The New Monetizing Playbook: A Product Leader's Framework for Pricing GenAI Capabilities

Rudrendu Paul, Apratim Mukherjee, and Sourav Nandy co-authored this article.

The first question product leaders are asking now is, “What's the Generative AI strategy?”

\ It’s a valid question, but it’s the wrong one.

\ For years, product leaders have been missing the real question, the one that actually determines success or failure: “What’s the AI monetization strategy?”

\ For most of our careers, monetization was a 'set it and forget it' line item on a launch plan. A per-seat model was chosen, and old users were grandfathered; everyone called it a day. That pricing model became a sacred cow, an immovable object we were told not to touch.

\ That era is officially over.

\ Generative AI isn't just another feature. It's a new, living product emerging within your existing one, actively breaking your old monetization models. The Chief Product Officers (CPOs) who treat pricing as a dynamic product, rather than a static artifact, will be the ones who win the next decade.

The per-seat license, as we know it, is dead.

The first casualty of the AI revolution is the per-seat license. Why? Because the value of AI doesn't scale with the number of users, it scales with outcomes.

\ Think about it: one "power user" on a new AI-powered "Pro" plan could generate 10,000 API calls a month, costing a fortune. Meanwhile, ten "light users" on the same plan might use almost none. The per-seat model is now fundamentally misaligned. You're charging for access, not value, and your costs are completely untethered from your revenue. This creates a new value-metric crisis.

\ We often see product leaders default to a cost-plus model: "The API calls cost $X, so we'll charge $X + 20%.". This is a race to the bottom that turns your most magical feature into a commodity. Worse, it means you're copying the business model of your API provider. That is a price war; we guarantee you don't want to join.

\ The real opportunity lies in building a profit center.

\ Don't charge for "AI usage" (a usage metric). Charge for "AI outcomes" (an outcome metric).

- Are you an HR-tech platform? Don't charge per token; charge per "job description written" or "candidate successfully screened."

- Are you a dev-tools company? Don't charge per "AI query"; charge per "bug-fix synthesized" or "test suite generated."

