SUI Price: Shorts Pile On as Token Tests Key Support Level. What’s Next?

TLDR

- SUI dropped 9% to $3.34 and retested support at $3.29 amid broader market weakness

- Shorts dominated with nearly $31 million in leverage, creating strong bearish pressure

- Network achieved record 1,632 TPS and $143 billion cumulative DEX trading volume

- Bulls targeting $4.33 (27% upside) if support holds, bears eye $2.80 if breakdown occurs

- Exchange outflows of $25 million suggest possible accumulation by larger players

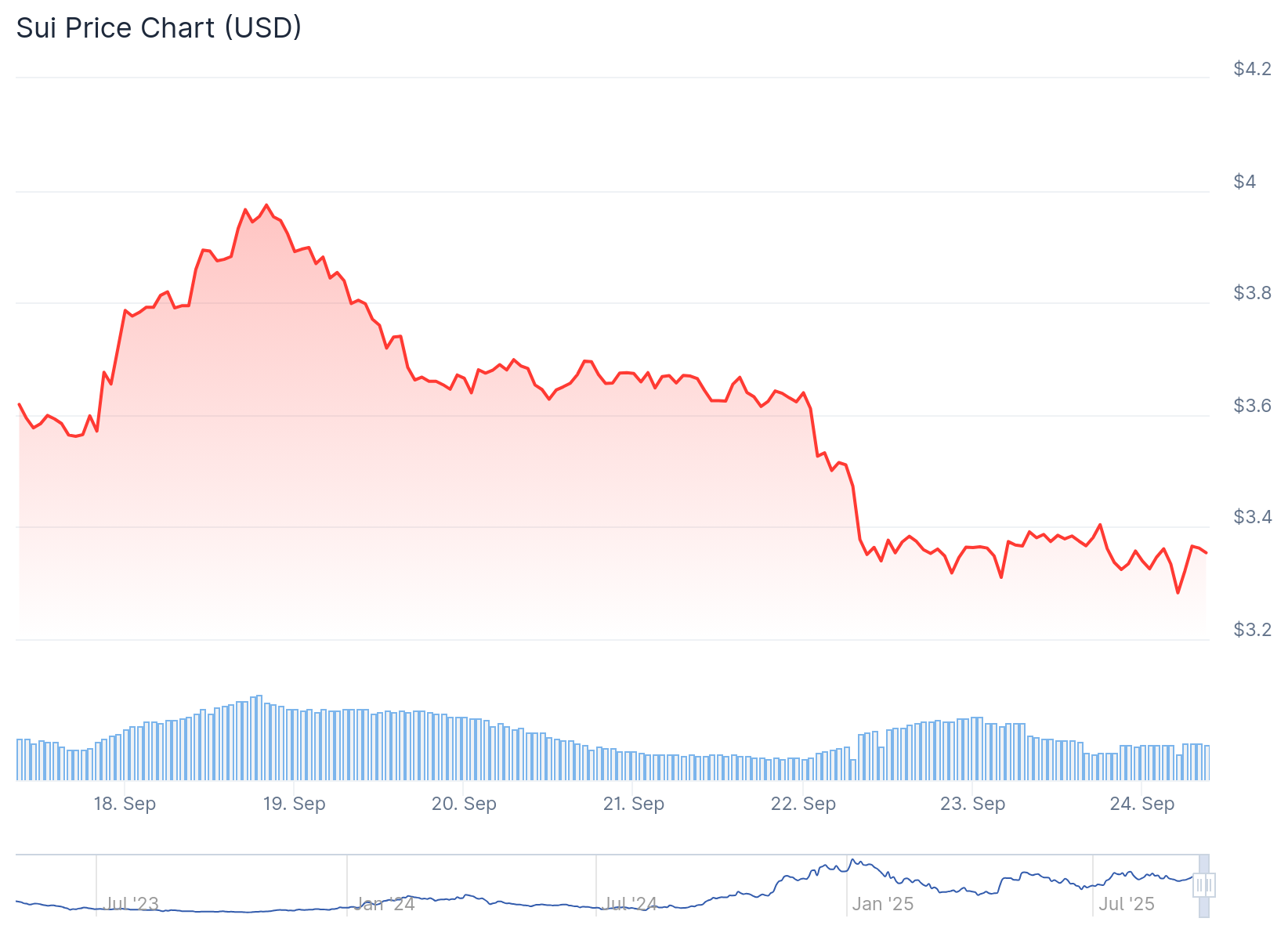

SUI has faced selling pressure in recent trading sessions, falling 9% to approximately $3.34. The token retested its support level at $3.29, a price point that has previously served as a launching pad for rebounds.

