, Pleasing International evolves from a traditional metals leader into a Web3 innovator shaping the future of real-world assets. By combining trusted infrastructure with decentralized technology, the company enables anyone to trade, invest, and earn from gold—anytime, anywhere.

The synergy between PGOLD and PUSD delivers what legacy systems never could: instant settlement, shared liquidity, and borderless participation in real value.

About Pleasing Golden

Pleasing Golden is an RWA platform that transforms precious metals into liquid, yield-generating tokens accessible to anyone, anywhere.

- Website: https://www.pleasinggold.com/

- Whitepaper: https://pleasing.gitbook.io/docs

- X (previously Twitter): https://x.com/PleasingGolden

You May Also Like

A whale that made a 141% profit on PUMP three days ago bought 321 million TRUMPs today, with a floating profit of $223,000.

Tokenized Assets Shift From Wrappers to Building Blocks in DeFi