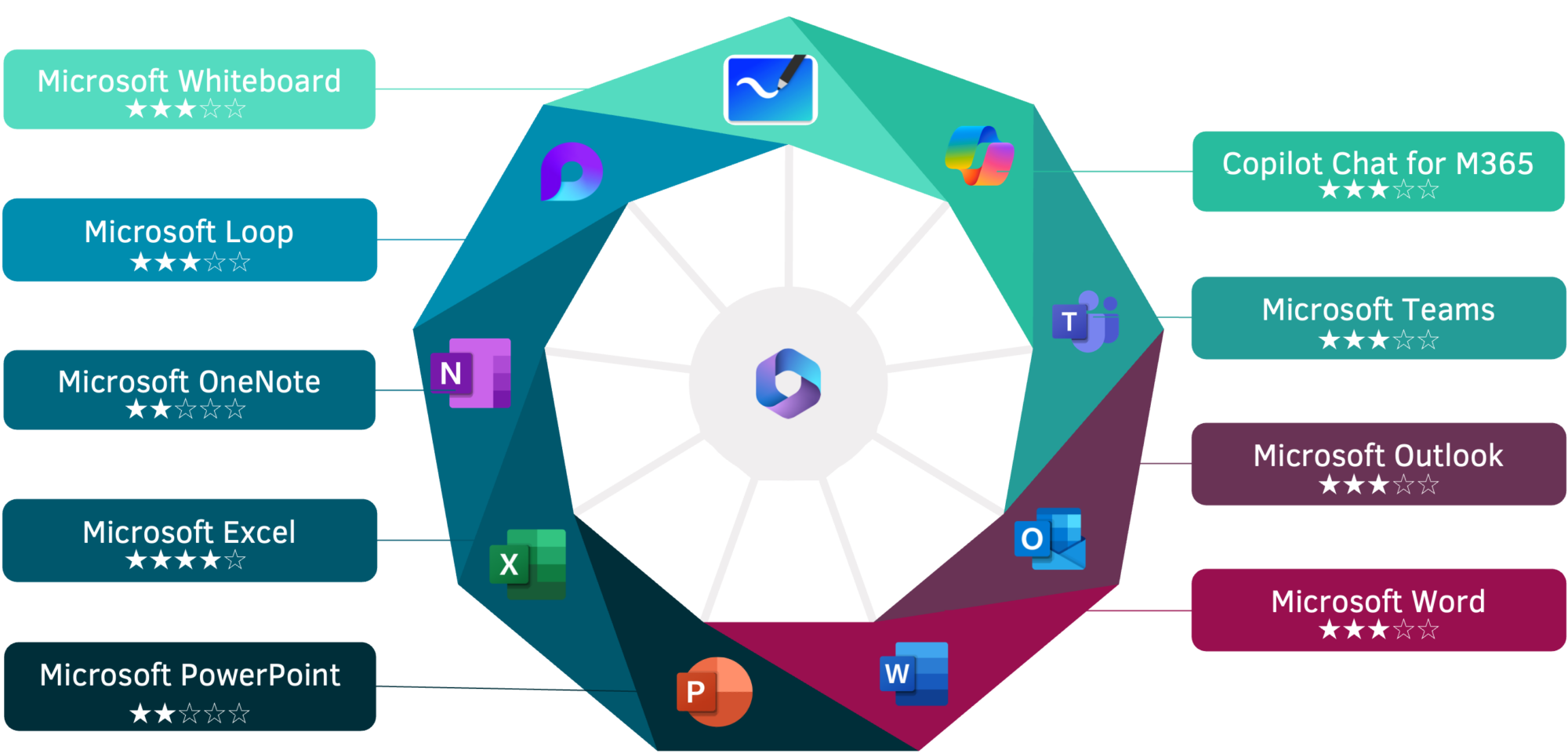

\ This is the only way to realign your price with this new, explosive form of customer value.  Image Source: Accilium

Image Source: Accilium

The Great Debate: 'Add-on' vs. 'Re-package'

Once you know how to charge, the next great debate is where to place the new features. This typically boils down to two choices: you "re-package" your existing tiers or you create a "horizontal add-on."

\ The "re-package" path has largely been the default for most SaaS companies. This is where you re-draw your "Starter," "Pro," and "Enterprise" plans, bundling the new AI features into the higher-priced tiers.

\ Your leadership team will inevitably push for the simplest version of this: just "add AI" to the existing "Enterprise" plan. Your sales team will love this idea because it provides them with a powerful new reason to call their top accounts and helps them close their largest deals.

\ This is a critical strategic trap.

\ You must arm your sales team to think bigger. Bundling AI only in the 'Enterprise' tier leaves 90% of your potential revenue on the table. It fails to capture value from 'Starter' or 'Pro' customers who would happily pay $20/month for the additional value from AI.

\ A horizontal add-on is a separate feature package sold as its own subscription, which any customer can purchase regardless of their base plan. Think of it as an "AI Co-Pilot" subscription that any customer, on any plan, can purchase. This strategy does two things beautifully.

\

- It isolates your costs. Those expensive API calls are now directly tied to a new, specific, high-margin revenue stream.

- It creates a new growth loop. It allows you to upsell your entire user base, not just the tiny fraction considering your "Enterprise" tier.

\ This is why the "horizontal add-on" model is decisively more effective.

\ You’re creating a new product (AI) that sits horizontally across all your existing vertical plans.

\ The 'horizontal add-on' model isn't just a pricing strategy; it's a growth strategy that turns your entire user base into a new upsell funnel.

Stop Guessing, Start Testing

Here's the truth: nobody knows what to charge for AI. The willingness-to-pay (WTP) for "magic" is completely unknown. So, stop debating it in a conference room. You can't use a spreadsheet to find the answer. The only way to find a price point for your AI features is to ship, test, and learn.

\ Consider A/B testing your AI add-on's pricing for optimization. You could offer a flat '$20/month' fee against a metered '200 AI credits/month' package, ensuring the credit price aligns with the average user cost. If a significant number of users prefer the 'credit' package, it's crucial to investigate the psychological drivers behind that choice.

