Unlock Bitcoin in Venezuela: Kontigo Platform Just Activated Pago Móvil On-Ramps.

- Kontigo now lets Venezuelans buy Bitcoin by depositing bolivars via Pago Móvil, converting them through USDC first.

- The platform’s “Kochinito Bitcoin” tool helps users set and track personalized savings goals for accumulating Bitcoin.

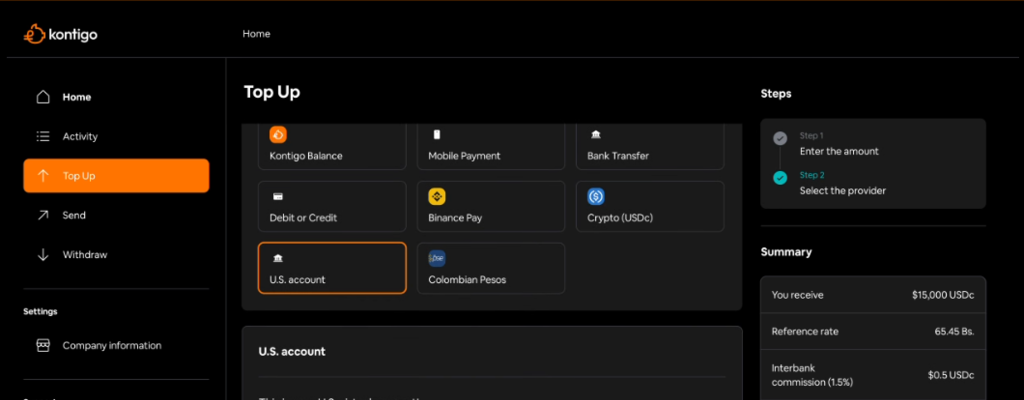

The digital platform Kontigo has activated a function for Venezuela that enables the acquisition of Bitcoin using the popular bank transfer system Pago Móvil. This mechanism provides users with a pathway to deposit bolívares directly into the application and convert them into Bitcoin.

The operation is executed within the platform’s environment, which holds an operational license granted by the National Superintendence of Cryptoassets (SUNACRIP). The process converts the bolívares into an intermediate step before obtaining bitcoin.

Source: Kontigo

Source: Kontigo

The procedure begins with a balance top-up using the Pago Móvil system from any local bank. The deposited funds are credited to the user’s account as USDC, the stablecoin issued by Circle that is pegged to the value of the US dollar. This stablecoin serves as the base asset for the final transaction.

Subsequently, the application presents the user with different investment plans. These options are designed to fit various user profiles and include the definition of personalized goals and growth projections.

Within the application, users can activate a function called «Kochinito Bitcoin». This tool is specifically designed to establish and manage Bitcoin savings goals. The interface continuously shows the user’s progress toward the set BTC accumulation target. It also provides a detailed record of the activity associated with each performed operation.

Conversion of Physical Dollars to USDC Expands with New Bank

Kontigo has added the Banco Nacional de Crédito (BNC) to its network of collaborating banking institutions in Venezuela. This addition allows users of the platform to make deposits in US dollar cash at the physical teller windows of BNC. After verification of the deposit, users receive the USDC stablecoin immediately in their digital wallet within the Kontigo application.

With the inclusion of BNC, the company extends the list of banking entities in Venezuela that facilitate the receipt of US dollar cash for its immediate conversion to the digital currency. BNC now joins other banks such as Activo, Plaza, and Bancamiga, which were already part of this network. A key operational aspect is that users do not need a pre-existing bank account with the chosen entity.

Regarding the fee structure, Kontigo applies differentiated commissions based on the bank used for the conversion service. For operations processed through Banco Plaza, Banco Activo, and the newly added BNC, the applied commission is 1.7%. For transactions using Bancamiga, the commission is 3.5%. Users only need to report the deposit operation correctly through the Kontigo application for the USDC balance to be credited instantly once the cash deposit is verified.

Once users have loaded funds as USDC within the application, they have the freedom to transfer these assets to other external digital wallets. These funds can subsequently be used on a variety of other platforms, including those that primarily operate with the USDT stablecoin.

]]>You May Also Like

WhiteWhale Meme Coin Crashes 60% in Minutes After Major Token Dump

Will Elon Musk buy this company next?