Top 3 Hidden Crypto Gems Set for 8,880% Gains, One Powered by Meme-to-Earn Culture

Crypto Gems Ready for 8,880% Gains

In the crypto market, the biggest gains often come from projects the crowd hasn’t noticed yet. Ethereum and Solana proved that early movers can turn pennies into fortunes.

Today, three under-the-radar coins are catching analyst attention for their mix of utility, adoption, and explosive upside. Avalanche (AVA) is reshaping scalability, XRP is reclaiming its role in global payments, and MAGAX is rewriting meme-coin history with its Meme-to-Earn model.

Together, they represent a rare blend of stability, innovation, and high-risk/high-reward potential. For investors willing to move early, the upside could be massive—up to 8,880% and beyond.

Coin #1: Avalanche (AVAX) — Scaling Smart with Subnets

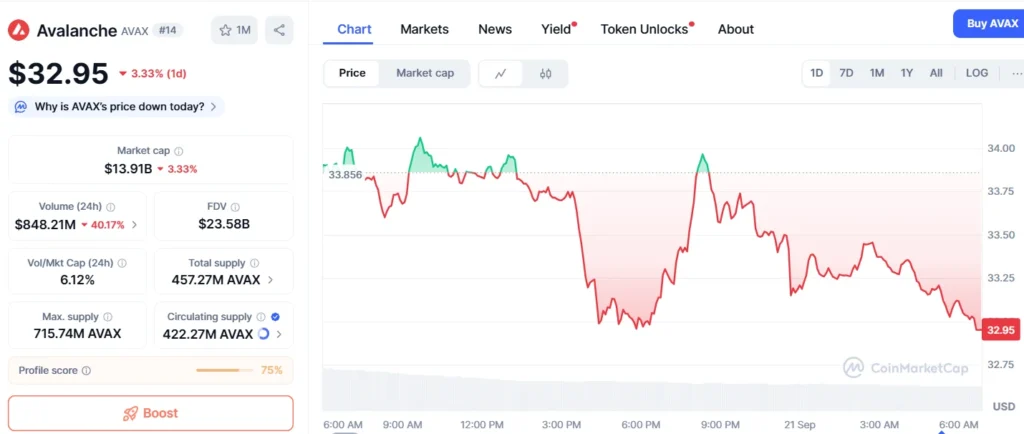

- Current Price: AVAX trades around $33.05 USD per token.

- What It Offers: Avalanche’s subnet architecture allows developers to deploy specialized blockchains (custom consensus, rules) for different use-cases—gaming, DeFi, stablecoins, etc. These subnets help reduce congestion, tailor transaction costs, and optimize performance.

- Technical & Adoption Drivers: Its transaction throughput capability, high developer activity, and growing Total Value Locked (TVL) in its DeFi ecosystem show Avalanche isn’t merely hype—there’s real utility.

- Risk / Why It’s Still Undervalued: AVAX is significantly below its all-time highs near ~$146. Full institutional adoption and broader use of subnets are needed to push it back toward triple digits. But its technical resilience and relative clarity give it a strong chance.

Source: CoinCapMarket

Coin #2: XRP — Veteran Settlements, Renewed Momentum

- Current Price: XRP is trading at approximately $2.99 USD.

- Strengths: Fast finality (seconds), very low transaction cost, long history of partnerships for cross-border payments. Its legal clarity has improved, especially after Ripple saw favorable rulings vs regulators.

- Use Case & Market Position: Many financial institutions in regions like Asia, the Middle East, and Europe are experimenting or already using XRP for remittances and payments. It’s not purely speculative. Liquidity is high, public trust is stronger than for many smaller coins.

- Potential Upside & Limitations: It likely won’t offer the astronomic multiples of very early meme projects, but its risk is more controlled. Regulatory developments, broad institutional adoption, or integrations (e.g. in payment rails) could drive solid returns.

MAGAX — Meme-to-Earn Utility, But Built for Real

- What Makes MAGAX Different: It’s not just another meme coin. It blends community culture, user engagement, and real utility. Users earn tokens by creating and sharing memes. It’s a Meme-to-Earn model: the culture itself becomes the engine of growth.

- Security & Authenticity: Undergoing a full CertiK audit, introducing anti-bot or fake engagement filtering, scarcity mechanisms (deflationary supply) are designed so that early participation is rewarded, and tokenomics make sense.

- Presale Status & Entry Price: Presale is underway. Stage 1 is already largely sold; current stage is priced around $0.000293 USD per token. Early entry gives much greater upside before token price increases with later stages.

- Upside Scenario: If MAGAX can replicate even a modest portion of meme coin virality plus utility features, analysts believe it has potential for returns in the thousands of percent—8,000%-plus looking reasonable if momentum, listings, and community growth align.

AVAX and XRP Have Strengths, but MAGAX Holds the Exponential Edge

Avalanche brings scalability, yet it remains tied to developer adoption and institutional integrations that can take years to fully mature. XRP, on the other hand, offers stability and regulatory clarity, but its upside is naturally capped by its status as a payment network rather than a high-growth disruptor.

That’s where MAGAX stands apart. By merging meme culture with real earning mechanics, it isn’t limited by technical bottlenecks or institutional timelines.

Instead, it thrives on community momentum, viral engagement, and deflationary tokenomics that fuel exponential growth potential. For investors chasing the next breakout, MAGAX is the asymmetric bet that solves the shortcomings of both AVAX and XRP.

Meme Token Has The Huge Capacity to Stay at The Top

If you believe in crypto cycles, utility meshed with culture, and early adoption, MAGAX is one of the rare meme-stage projects where presale timing matters deeply. Each presale stage raises the price; once distribution begins publicly, the cost of entry will go up.

Joining now doesn’t mean blind faith—it means picking carefully. But in the mix of AVAX’s infrastructure, XRP’s payments legacy, and MAGAX’s meme-to-earn innovation, you have a diversified set of bets across different layers of risk & reward.

If you want a shot at outsized upside, MAGAX’s presale is a chance that might define the meme-coin wave of 2025. Don’t just watch from the sidelines.

This article is not intended as financial advice. Educational purposes only.

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Bitcoin Has Taken Gold’s Role In Today’s World, Eric Trump Says