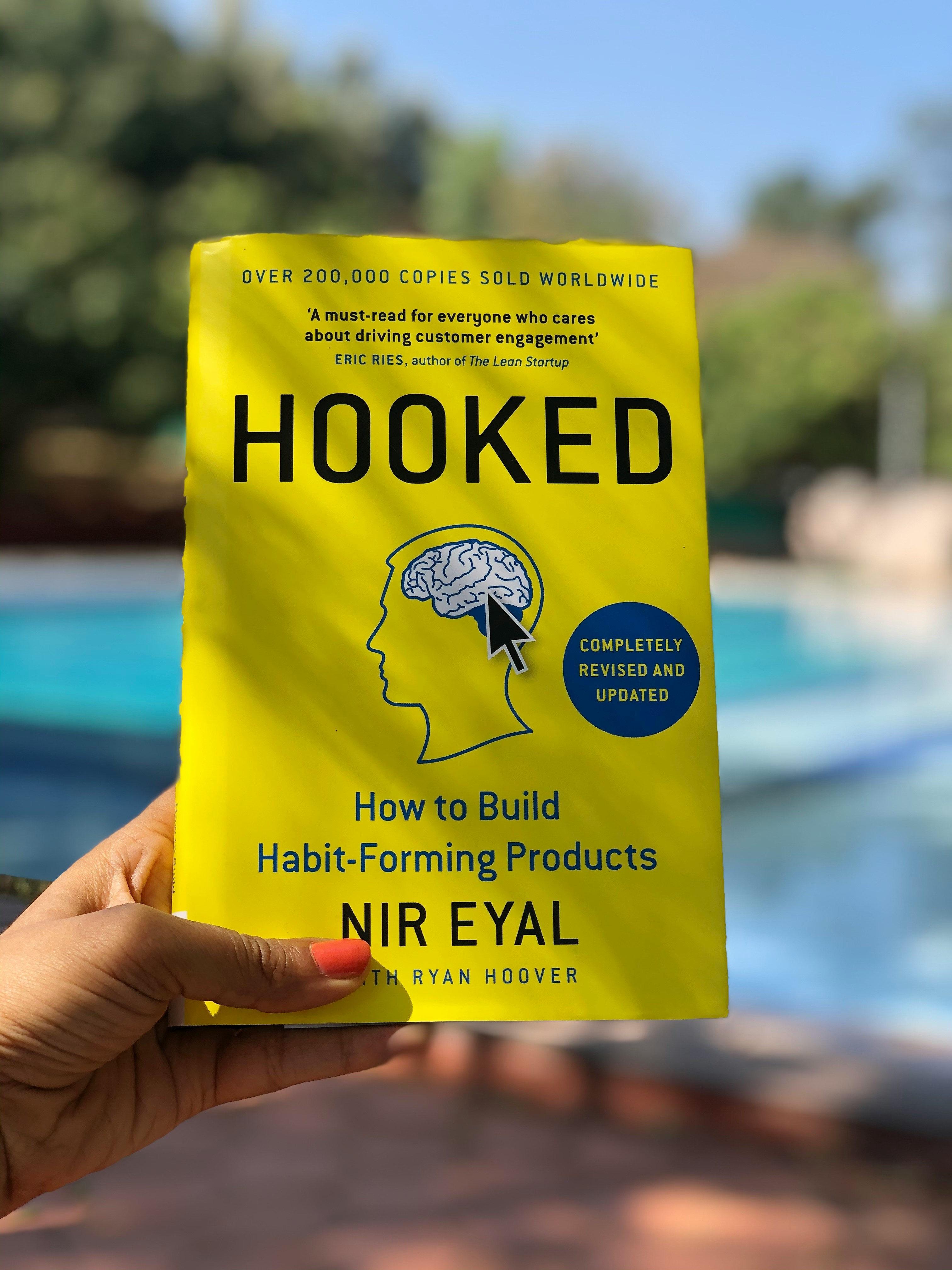

You're not selling a feature; you're selling a habit.

You can't just show users a paywall for a feature they've never used. The user's internal math is simple: Is this new magic worth the new price and the new friction?

\n  Photo by Alka Jha on Unsplash

Photo by Alka Jha on Unsplash

To win this equation, you have to optimize the conversion journey.

\

- First, Educate. Build perceived value. Don't use tooltips. Show them a 10-second video of the AI solving their most annoying problem.

- Second, Activate. This is the most critical step. Give every single user 10 free "AI credits." Let them feel the "aha!" moment. Let them experience the power.

- Third, Convert. Once they've built a habit around this new, super-powered workflow, then you introduce the paywall.

\ You're not selling them an AI feature. You're selling them efficiency and reclaimed time. And once that habit is formed, the friction of paying becomes trivial compared to the pain of going back to the "old way."

The next frontier: from co-pilot to agent

What has been described is the playbook for the "co-pilot" era, where AI helps humans. The next seismic shift, already underway, is the move to "agents" AI systems that act autonomously on the user's behalf.

\ A co-pilot suggests a bug-fix; an agent finds the bug, writes the fix, tests it, and deploys it. This evolution requires another shift in our monetization strategy.

\ We transition from pricing a suggested outcome (the bug fix) to pricing an autonomous result (the live, functioning code). Instead of charging per user, an AI procurement agent might charge a percentage of the savings it delivered. This is the "automation arbitrage" VCs are talking about, charging human-equivalent rates for digital labor.

\ This arbitrage won't last. As competition rises and the value delivered to users gets more commoditized, prices will normalize toward the costs of computation. The durable, long-term winners will be the products that own the entire, trusted, autonomous workflow.

Your first three steps

If you're wondering where to start, here are your first three steps for your current co-pilot features:

- Isolate Your "Magic." Identify the most valuable outcome your AI provides. Is it "summarizing a long document" or "generating a sales email"? Find that one "wow" moment. This is the key value exchange step that will form the basis of your pricing strategy.

- Instrument Your Costs. You can't price what you can't measure. Set up analytics today to understand the cost per-user and per-outcome for that "magic" moment. This is your baseline, not your price.

- Launch a "Free Credit" Test. Create a simple "AI credits" system. Offer every user a small amount of free credits to test your new feature. This is the fastest way to gather real-world data on activation, usage patterns, and future willingness to pay, all while delighting your users.

Monetization is the new strategy

Monetization is no longer a line item on a launch checklist. It is the most dynamic and high-stakes business goal for the product you own.

\ The leaders who master this new playbook, pricing outcomes, building habits, and bravely navigating the shift from co-pilots to autonomous agents are the ones who will build the next generation of defensible, high-growth companies.

Gen AI Product Monetization (For illustrative purposes only)

Image Source: Appflyer

You May Also Like

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings

Unleashing A New Era Of Seller Empowerment