SUI Price

SUI Price

Short positions have accumulated rapidly, with nearly $31 million in leverage added to bearish trades. This surge in short interest reflects growing pessimism among traders about SUI’s near-term prospects.

The broader cryptocurrency market contributed to SUI’s decline. Bitcoin dropped almost 3% while Ethereum lost nearly 7%, creating downward pressure across altcoins.

Technical Outlook and Key Levels

SUI has now tested its rising trendline from April 2025 for the third time. Historical patterns suggest that previous bounces from this level led to strong rallies. If the support holds again, bulls could target a 27% move toward $4.33.

Source: TradingView

Source: TradingView

The token also touched the lower band of its Bollinger Bands on the daily timeframe. Since June, each touch of this level has been followed by a price reversal. However, the Average Directional Index sits at just 14.65, indicating weak trend strength.

A breakdown below current support could send SUI toward $2.80, representing approximately 16% downside from current levels. Key liquidation levels cluster between $3.29 and $3.70, keeping short-term sentiment fragile.

Long positions worth $3.66 million were liquidated during the recent decline. This compares to the much larger short position buildup, highlighting the bearish tilt in trader positioning.

Network Fundamentals Remain Strong

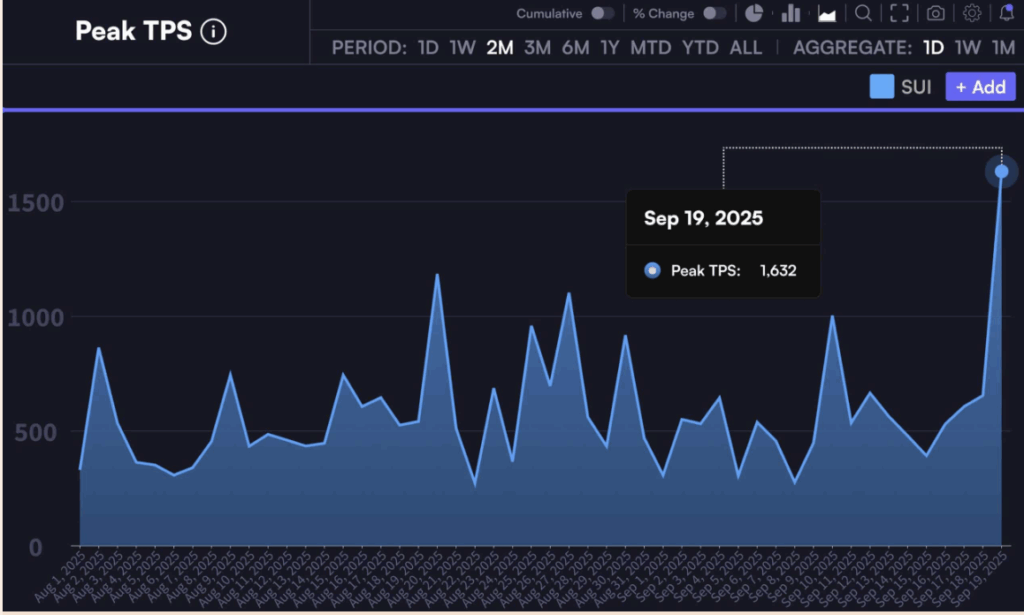

Despite price weakness, SUI’s underlying network metrics continue to improve. The blockchain achieved a record 1,632 transactions per second last week, demonstrating its capacity to handle high throughput.

Source: Coinglass

Source: Coinglass

Cumulative decentralized exchange trading volume on SUI reached $143 billion, marking another all-time high. This growth in on-chain activity suggests continued user adoption and network utilization.

Exchange flow data provides some optimism for SUI holders. Nearly $25 million flowed out of exchanges on September 22, according to CoinGlass data. Such outflows typically indicate accumulation behavior by larger investors.

The contrast between strong fundamentals and weak price action creates an interesting dynamic. Network growth continues while trader sentiment remains bearish in the short term.

Trading volumes have remained steady, indicating sustained market engagement despite the price decline. This suggests that while sentiment is negative, interest in the token persists among market participants.

SUI was trading at approximately $3.53 at press time, down 3.90% in the last 24 hours according to recent market data.

The post SUI Price: Shorts Pile On as Token Tests Key Support Level. What’s Next? appeared first on CoinCentral.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

CME Group to Launch Solana and XRP Futures Options